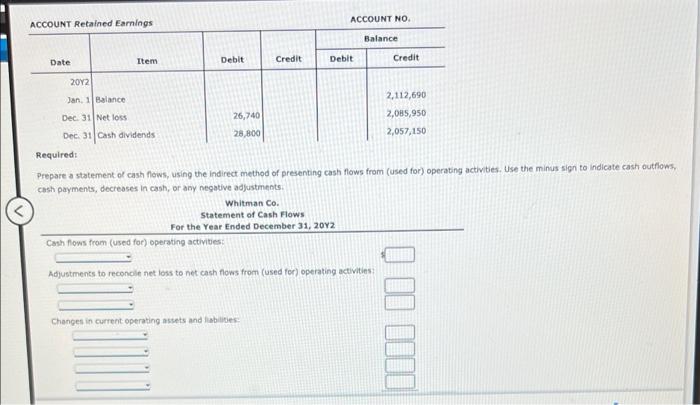

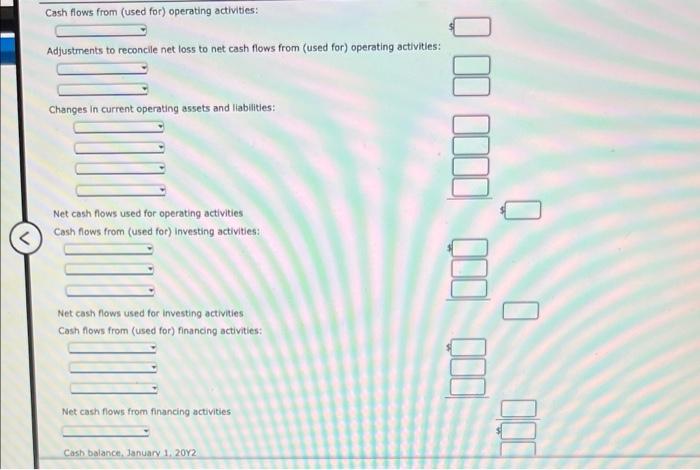

Question: please help Statement of Cash Flows The comparative balance sheet of Whitman Co. at December 31, 20Y2 and 20Y1, is as follows: Dec. 31, 2012

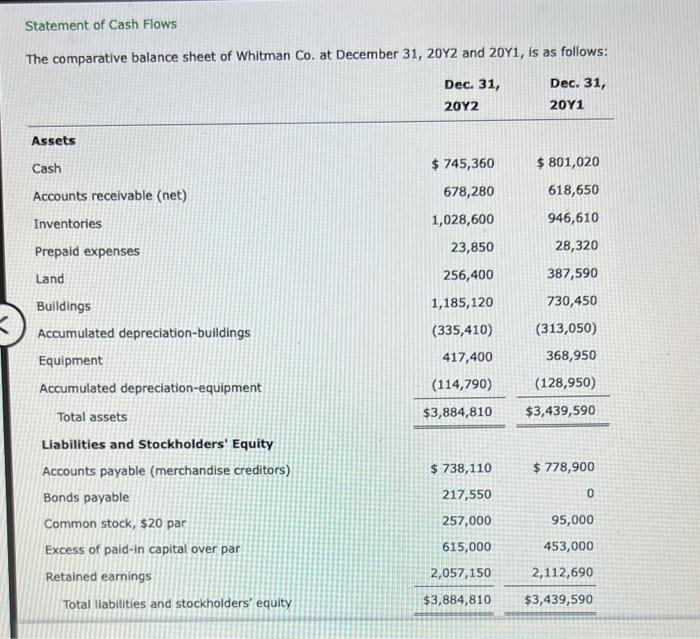

Statement of Cash Flows The comparative balance sheet of Whitman Co. at December 31, 20Y2 and 20Y1, is as follows: Dec. 31, 2012 Assets Cash Accounts receivable (net) Inventories Prepaid expenses Land Buildings Accumulated depreciation-buildings Equipment Accumulated depreciation-equipment Total assets Liabilities and Stockholders' Equity Accounts payable (merchandise creditors) Bonds payable Common stock, $20 par Excess of paid-in capital over par Retained earnings Total liabilities and stockholders' equity $ 745,360 678,280 1,028,600 23,850 256,400 1,185,120 (335,410) 417,400 (114,790) $3,884,810 $ 738,110 217,550 257,000 615,000 2,057,150 $3,884,810 Dec. 31, 20Y1 $ 801,020 618,650 946,610 28,320 387,590 730,450 (313,050) 368,950 (128,950) $3,439,590 $ 778,900 0 95,000 453,000 2,112,690 $3,439,590

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts