Question: please help solve QUESTION 6 North Pole Co is considering an iron ore extraction project that requires an initial investment of $1,400,000 and will yield

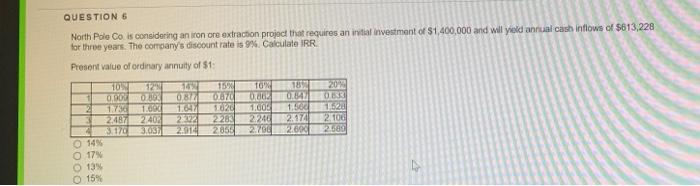

QUESTION 6 North Pole Co is considering an iron ore extraction project that requires an initial investment of $1,400,000 and will yield annual cash inflows of $613,228 for three years. The company's discount rate is 9% Calculate RR Present value of ordinary annuity of $1 184 09 OB 104 22 TON OBO 0302 2 1.73 1.00 27403 3.170ST 14% O 17% 13% 15% 151 OY 10201 2283 2058 TON 0.00 1.005 2.240 22/06 1.500 2.174 2.600 2009 08 162 2 100 280

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts