Question: please help solve show step by step please. TY (Expected rate of return and risk) Syntex, Inc is considering an investment in one of two

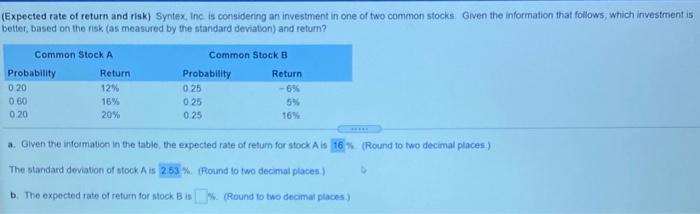

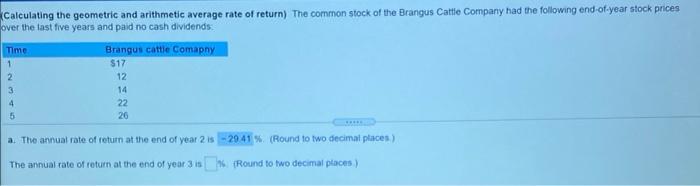

(Expected rate of return and risk) Syntex, Inc is considering an investment in one of two common stocks Given the intormation that follows, which investment is better, based on the risk (as measured by the standard deviation) and return? Common Stock A Probability Return 020 12% 0.60 16% 0.20 20% Common Stock B Probability Return 025 0 25 0.25 16% - 6% a. Given the information in the table, the expected rate of return for stock Ais 16 (Round to two decimal places) The standard deviation of stock AS 2.53% Round to two decimal places) b. The expected rate of return for stock Bis (Round to two decimal places) Calculating the geometric and arithmetic average rate of return) The common stock of the Brangus Cattie Company had the following end-of-year stock prices over the last five years and paid no cash dividends: Time Brangus cattle Comapny 1 $17 12 14 22 26 3 4 *** a. The annual rate of return at the end of year 2 is - 2941 % (Round to two decimal places) The annual rate of return at the end of year 3 is 36. Round to two decimal places)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts