Question: PLEASE help soon and explain because I dont understand anything!! Instructions Investment in Fixed Assets 1. The project requires an initial investment of $10 million

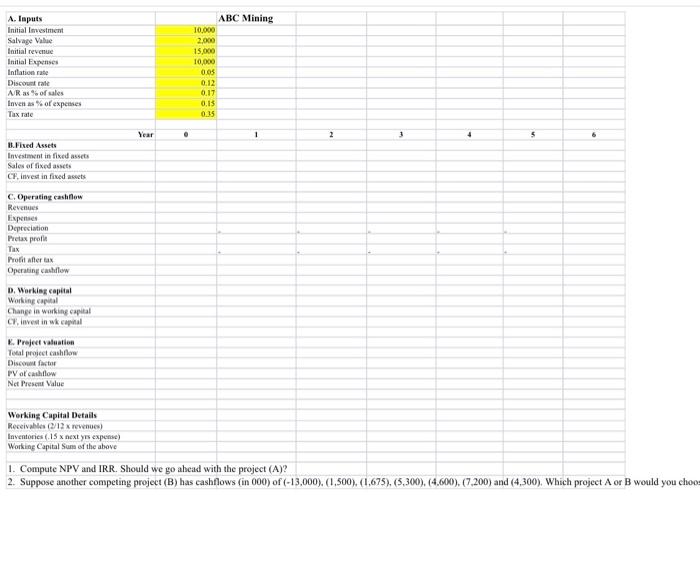

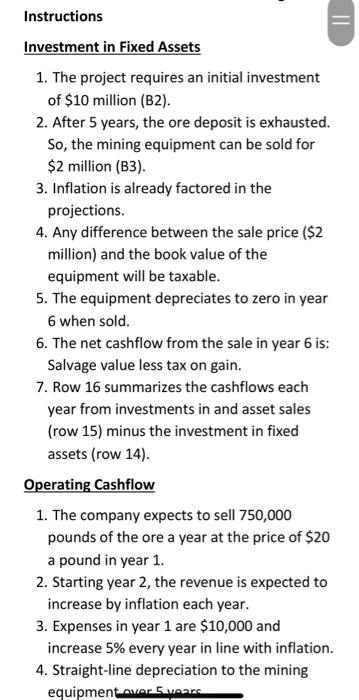

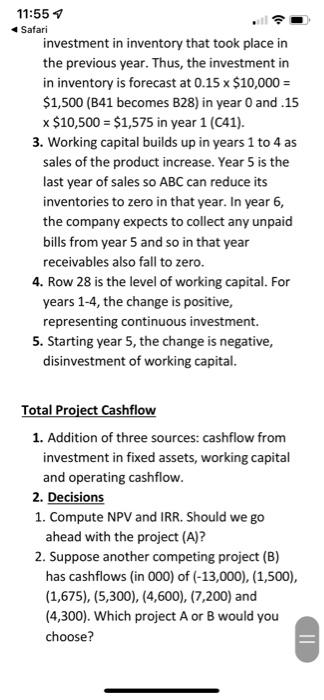

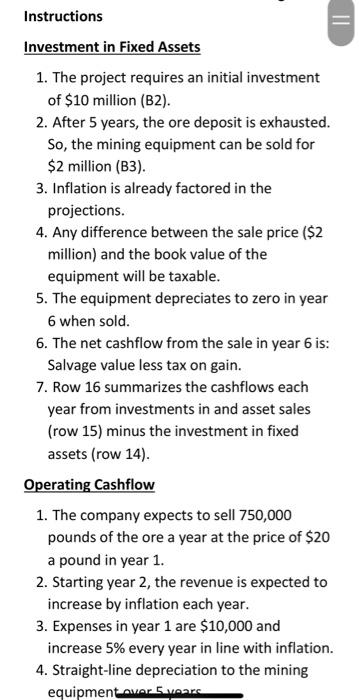

Instructions Investment in Fixed Assets 1. The project requires an initial investment of $10 million (B2). 2. After 5 years, the ore deposit is exhausted. So, the mining equipment can be sold for $2 million (B3). 3. Inflation is already factored in the projections. 4. Any difference between the sale price $2 million) and the book value of the equipment will be taxable. 5. The equipment depreciates to zero in year 6 when sold. 6. The net cashflow from the sale in year 6 is: Salvage value less tax on gain. 7. Row 16 summarizes the cashflows each year from investments in and asset sales (row 15) minus the investment in fixed assets (row 14). Operating Cashflow 1. The company expects to sell 750,000 pounds of the ore a year at the price of $20 a pound in year 1 . 2. Starting year 2, the revenue is expected to increase by inflation each year. 3. Expenses in year 1 are $10,000 and increase 5% every year in line with inflation. 4. Straight-line depreciation to the mining 11:55 4 Safari investment in inventory that took place in the previous year. Thus, the investment in in inventory is forecast at 0.15$10,000= $1,500 (B41 becomes B28) in year 0 and .15 x$10,500=$1,575 in year 1 (C41). 3. Working capital builds up in years 1 to 4 as sales of the product increase. Year 5 is the last year of sales so ABC can reduce its inventories to zero in that year. In year 6 , the company expects to collect any unpaid bills from year 5 and so in that year receivables also fall to zero. 4. Row 28 is the level of working capital. For years 14, the change is positive, representing continuous investment. 5. Starting year 5 , the change is negative, disinvestment of working capital. Total Project Cashflow 1. Addition of three sources: cashflow from investment in fixed assets, working capital and operating cashflow. 2. Decisions 1. Compute NPV and IRR. Should we go ahead with the project (A)? 2. Suppose another competing project (B) has cashflows (in 000) of (13,000),(1,500), (1,675),(5,300),(4,600),(7,200) and (4,300). Which project A or B would you choose? Instructions Investment in Fixed Assets 1. The project requires an initial investment of $10 million ( B2 ). 2. After 5 years, the ore deposit is exhausted. So, the mining equipment can be sold for $2 million (B3). 3. Inflation is already factored in the projections. 4. Any difference between the sale price ( $2 million) and the book value of the equipment will be taxable. 5. The equipment depreciates to zero in year 6 when sold. 6. The net cashflow from the sale in year 6 is: Salvage value less tax on gain. 7. Row 16 summarizes the cashflows each year from investments in and asset sales (row 15) minus the investment in fixed assets (row 14). Operating Cashflow 1. The company expects to sell 750,000 pounds of the ore a year at the price of $20 a pound in year 1 . 2. Starting year 2 , the revenue is expected to increase by inflation each year. 3. Expenses in year 1 are $10,000 and increase 5% every year in line with inflation. 4. Straight-line depreciation to the mining

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts