Question: Please help solve with steps A global positioning system (GPS) receiver is purchased for $2,000. The IRS informs your company that the useful (class) life

Please help solve with steps

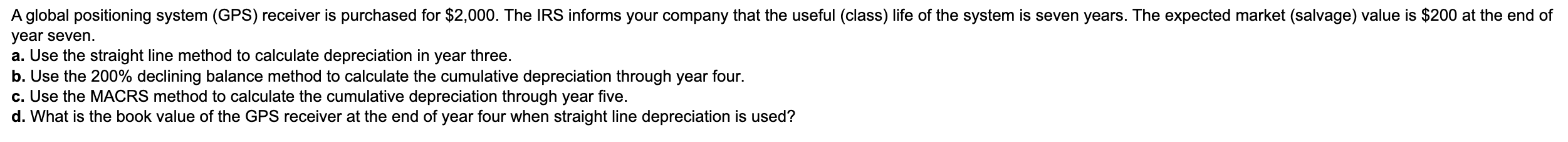

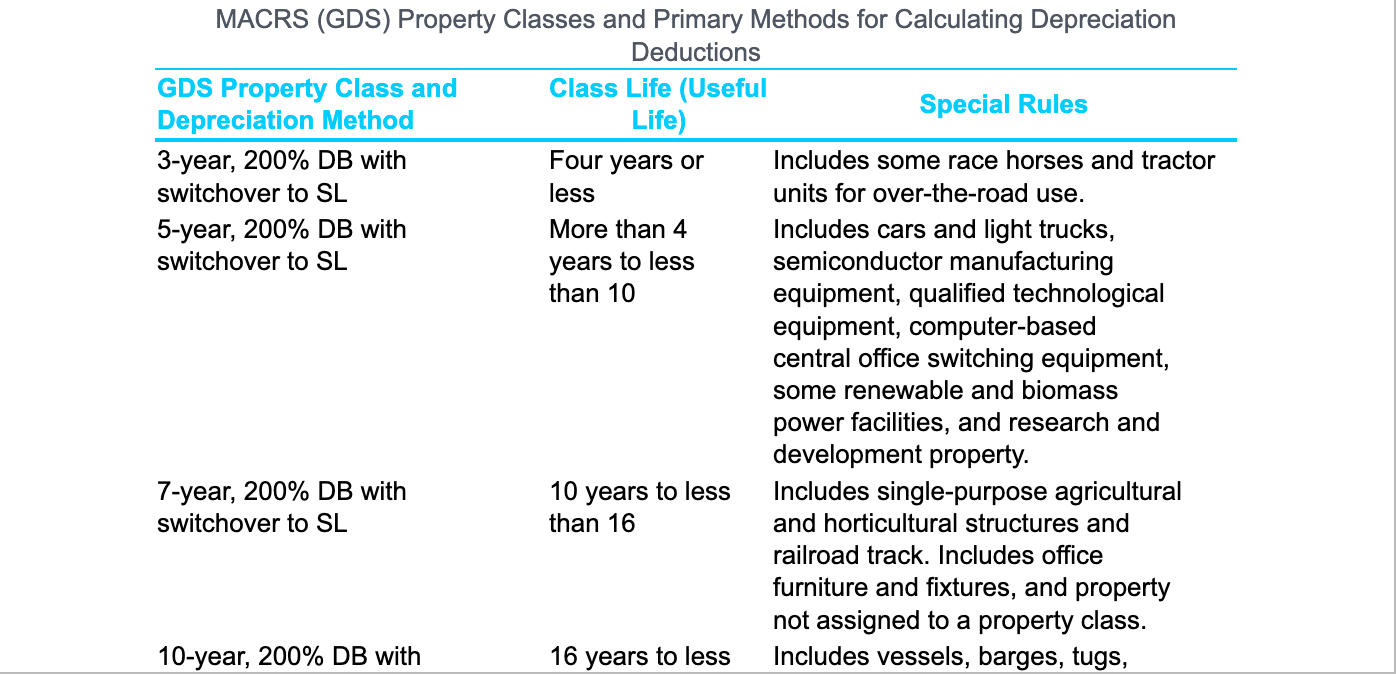

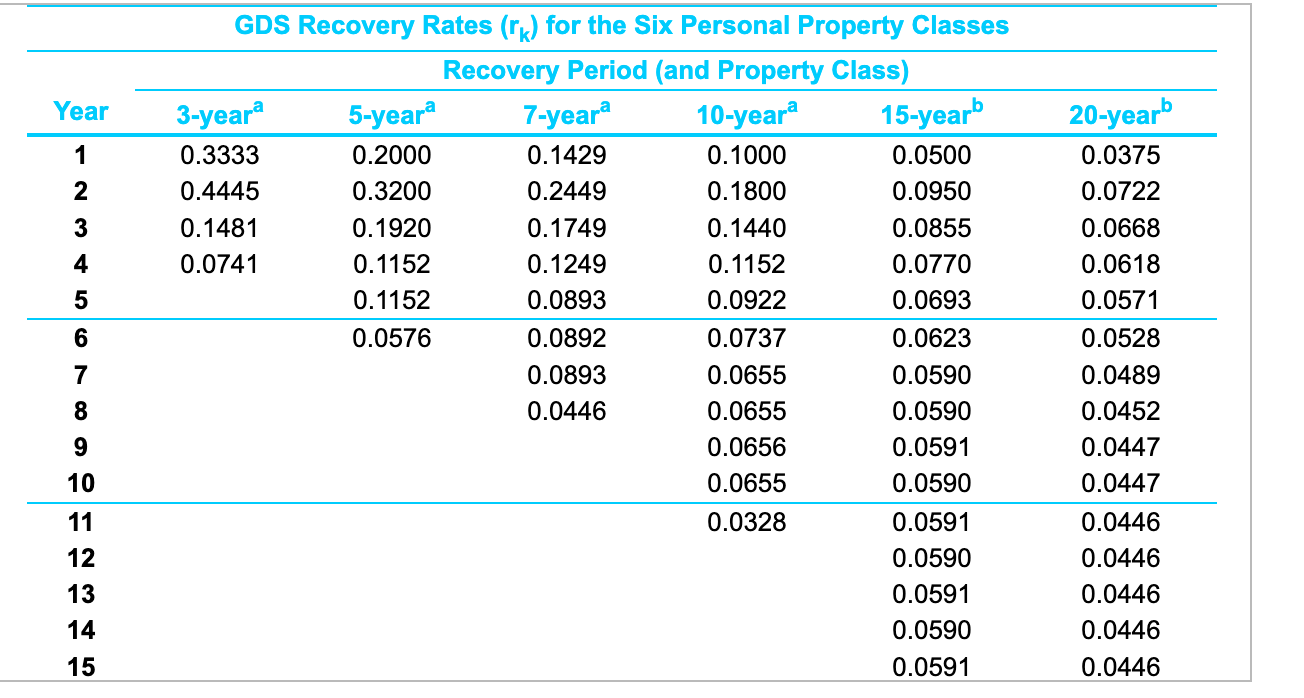

A global positioning system (GPS) receiver is purchased for $2,000. The IRS informs your company that the useful (class) life of the system is seven years. The expected market (salvage) value is $200 at the end of year seven. a. Use the straight line method to calculate depreciation in year three. b. Use the 200% declining balance method to calculate the cumulative depreciation through year four. c. Use the MACRS method to calculate the cumulative depreciation through year five. d. What is the book value of the GPS receiver at the end of year four when straight line depreciation is used? MACRS (GDS) Property Classes and Primary Methods for Calculating Depreciation Deductions GDS Property Class and Class Life (Useful Depreciation Method Life) Special Rules 3-year, 200% DB with Four years or Includes some race horses and tractor switchover to SL less units for over-the-road use. 5-year, 200% DB with More than 4 Includes cars and light trucks, switchover to SL years to less semiconductor manufacturing than 10 equipment, qualified technological equipment, computer-based central office switching equipment, some renewable and biomass power facilities, and research and development property. 7-year, 200% DB with 10 years to less Includes single-purpose agricultural switchover to SL than 16 and horticultural structures and railroad track. Includes office furniture and fixtures, and property not assigned to a property class. 10-year, 200% DB with 16 years to less Includes vessels, barges, tugs, Year 1 2 3 OUT AWN 4 5 6 GDS Recovery Rates (rk) for the Six Personal Property Classes Recovery Period (and Property Class) 3-yeara 5-yeara 7-yeara 10-yeara 15-year 0.3333 0.2000 0.1429 0.1000 0.0500 0.4445 0.3200 0.2449 0.1800 0.0950 0.1481 0.1920 0.1749 0.1440 0.0855 0.0741 0.1152 0.1249 0.1152 0.0770 0.1152 0.0893 0.0922 0.0693 0.0576 0.0892 0.0737 0.0623 0.0893 0.0655 0.0590 0.0446 0.0655 0.0590 0.0656 0.0591 0.0655 0.0590 0.0328 0.0591 0.0590 0.0591 0.0590 0.0591 7 8 20-yearb 0.0375 0.0722 0.0668 0.0618 0.0571 0.0528 0.0489 0.0452 0.0447 0.0447 0.0446 0.0446 0.0446 0.0446 0.0446 9 10 11 12 13 14 15 A global positioning system (GPS) receiver is purchased for $2,000. The IRS informs your company that the useful (class) life of the system is seven years. The expected market (salvage) value is $200 at the end of year seven. a. Use the straight line method to calculate depreciation in year three. b. Use the 200% declining balance method to calculate the cumulative depreciation through year four. c. Use the MACRS method to calculate the cumulative depreciation through year five. d. What is the book value of the GPS receiver at the end of year four when straight line depreciation is used? MACRS (GDS) Property Classes and Primary Methods for Calculating Depreciation Deductions GDS Property Class and Class Life (Useful Depreciation Method Life) Special Rules 3-year, 200% DB with Four years or Includes some race horses and tractor switchover to SL less units for over-the-road use. 5-year, 200% DB with More than 4 Includes cars and light trucks, switchover to SL years to less semiconductor manufacturing than 10 equipment, qualified technological equipment, computer-based central office switching equipment, some renewable and biomass power facilities, and research and development property. 7-year, 200% DB with 10 years to less Includes single-purpose agricultural switchover to SL than 16 and horticultural structures and railroad track. Includes office furniture and fixtures, and property not assigned to a property class. 10-year, 200% DB with 16 years to less Includes vessels, barges, tugs, Year 1 2 3 OUT AWN 4 5 6 GDS Recovery Rates (rk) for the Six Personal Property Classes Recovery Period (and Property Class) 3-yeara 5-yeara 7-yeara 10-yeara 15-year 0.3333 0.2000 0.1429 0.1000 0.0500 0.4445 0.3200 0.2449 0.1800 0.0950 0.1481 0.1920 0.1749 0.1440 0.0855 0.0741 0.1152 0.1249 0.1152 0.0770 0.1152 0.0893 0.0922 0.0693 0.0576 0.0892 0.0737 0.0623 0.0893 0.0655 0.0590 0.0446 0.0655 0.0590 0.0656 0.0591 0.0655 0.0590 0.0328 0.0591 0.0590 0.0591 0.0590 0.0591 7 8 20-yearb 0.0375 0.0722 0.0668 0.0618 0.0571 0.0528 0.0489 0.0452 0.0447 0.0447 0.0446 0.0446 0.0446 0.0446 0.0446 9 10 11 12 13 14 15

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts