Question: please help solve this problem and show all work, the core t answers are below. thanks! 2. Summertime, Inc. is a pool supplies company with

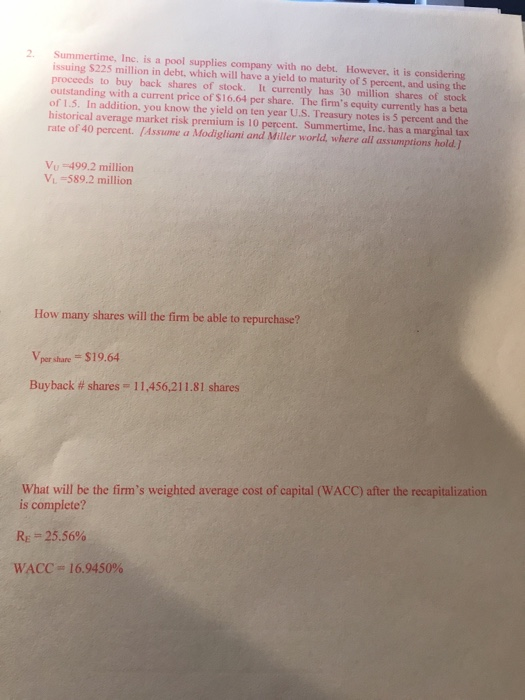

2. Summertime, Inc. is a pool supplies company with no debt. However, it is considering issuing $225 million in debt, which will have a yield to maturity of 5 percent, and using the proceeds to buy back shares of stock. It currently has 30 million shares of stock outstanding with a current price of $16.64 per share. The firm's equity currently has a beta of 1.5. In addition, you know the yield on ten year U.S. Treasury notes is 5 percent and the historical average market risk premium is 10 percent. Summertime, Inc. has a marginal tax rate of 40 percent. /Assume a Modigliani and Miller world, where all assumptions hold. 1 Vu -499.2 million VL -589.2 million How many shares will the firm be able to repurchase? per share $19.64 11,456,211.81 shares Buyback # shares What will be the firm's weighted average cost of capital (WACC) after the recapitalization is complete? RE-25.56% WACC-1 6.9450%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts