Question: Please help solve this problem with working, solutions and recommendations. Thank you and I hope this is clear enough. Question: 1. (12+8+8+12) Nicole Nelson has

Please help solve this problem with working, solutions and recommendations. Thank you and I hope this is clear enough.

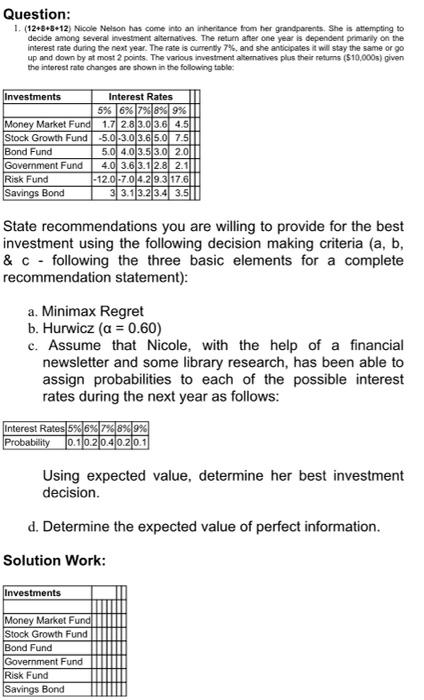

Question: 1. (12+8+8+12) Nicole Nelson has come into an inheritance from her grandparents. She is attempting to decide among several investment alternatives. The return after one year is dependent primarily on the interest rate during the next year. The rate is currently 7%, and she anticipates will stay the same or go up and down by at most 2 points. The various investment alternatives plus their retums ($10,000s) given the interest rate changes are shown in the following table Investments Interest Rates 5% 6% 7% 8% 9% Money Market Fund 1.7 2.8 3.0 3.6 4.5 Stock Growth Fund -5.0-3.0/3.6 5.0 7.5 Bond Fund 5.0 4.0 3.5 3.0 2.0 Government Fund 4.0 3.6 3.1 2.8 2.1 Risk Fund -12.0 -7.0 4.2 9.3 17.6 Savings Bond 3 3.1 3.2 3.4 3.51 State recommendations you are willing to provide for the best investment using the following decision making criteria (a, b, & C - following the three basic elements for a complete recommendation statement): a. Minimax Regret b. Hurwicz (a = 0.60) c. Assume that Nicole, with the help of a financial newsletter and some library research, has been able to assign probabilities to each of the possible interest rates during the next year as follows: Interest Rates 5% 6% 7% 8% 9% Probability 0.1 0.2 0.4 0.210.1 Using expected value, determine her best investment decision. d. Determine the expected value of perfect information. Solution Work: Investments Money Market Fund Stock Growth Fund Bond Fund Government Fund Risk Fund Savings Bond Investments Money Market Fund Stock Growth Fund Bond Fund Government Fund Risk Fund Savings Bond Investments Money Market Fund Stock Growth Fund Bond Fund Government Fund Risk Fund Savings Bond Investments Money Market Fund Stock Growth Fund Bond Fund Government Fund Risk Fund Savings Bond Recommendations: (a) (b) (c) Answer: (d)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts