Question: please help solve these problems and show all work, the correct answrs are below. thank you!! 1. Hasta Enterprises is an equipment manufacturer which is

please help solve these problems and show all work, the correct answrs are below. thank you!!

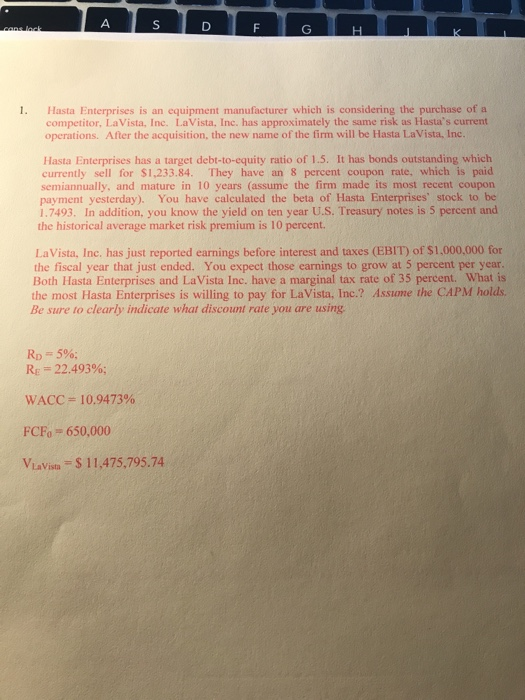

1. Hasta Enterprises is an equipment manufacturer which is considering the purchase of a competitor, LaVista, Inc. LaVista, Inc. has approximately the same risk as Hasta's current operations. After the acquisition, the new name of the firm will be Hasta LaVista, Inc. Hasta Enterprises has a target debt-to-equity ratio of 1.5. It has bonds outstanding which currently sell for $1,233.84. They have an 8 percent coupon rate, which is paid semiannually, and mature in 10 years (assume the firm made its most recent coupon payment yesterday). You have calculated the beta of Hasta Enterprises' stock to be 1.7493. In addition, you know the yield on ten year U.S. Treasury notes is 5 percent and the historical average market risk premium is 10 percent. LaVista, Ine, has just reported earnings before interest and taxes (EBIT) of $1,000,000 for the fiscal year that just ended. You expect those earnings to grow at 5 percent per year. Both Hasta Enterprises and LaVista Inc. have a marginal tax rate of 35 percent. What is the most Hasta Enterprises is willing to pay for LaVista, Inc.? Assune the CAPM holds. Be sure to clearly indicate what discount rate you are using RD-5%; RE-22.493%; WACC- 10.9473% FCFo 650,000 VLaVista $ 11,475,795.74

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts