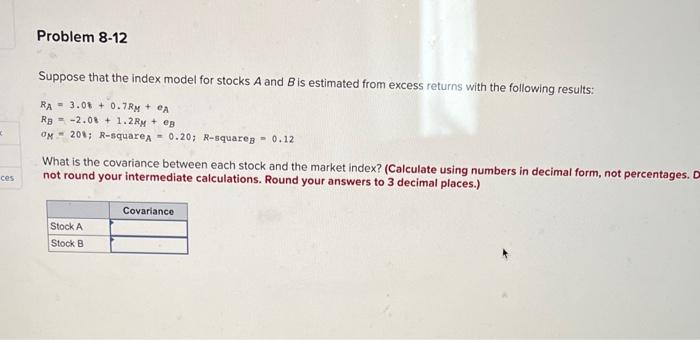

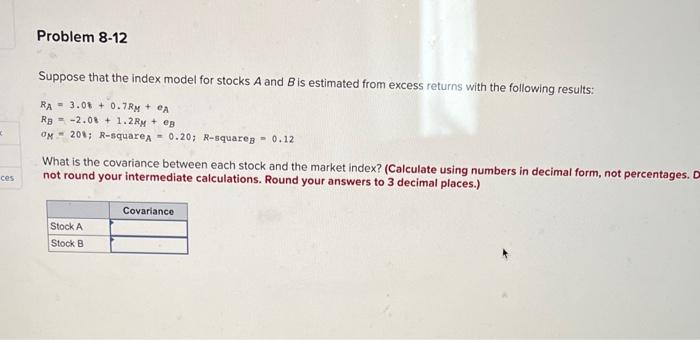

Question: please help Suppose that the index model for stocks A and B is estimated from excess returns with the following results: RA=3.08+0.7RM+eARB=2.08+1.2RM+eBM=208;Rs-suareeA=0.20;R-squareeB=0.12 What is the

please help

Suppose that the index model for stocks A and B is estimated from excess returns with the following results: RA=3.08+0.7RM+eARB=2.08+1.2RM+eBM=208;Rs-suareeA=0.20;R-squareeB=0.12 What is the covariance between each stock and the market index? (Calculate using numbers in decimal form, not percentages. not round your intermediate calculations. Round your answers to 3 decimal places.)

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock