Question: please help solve this question Suppose you are the Chief Financial Officer (CFO) of Xero Limited (XROAX). Recently, XRO is planning to establish a cloud-based

please help solve this question

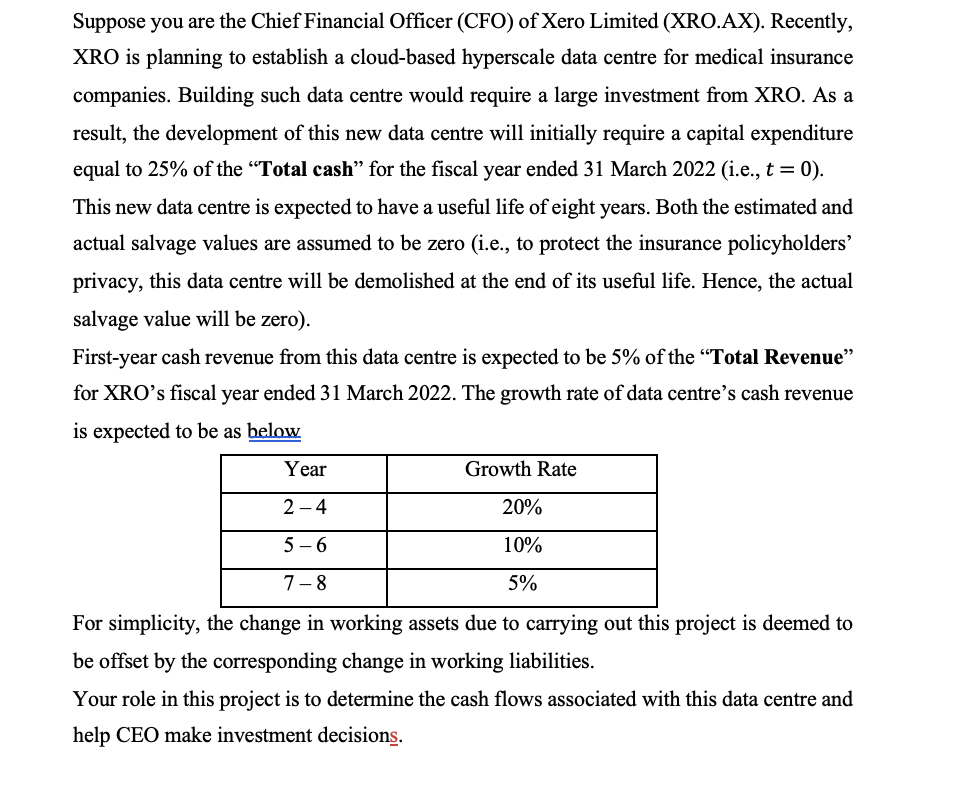

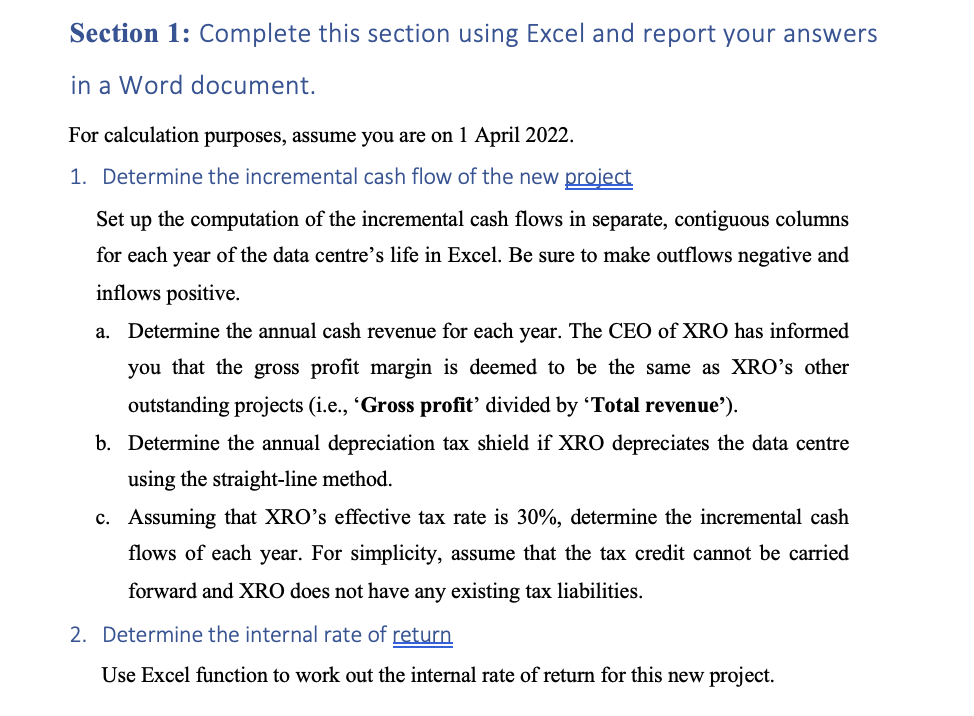

Suppose you are the Chief Financial Officer (CFO) of Xero Limited (XROAX). Recently, XRO is planning to establish a cloud-based hyperscale data centre for medical insurance companies. Building such data centre would require a large investment 'om XRO. As a result, the development of this new data centre will initially require a capital expenditure equal to 25% of the \"Total cash\" for the fiscal year ended 31 March 2022 (i.e., t = 0). This new data centre is expected to have a useful life of eight years. Both the estimated and actual salvage values are assumed to be zero (i.e., to protect the insurance policyholders' privacy, this data centre will be demolished at the end of its useful life. Hence, the actual salvage value will be zero). First-year cash revenue 'om this data centre is expected to be 5% of the \"Total Revenue" for XRO's scal year ended 31 March 2022. The grth rate of data centre's cash revenue is expected to be as below. For simplicity, the change in working assets due to carrying out this project is deemed to be offset by the corresponding change in working liabilities. Your role in this project is to determine the cash flows associated with this data centre and help CEO make investment decisions. Section 1: Complete this section using Excel and report your answers in a Word document. For calculation purposes, assume you are on 1 April 2022. 1. Determine the incremental cash flow of the new gig Set up the computation of the incremental cash ows in separate, contiguous columns for each year of the data centre's life in Excel. Be sure to make outows negative and inows positive. a. Determine the annual cash revenue for each year. The CEO of XRO has informed you that the gross profit margin is deemed to be the same as XRO's other outstanding projects (i.e., 'Gross prot' divided by 'Total revenue'). b. Determine the annual depreciation tax shield if XRO depreciates the data centre using the straight-line method. c. Assuming that XRO's effective tax rate is 30%, determine the incremental cash ows of each year. For simplicity, assume that the tax credit cannot be carried forward and XRO does not have any existing tax liabilities. 2. Determine the internal rate of Lemm Use Excel function to work out the internal rate of return for this new project

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts