Question: please help solve these questions 25) Debt is generally the least expensive source of capital. This is primarily due to A) fixed interest payments. B)

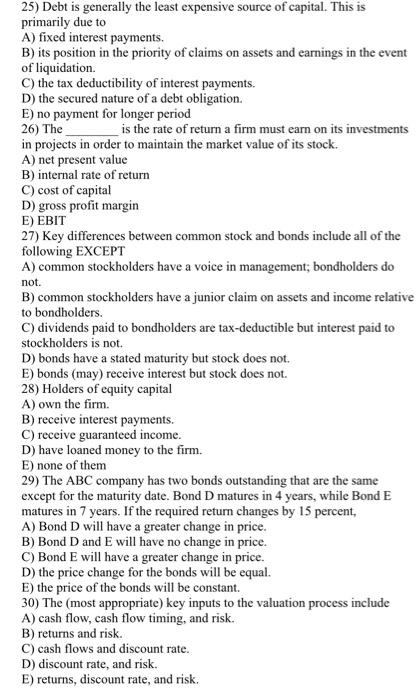

25) Debt is generally the least expensive source of capital. This is primarily due to A) fixed interest payments. B) its position in the priority of claims on assets and earnings in the event of liquidation. C) the tax deductibility of interest payments. D) the secured nature of a debt obligation. E) no payment for longer period 26) The is the rate of return a firm must earn on its investments in projects in order to maintain the market value of its stock. A) net present value B) internal rate of return C) cost of capital D) gross profit margin E) EBIT 27) Key differences between common stock and bonds include all of the following EXCEPT A) common stockholders have a voice in management; bondholders do not. B) common stockholders have a junior claim on assets and income relative to bondholders. C) dividends paid to bondholders are tax-deductible but interest paid to stockholders is not. D) bonds have a stated maturity but stock does not. E) bonds (may) receive interest but stock does not. 28) Holders of equity capital A) own the firm. B) receive interest payments. C) receive guaranteed income. D) have loaned money to the firm. E) none of them 29) The ABC company has two bonds outstanding that are the same except for the maturity date. Bond D matures in 4 years, while Bond E matures in 7 years. If the required return changes by 15 percent, A) Bond D will have a greater change in price. B) Bond D and E will have no change in price. C) Bond E will have a greater change in price. D) the price change for the bonds will be equal. E) the price of the bonds will be constant. 30) The (most appropriate) key inputs to the valuation process include A) cash flow, cash flow timing, and risk. B) returns and risk. C) cash flows and discount rate. D) discount rate, and risk. E) returns, discount rate, and risk

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts