Question: please help solve Providing for Doubtful Accounts At the end of the current year, the accounts receivable account has a balance of $636,000 and sales

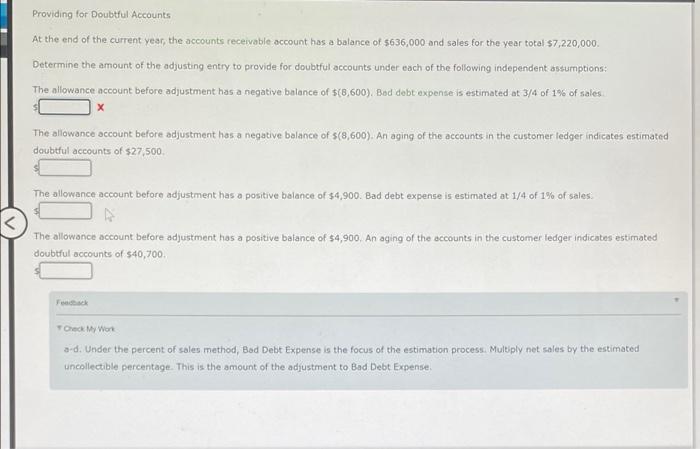

Providing for Doubtful Accounts At the end of the current year, the accounts receivable account has a balance of $636,000 and sales for the year total $7,220,000. Determine the amount of the adjusting entry to provide for doubtful accounts under each of the following independent assumptions: The allowance account before adjustment has a negative balance of $(6,600). Bod debt expense is estimated at 3/4 of 1% of sales The allowance account before adjustment has a negative balance of (8,600). An aging of the accounts in the customer ledger indicates estimated doubtful accounts of $27,500 The allowance account before adjustment has a positive balance of $4,900. Bad debt expense is estimated at 1/4 of 1% of sales a The allowance account before adjustment has a positive balance of $4,900. An aging of the accounts in the customer ledger indicates estimated doubtful accounts of $40,700, Check My Wort a-d. Under the percent of sales method, Bod Debt Expense is the focus of the estimation process. Multiply net sales by the estimated uncollectible percentage. This is the amount of the adjustment to Bad Debt Expense

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts