Question: please help struggling Question 14 (2.5 points) The risk structure of interest rates explains that bonds with similar maturity may have different yields due to

please help struggling

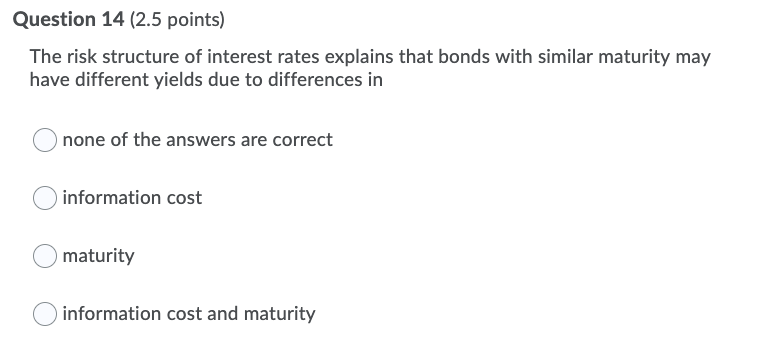

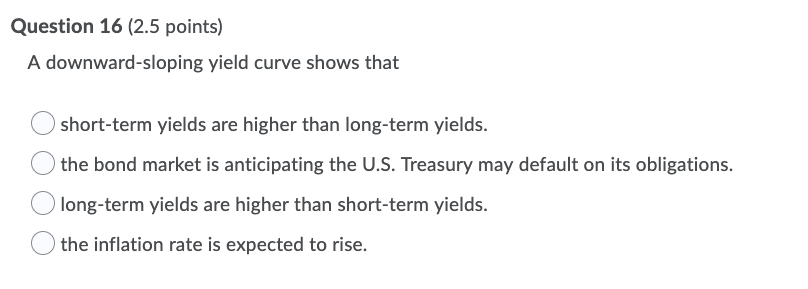

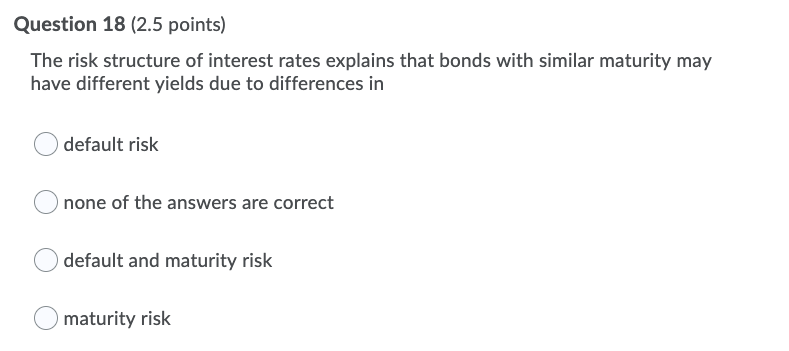

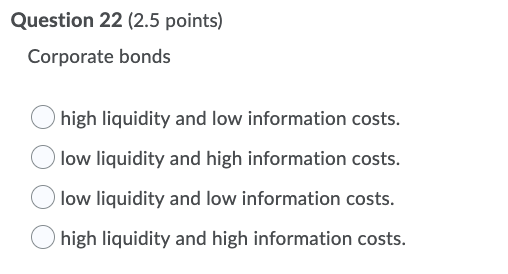

Question 14 (2.5 points) The risk structure of interest rates explains that bonds with similar maturity may have different yields due to differences in Onone of the answers are correct information cost O maturity information cost and maturity Question 16 (2.5 points) A downward-sloping yield curve shows that O short-term yields are higher than long-term yields. the bond market is anticipating the U.S. Treasury may default on its obligations. Olong-term yields are higher than short-term yields. the inflation rate is expected to rise. Question 18 (2.5 points) The risk structure of interest rates explains that bonds with similar maturity may have different yields due to differences in default risk Onone of the answers are correct default and maturity risk O maturity risk Question 22 (2.5 points) Corporate bonds high liquidity and low information costs. low liquidity and high information costs. low liquidity and low information costs. high liquidity and high information costs

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts