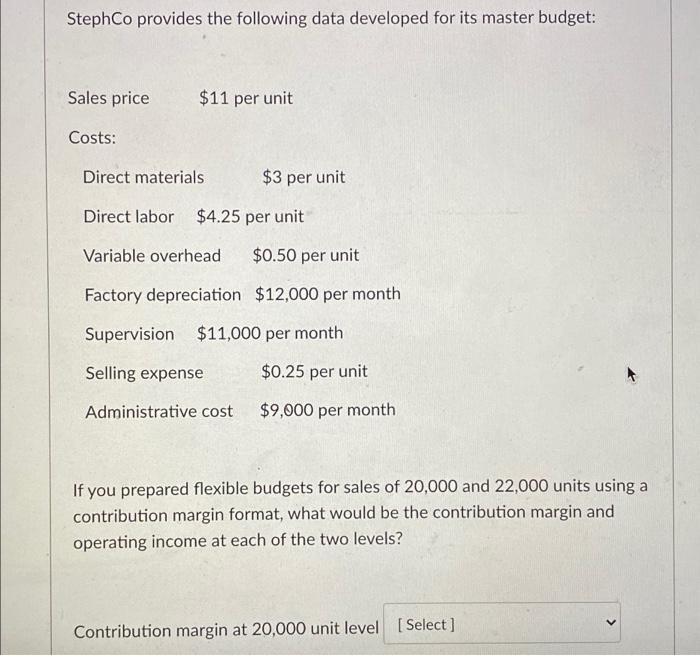

Question: please help StephCo provides the following data developed for its master budget: Sales price $11 per unit Costs: Direct materials $3 per unit Direct labor

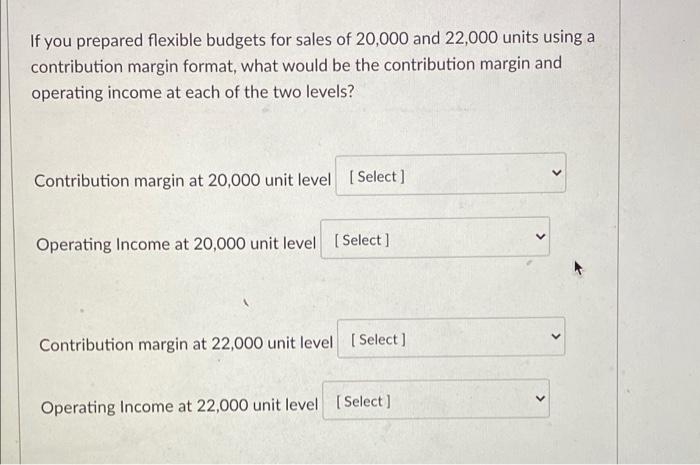

StephCo provides the following data developed for its master budget: Sales price $11 per unit Costs: Direct materials $3 per unit Direct labor $4.25 per unit Variable overhead $0.50 per unit Factory depreciation $12,000 per month Supervision $11,000 per month Selling expense $0.25 per unit Administrative cost $9,000 per month If you prepared flexible budgets for sales of 20,000 and 22,000 units using a contribution margin format, what would be the contribution margin and operating income at each of the two levels? Contribution margin at 20,000 unit level [Select] If you prepared flexible budgets for sales of 20,000 and 22,000 units using a contribution margin format, what would be the contribution margin and operating income at each of the two levels? > Contribution margin at 20,000 unit level [Select] Operating Income at 22,000 unit level (Select]

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts