Question: please help solve thanks! P16-6A Hamilton Processing Company uses a weighted-average process cost system and manufactures a single product-an industrial carpet shampoo and cleaner used

please help solve thanks!

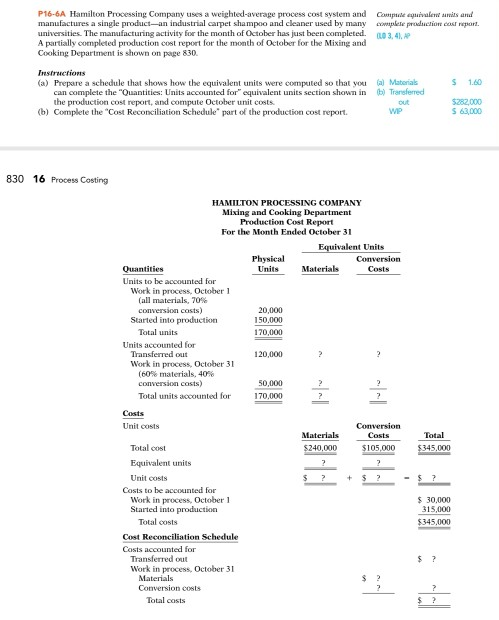

P16-6A Hamilton Processing Company uses a weighted-average process cost system and manufactures a single product-an industrial carpet shampoo and cleaner used by many universities. The manufacturing activity for the month of October has just been completed. A partially completed production cost report for the month of October for the Mixing and Cooking Department is shown on page 830. Compue aquivalewt umits and complete prodsuction cost repart L0 3,41, AP Instructions (a) Prepare a schedule that shows how the equivalent units were computed so that you can complete the "Quantities: Units accounted for" equivalent units section shown in the production cost report, and compute October unit costs. (b) Complete the "Cost Reconciliation Schedule" part of the production cost report (a) Matorials b)Transfered 1.60 $282000 out S 63000 WP 830 16 Process Costing HAMILTON PROCESSING COMPANY Mixing and Cooking Department Production Cost Report For the Month Ended October 31 Equivalent Units Physical Conversion Materials Quantities Units Costs Units to be accounted for Work in process, October 1 (all materials, 70 % conversion costs) Started into production. 20.000 150,000 Total units 170,000 Units accounted for Transferred out Work in process, October 31 (60% materials, 40% conversion costs) 120,000 50,000 Total units accounted for 170,000 7 Costs Unit costs Conversion Costs Materials Total Total cost. $240,000 $105,000 $345,000 Equivalent units Unit costs Costs to be accounted for S 30.000 Work in process, October 1 Started into production 315.000 Total costs $345,000 Cost Reconciliation Schedule Costs accounted for Transferred out Work in process, October 31 Materials S 2 Conversion costs 7 Total costs P16-6A Hamilton Processing Company uses a weighted-average process cost system and manufactures a single product-an industrial carpet shampoo and cleaner used by many universities. The manufacturing activity for the month of October has just been completed. A partially completed production cost report for the month of October for the Mixing and Cooking Department is shown on page 830. Compue aquivalewt umits and complete prodsuction cost repart L0 3,41, AP Instructions (a) Prepare a schedule that shows how the equivalent units were computed so that you can complete the "Quantities: Units accounted for" equivalent units section shown in the production cost report, and compute October unit costs. (b) Complete the "Cost Reconciliation Schedule" part of the production cost report (a) Matorials b)Transfered 1.60 $282000 out S 63000 WP 830 16 Process Costing HAMILTON PROCESSING COMPANY Mixing and Cooking Department Production Cost Report For the Month Ended October 31 Equivalent Units Physical Conversion Materials Quantities Units Costs Units to be accounted for Work in process, October 1 (all materials, 70 % conversion costs) Started into production. 20.000 150,000 Total units 170,000 Units accounted for Transferred out Work in process, October 31 (60% materials, 40% conversion costs) 120,000 50,000 Total units accounted for 170,000 7 Costs Unit costs Conversion Costs Materials Total Total cost. $240,000 $105,000 $345,000 Equivalent units Unit costs Costs to be accounted for S 30.000 Work in process, October 1 Started into production 315.000 Total costs $345,000 Cost Reconciliation Schedule Costs accounted for Transferred out Work in process, October 31 Materials S 2 Conversion costs 7 Total costs

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts