Question: please help solve! thank you. You are an intern with an automobile company in its corporate finance division. The company is planning to issue $10

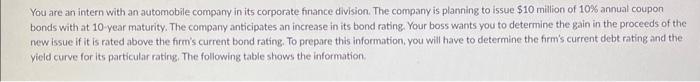

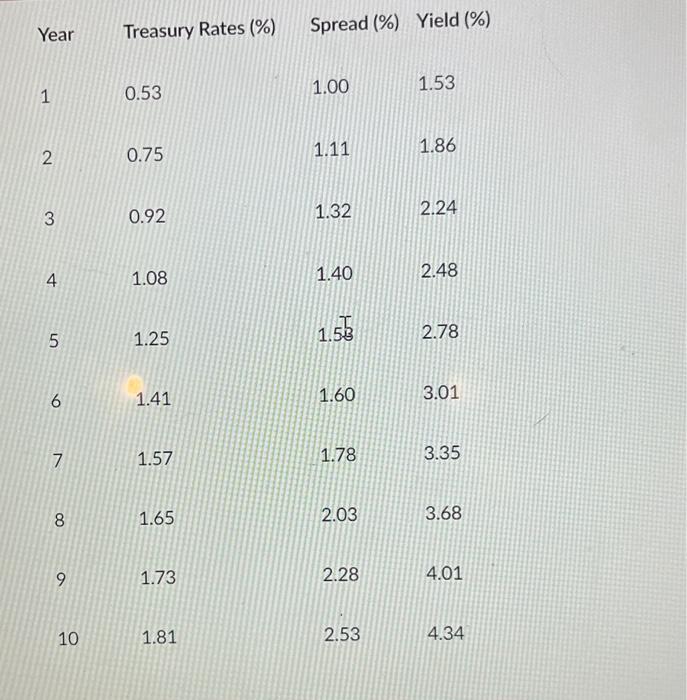

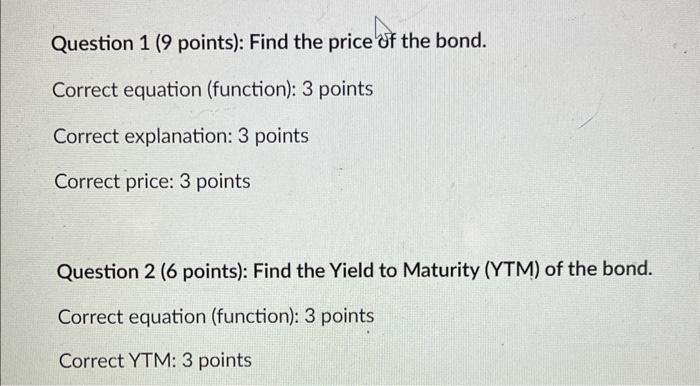

You are an intern with an automobile company in its corporate finance division. The company is planning to issue $10 million of 10% annual coupon bonds with at 10 -year maturity. The company anticipates an increase in its bond rating Your boss wants you to determine the gain in the proceeds of the new issue if it is rated above the firm's current bond rating. To prepare this information, you will have to determine the firm's current debt rating and the vield curve for its particular rating. The following table shows the information. Year Treasury Rates (\%) Spread (\%) Yield (\%) 10.531.001.53 \begin{tabular}{l|l|l|l} 2 & 0.75 & 1.11 & 1.86 \end{tabular} \begin{tabular}{l|l|l|l} 3 & 0.92 & 1.32 & 2.24 \end{tabular} 41.081.402.48 51.251.5B2.78 \begin{tabular}{l|l} 6 & 1.41 \end{tabular} \begin{tabular}{l|l|l|l} 7 & 1.57 & 1.78 & 3.35 \end{tabular} \begin{tabular}{l|l|l|l|l} 9 & 1.73 & 2.28 & 4.01 \end{tabular} \begin{tabular}{|l|l|l|l} 10 & 1.81 & 2.53 & 4.34 \end{tabular} Question 1 ( 9 points): Find the price of the bond. Correct equation (function): 3 points Correct explanation: 3 points Correct price: 3 points Question 2 (6 points): Find the Yield to Maturity (YTM) of the bond. Correct equation (function): 3 points Correct YTM: 3 points

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts