Question: please help solve part B of question 7. show work pleae Q7 You expect DM Corporation to generate the following free cash flows over the

please help solve part B of question 7. show work pleae

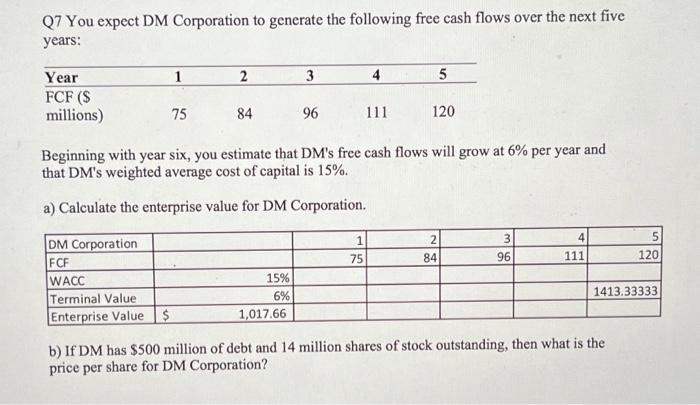

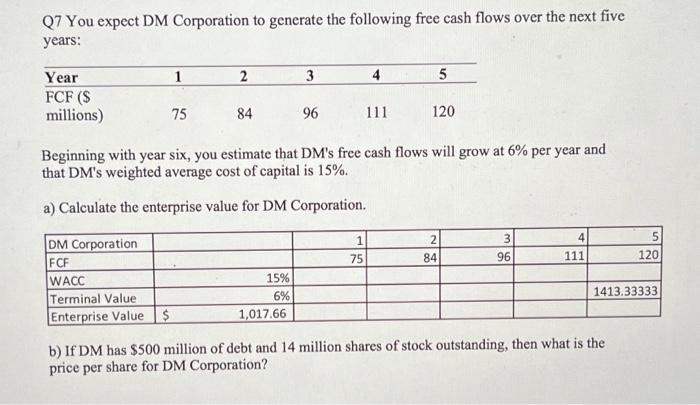

Q7 You expect DM Corporation to generate the following free cash flows over the next five years: 1 2 3 4 5 Year FCF ($ millions) 75 84 96 111 120 Beginning with year six, you estimate that DM's free cash flows will grow at 6% per year and that DM's weighted average cost of capital is 15%. a) Calculate the enterprise value for DM Corporation. 4 1 75 2 84 3 96 5 120 111 DM Corporation FCF WACC Terminal Value Enterprise Values 15% 6% 1,017.66 1413.33333 b) If DM has $500 million of debt and 14 million shares of stock outstanding, then what is the price per share for DM Corporation

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock