Question: Please help solve this problem. Thank you. McGlla Golf is evaluating a new line of golf clubs. The clubs will sell for $970 per set

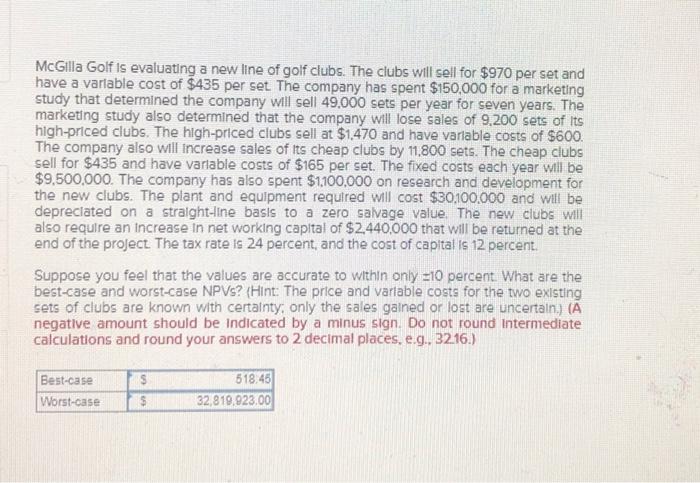

McGlla Golf is evaluating a new line of golf clubs. The clubs will sell for $970 per set and have a varlable cost of $435 per set. The company has spent $150,000 for a marketing study that determined the company will sell 49,000 sets per year for seven years. The marketing study also determined that the company will lose sales of 9.200 sets of its high-priced clubs. The high-priced clubs sell at $1,470 and have varlable costs of $600. The company also will increase sales of its cheap clubs by 11,800 sets. The cheap clubs sell for $435 and have varlable costs of $165 per set. The fixed costs each year will be $9,500,000. The company has also spent $1,100,000 on research and development for the new clubs. The plant and equipment required will cost $30,100,000 and will be depreclated on a straight-line basis to a zero salvage value. The new clubs will also require an increase in net working capital of $2,440,000 that will be returned at the end of the project. The tax rate is 24 percent, and the cost of capital is 12 percent. Suppose you feel that the values are accurate to within only =10 percent. What are the best-case and worst-case NPVs? (Hint: The price and varlable costs for the two existing sets of clubs are known with certainty; only the sales gained or lost are uncertain) (A negative amount should be indicated by a minus sign. Do not round intermediate calculations and round your answers to 2 decimal places, e.g., 3216.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts