Question: Please help solve these with explanations. Questions 1-3 are based on the following information. Discounted Cash Flow Valuation. Aaron is considering an investment that will

Please help solve these with explanations.

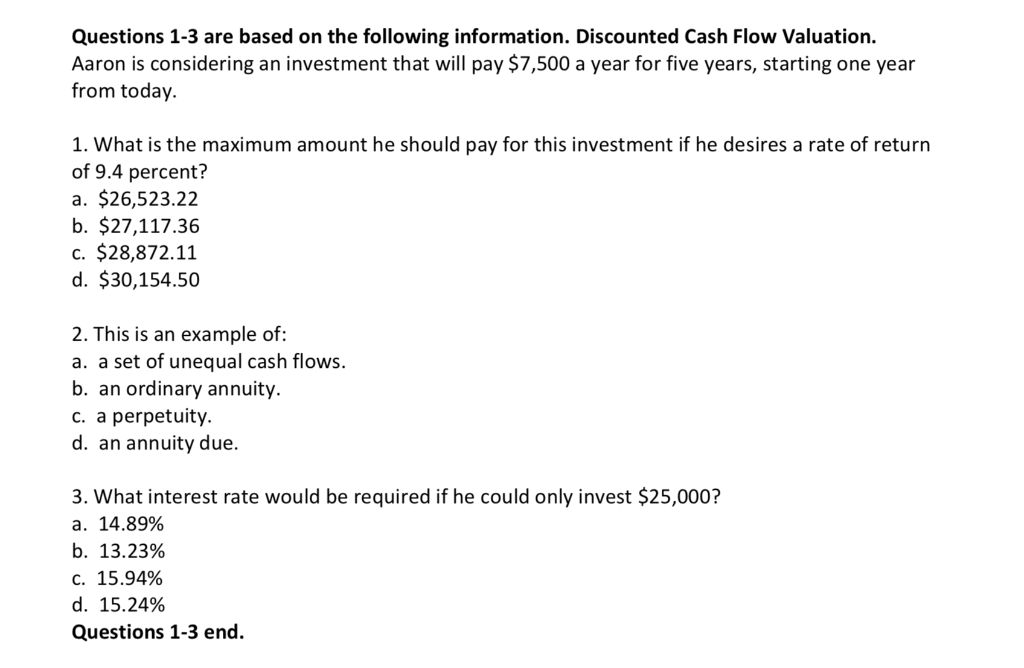

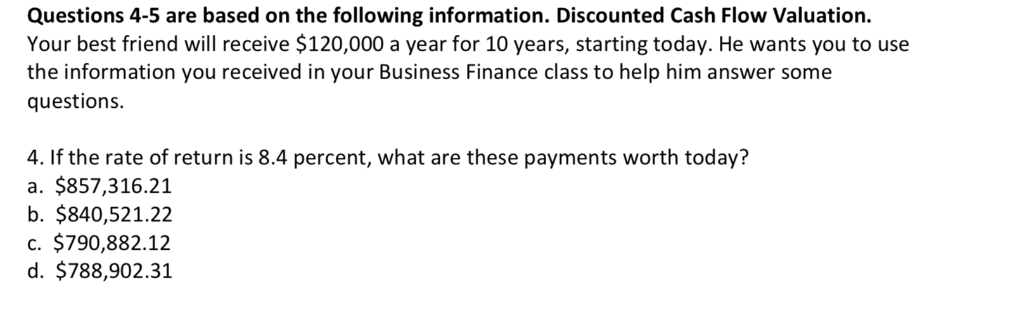

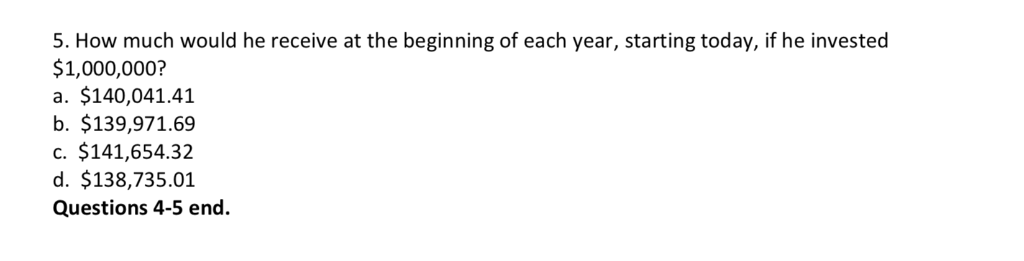

Questions 1-3 are based on the following information. Discounted Cash Flow Valuation. Aaron is considering an investment that will pay $7,500 a year for five years, starting one year from today. 1. What is the maximum amount he should pay for this investment if he desires a rate of return of 9.4 percent? a. $26,523.22 b. $27,117.36 c. $28,872.11 d. $30,154.50 2. This is an example of: a. a set of unequal cash flows. b. an ordinary annuity. c. a perpetuity d. an annuity due. 3. What interest rate would be required if he could only invest $25,000? a. 14.89% b. 13.23% C. 15.94% d. 15.24% Questions 1-3 end. information. Questions 4-5 are based on the following information. Discounted Cash Flow Valuation. Your best friend will receive $120,000 a year for 10 years, starting today. He wants you to use the information you received in your Business Finance class to help him answer some questions. Your best friend wi 4. If the rate of return is 8.4 percent, what are these payments worth today? a. $857,316.21 b. $840,521.22 c. $790,882.12 d. $788,902.31 5. How much would he receive at the beginning of each year, starting today, if he invested $1,000,000? a. $140,041.41 b. $139,971.69 c. $141,654.32 d. $138,735.01 Questions 4-5 end

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts