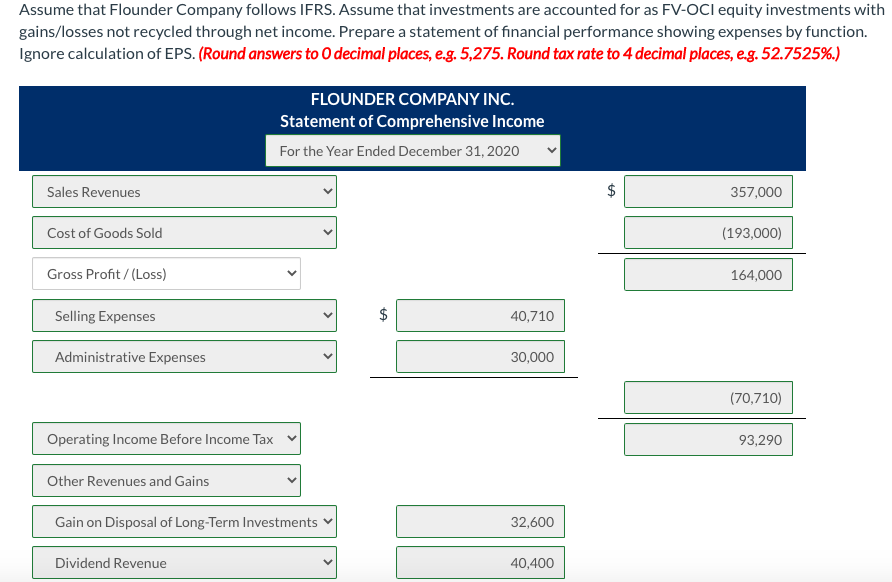

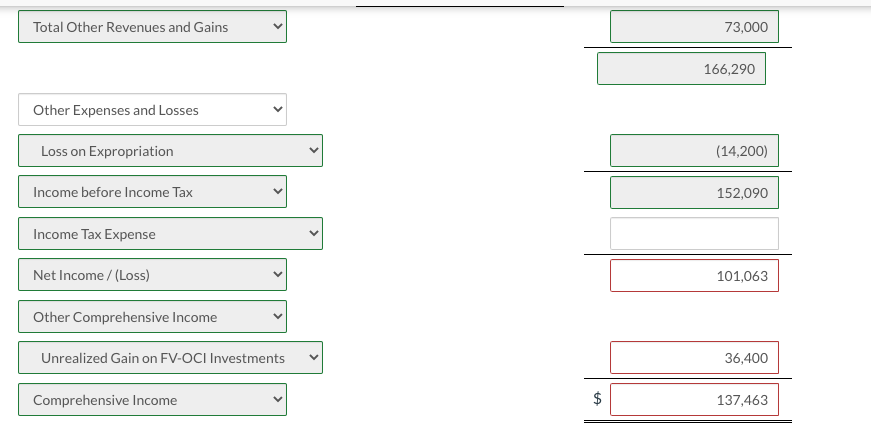

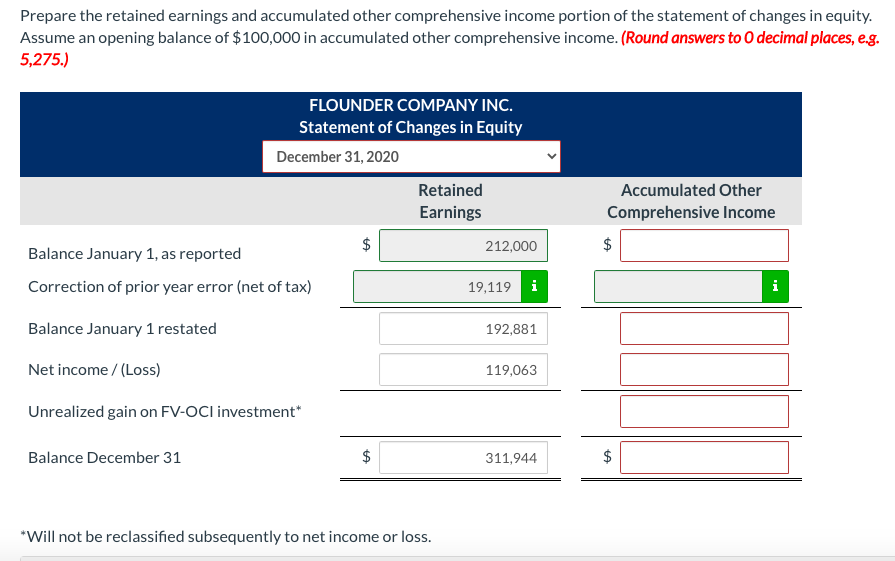

Question: Please help! Stuck with the final numbers shown highlighted in red. Green highlighted cells means they're correct. Joe Schreiner, controller for Flounder Company Inc., recently

Please help! Stuck with the final numbers shown highlighted in red. Green highlighted cells means they're correct.

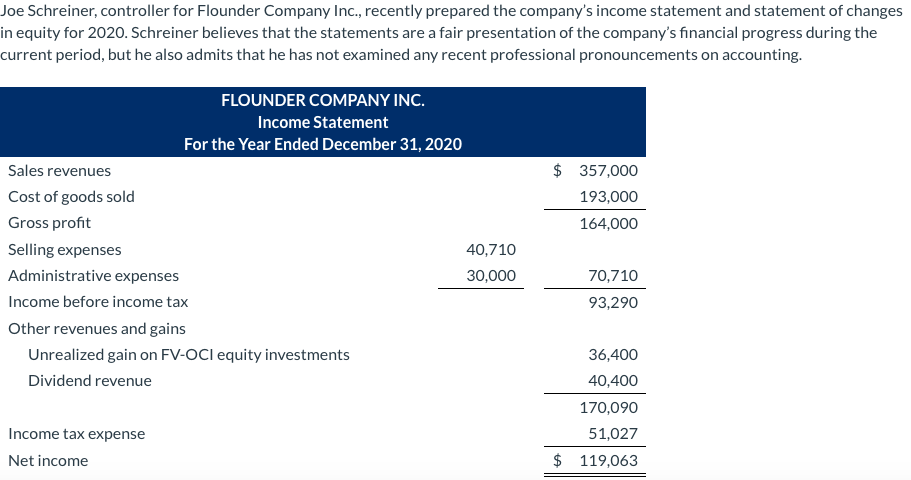

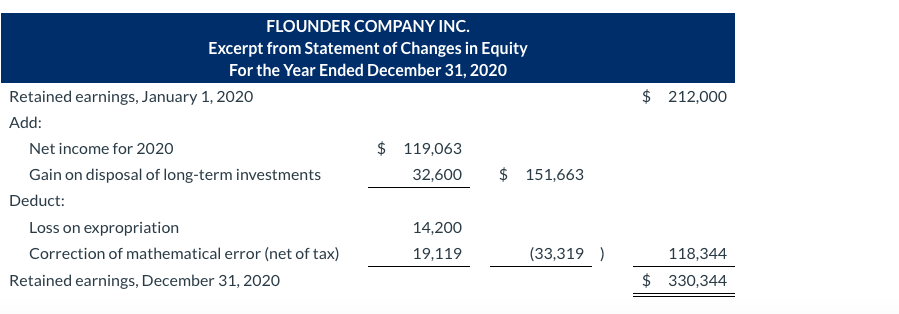

Joe Schreiner, controller for Flounder Company Inc., recently prepared the company's income statement and statement of changes in equity for 2020. Schreiner believes that the statements are a fair presentation of the company's financial progress during the current period, but he also admits that he has not examined any recent professional pronouncements on accounting. $ 357,000 193,000 164,000 FLOUNDER COMPANY INC. Income Statement For the Year Ended December 31, 2020 Sales revenues Cost of goods sold Gross profit Selling expenses 40,710 Administrative expenses 30,000 Income before income tax Other revenues and gains Unrealized gain on FV-OCl equity investments Dividend revenue 70,710 93,290 36,400 40,400 170,090 51,027 $ 119,063 Income tax expense Net income $ 212,000 FLOUNDER COMPANY INC. Excerpt from Statement of Changes in Equity For the Year Ended December 31, 2020 Retained earnings, January 1, 2020 Add: Net income for 2020 $ 119,063 Gain on disposal of long-term investments 32,600 $ 151,663 Deduct: Loss on expropriation 14,200 Correction of mathematical error (net of tax) 19,119 (33,319) Retained earnings, December 31, 2020 118,344 $ 330,344 Assume that Flounder Company follows IFRS. Assume that investments are accounted for as FV-OCl equity investments with gains/losses not recycled through net income. Prepare a statement of financial performance showing expenses by function. Ignore calculation of EPS. (Round answers to decimal places, e.g. 5,275. Round tax rate to 4 decimal places, eg. 52.7525%.) FLOUNDER COMPANY INC. Statement of Comprehensive Income For the Year Ended December 31, 2020 Sales Revenues $ 357,000 Cost of Goods Sold (193,000) Gross Profit/(Loss) 164,000 Selling Expenses $ 40,710 Administrative Expenses 30,000 (70,710) Operating Income Before Income Tax 93,290 Other Revenues and Gains Gain on Disposal of Long-Term Investments 32,600 Dividend Revenue 40,400 Total Other Revenues and Gains 73,000 166,290 Other Expenses and Losses

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts