Question: Please help solve these two questions DEFAULT RISK PREMIUM A company's 5-year bonds are yielding 7.75 percentage per year. Treasury bonds with the same maturity

Please help solve these two questions

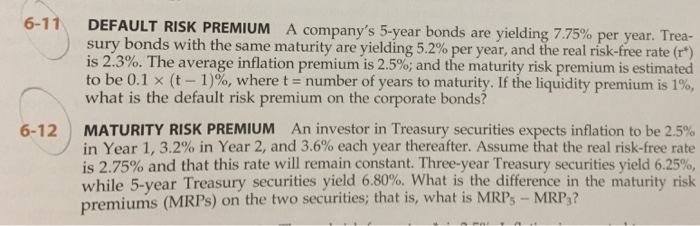

Please help solve these two questions DEFAULT RISK PREMIUM A company's 5-year bonds are yielding 7.75 percentage per year. Treasury bonds with the same maturity are yielding 5.2 percentage per year, and the real risk-free rate (r astir) is 2.3 percentage. The average inflation premium is 2.5 percentage; and the maturity risk premium is estimated to be 0.1 times (t -1)percentage, where t = number of year to maturity. If the liquidity premium is 1 percentage, what is the default risk premium on the corporate bonds? MATURITY RISK PREMIUM An investor in Treasury securities expects inflation to be 2.5 percentage in Year 1, 3.2 percentage in Year 2, and 3.6 percentage each year thereafter. Assume that the real risk-free rate is 2.75 percentage and that this rate will remain constant. Three-year Treasury securities yield 6.25 percentage, while 5-year Treasury securities yield 6.80 percentage. What is the difference in the maturity risk premiums (MRPs) on the two securities; that is, what is MRP_5-MRP_3

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts