Question: Please help solve Pro Systems specializes in servers for work-group, e-commerce, and enterprise resource planning (ERP) applications The company's original job cost system has two

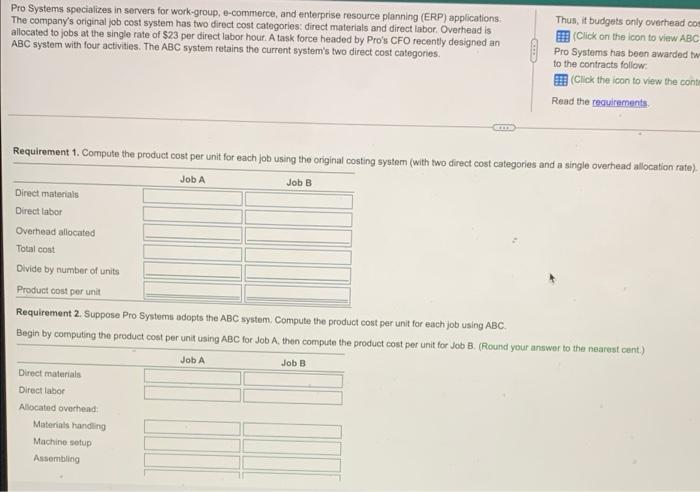

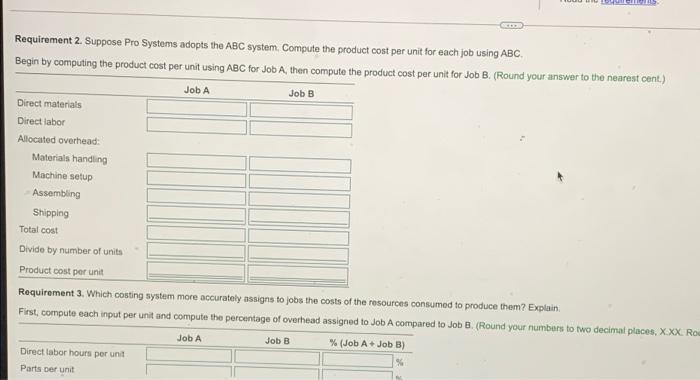

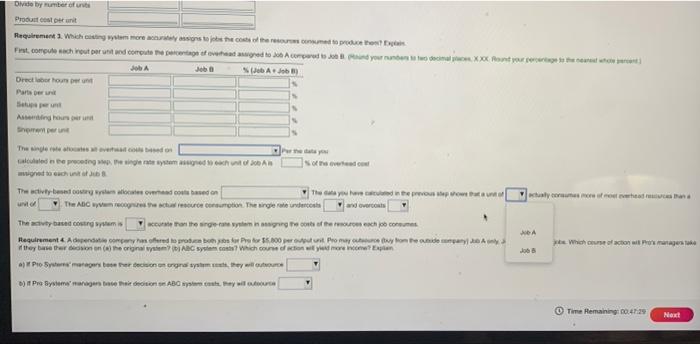

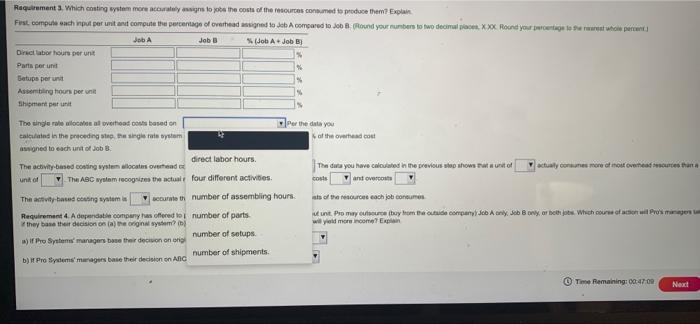

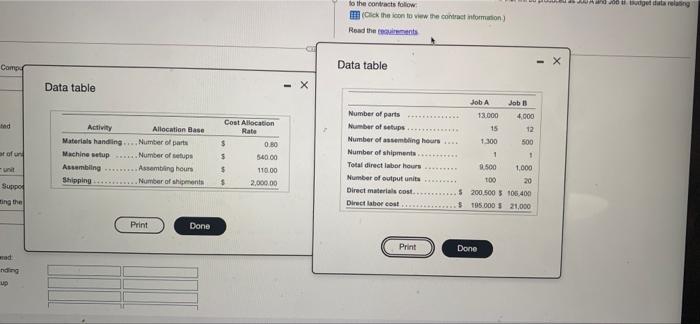

Pro Systems specializes in servers for work-group, e-commerce, and enterprise resource planning (ERP) applications The company's original job cost system has two direct cost categories: direct materials and direct labor, Overhead is allocated to jobs at the single rate of $23 per direct labor hour. A task force headed by Pro's CFO recently designed an ABC system with four activities. The ABC system retains the current system's two direct cost categories GOOD Thus, it budgets only overhead co (Click on the icon to view ABC Pro Systems has been awarded to to the contracts follow Click the icon to view the conte Read the requirements GER Requirement 1. Compute the product cost per unit for each job using the original costing system (with two direct cost categories and a single overhead allocation rate) JobA Job B Direct materials Direct labor Overhead allocated Total cost Divide by number of units Product cost per unit Requirement 2. Suppose Pro Systems adopts the ABC system. Compute the product cost per unit for each job using ABC Begin by computing the product cost per unit using ABC for Job A, then compute the product cost per unit for Job B. (Round your answer to the nearest cont.) JobA Job B Direct materials Direct labor Alocated overhead Materials handling Machine setup Assembling Requirement 2. Suppose Pro Systems adopts the ABC system Compute the product cost per unit for each job using ABC Begin by computing the product cost per unit using ABC for Job A, then compute the product cost per unit for Job B. (Round your answer to the nearest cent.) JobA Job B Direct materials Direct labor Allocated overhead: Materials handling Machine setup Assembling Shipping Total cost Divide by number of units Product cost per unit Requirement 3. Which costing system more accurately assigns to jobs the costs of the resources consumed to produce them? Explain First, compute each input per unit and compute the percentage of overhead assigned to Job A compared to Job 8. (Round your numbers to two decimal places, XXX Row JobA Job B % (Job A Job B) Direct labor hours per unit Parts per unit Divide byter of Proust cost per unit RequirementWichtig stress to the chosed to producent Frat.com sach router unted correcto e percentage of what are come your internecim Xxx Front pour cette Job JA Orector hours Parter Ang Shop y con nosotrete rutes The singles ovo w they Gallering mengesystemet of the feed mugist dochine #t Job9 The activity by words The stayed in the powstawa und The Account The single and overcos The activity based com clean the recent of the school Requirement 4. de company ofered to proti bo Pretor 55.000 poput Promwonende they seer (the original som system contes? Which connection worn Pro Smart Precio en orgina system. They will Pro Symanagers henABC.com.my Time Hemaining 60:41:29 Next Requirement 3. Which costing system more accurately to be the costs of the resourced to produce them? Explai Fost compute ohut per unit and compute the percentage of owerhead magned to compared to Job 8. Round your runters to two decimal place. xxc Round your worlagets erwaren who pero Job Jobs Job A Job Director hours per unit Parta per un Getups per unit Assoming hours per Shipment per unit The single role localitatioad based on Pe the data you talitated in the preceding to the single tale tym of the owned com gned to each unit of Job direct labor hours The activity-based costing water locates head The data you have calculated in the previous stop shows of actually connes more at not overhead scurtes than | | The ABC wystam recognize the actual four different activities costs Want over The activity based coming system curate the number of assembling hours ats of her each consume Requirement 4. A depende company has offered to number of parts they base the decision on the original system? will you more come Exam number of setups u) if the Systems managers as the decision on number of shipments. b) Pro tysims managers base their decision on AG tunt Pro may course they hom te cude company debe Acry, sub Bony er best be. Which court or actor il Presiune Time Remaining:00:47.00 Next 100 gedureng to the contracts follow Click the icon to www the contract information) Read the Como Data table - X Data table ad of our Activity Allocation Base Materials handling... Number of parts Machine up Number of sups Assembling Assembling hours Shipping Number of shipments Cost Allocation Rate $ 0.80 5 54000 $ 110.00 5 2,000.00 Number of parts Number of setups Number of assembling hours Number of shipments Total direct labor hours Number of output unita Direct materials cost Direct labor cost JobA Job 13.000 4.000 15 12 1.300 500 1 1 2.500 100 20 200.500 5 105.400 $95.000 21,000 1.000 Suppo ting the Print Done Print Done rad nding up Pro Systems specializes in servers for work-group, e-commerce, and enterprise resource planning (ERP) applications The company's original job cost system has two direct cost categories: direct materials and direct labor, Overhead is allocated to jobs at the single rate of $23 per direct labor hour. A task force headed by Pro's CFO recently designed an ABC system with four activities. The ABC system retains the current system's two direct cost categories GOOD Thus, it budgets only overhead co (Click on the icon to view ABC Pro Systems has been awarded to to the contracts follow Click the icon to view the conte Read the requirements GER Requirement 1. Compute the product cost per unit for each job using the original costing system (with two direct cost categories and a single overhead allocation rate) JobA Job B Direct materials Direct labor Overhead allocated Total cost Divide by number of units Product cost per unit Requirement 2. Suppose Pro Systems adopts the ABC system. Compute the product cost per unit for each job using ABC Begin by computing the product cost per unit using ABC for Job A, then compute the product cost per unit for Job B. (Round your answer to the nearest cont.) JobA Job B Direct materials Direct labor Alocated overhead Materials handling Machine setup Assembling Requirement 2. Suppose Pro Systems adopts the ABC system Compute the product cost per unit for each job using ABC Begin by computing the product cost per unit using ABC for Job A, then compute the product cost per unit for Job B. (Round your answer to the nearest cent.) JobA Job B Direct materials Direct labor Allocated overhead: Materials handling Machine setup Assembling Shipping Total cost Divide by number of units Product cost per unit Requirement 3. Which costing system more accurately assigns to jobs the costs of the resources consumed to produce them? Explain First, compute each input per unit and compute the percentage of overhead assigned to Job A compared to Job 8. (Round your numbers to two decimal places, XXX Row JobA Job B % (Job A Job B) Direct labor hours per unit Parts per unit Divide byter of Proust cost per unit RequirementWichtig stress to the chosed to producent Frat.com sach router unted correcto e percentage of what are come your internecim Xxx Front pour cette Job JA Orector hours Parter Ang Shop y con nosotrete rutes The singles ovo w they Gallering mengesystemet of the feed mugist dochine #t Job9 The activity by words The stayed in the powstawa und The Account The single and overcos The activity based com clean the recent of the school Requirement 4. de company ofered to proti bo Pretor 55.000 poput Promwonende they seer (the original som system contes? Which connection worn Pro Smart Precio en orgina system. They will Pro Symanagers henABC.com.my Time Hemaining 60:41:29 Next Requirement 3. Which costing system more accurately to be the costs of the resourced to produce them? Explai Fost compute ohut per unit and compute the percentage of owerhead magned to compared to Job 8. Round your runters to two decimal place. xxc Round your worlagets erwaren who pero Job Jobs Job A Job Director hours per unit Parta per un Getups per unit Assoming hours per Shipment per unit The single role localitatioad based on Pe the data you talitated in the preceding to the single tale tym of the owned com gned to each unit of Job direct labor hours The activity-based costing water locates head The data you have calculated in the previous stop shows of actually connes more at not overhead scurtes than | | The ABC wystam recognize the actual four different activities costs Want over The activity based coming system curate the number of assembling hours ats of her each consume Requirement 4. A depende company has offered to number of parts they base the decision on the original system? will you more come Exam number of setups u) if the Systems managers as the decision on number of shipments. b) Pro tysims managers base their decision on AG tunt Pro may course they hom te cude company debe Acry, sub Bony er best be. Which court or actor il Presiune Time Remaining:00:47.00 Next 100 gedureng to the contracts follow Click the icon to www the contract information) Read the Como Data table - X Data table ad of our Activity Allocation Base Materials handling... Number of parts Machine up Number of sups Assembling Assembling hours Shipping Number of shipments Cost Allocation Rate $ 0.80 5 54000 $ 110.00 5 2,000.00 Number of parts Number of setups Number of assembling hours Number of shipments Total direct labor hours Number of output unita Direct materials cost Direct labor cost JobA Job 13.000 4.000 15 12 1.300 500 1 1 2.500 100 20 200.500 5 105.400 $95.000 21,000 1.000 Suppo ting the Print Done Print Done rad nding up

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts