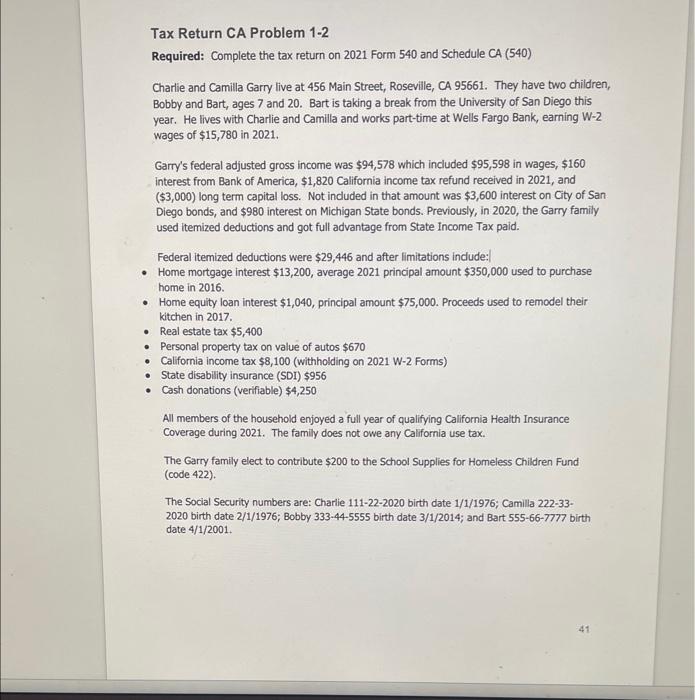

Question: please help Tax Return CA Problem 1-2 Required: Complete the tax return on 2021 Form 540 and Schedule CA (540) Tax Return CA Problem 1-2

Tax Return CA Problem 1-2 Required: Complete the tax return on 2021 Form 540 and Schedule CA (540) Charlie and Camilla Garry live at 456 Main Street, Roseville, CA 95661. They have two children, Bobby and Bart, ages 7 and 20. Bart is taking a break from the University of San Diego this year. He lives with Charlie and Camilla and works part-time at Wells Fargo Bank, earning W-2 wages of $15,780 in 2021 . Garry's federal adjusted gross income was $94,578 which included $95,598 in wages, $160 interest from Bank of America, $1,820 California income tax refund received in 2021, and ($3,000) long term capital loss. Not induded in that amount was $3,600 interest on City of San Diego bonds, and $980 interest on Michigan State bonds. Previously, in 2020, the Garry family used itemized deductions and got full advantage from State Income Tax paid. Federal itemized deductions were $29,446 and after limitations indude:| - Home mortgage interest $13,200, average 2021 principal amount $350,000 used to purchase home in 2016. - Home equity loan interest $1,040, principal amount $75,000. Proceeds used to remodel their kitchen in 2017. - Real estate tax $5,400 - Personal property tax on value of autos $670 - Calfornia income tax $8,100 (withholding on 2021 W-2 Forms) - State disablily insurance (SDI) $956 - Cash donations (verifiable) $4,250 All members of the household enjoyed a full year of qualifying California Health Insurance Coverage during 2021. The family does not owe any Calfornia use tax. The Garry family elect to contribute $200 to the School Supplies for Homeless Children Fund (code 422). The Social Security numbers are: Charlie 111-22-2020 birth date 1/1/1976; Camilla 222-332020 birth date 2/1/1976; Bobby 333-44-5555 birth date 3/1/2014; and Bart 555-66-7777 birth date 4/1/2001. Tax Return CA Problem 1-2 Required: Complete the tax return on 2021 Form 540 and Schedule CA (540) Charlie and Camilla Garry live at 456 Main Street, Roseville, CA 95661. They have two children, Bobby and Bart, ages 7 and 20. Bart is taking a break from the University of San Diego this year. He lives with Charlie and Camilla and works part-time at Wells Fargo Bank, earning W-2 wages of $15,780 in 2021 . Garry's federal adjusted gross income was $94,578 which included $95,598 in wages, $160 interest from Bank of America, $1,820 California income tax refund received in 2021, and ($3,000) long term capital loss. Not induded in that amount was $3,600 interest on City of San Diego bonds, and $980 interest on Michigan State bonds. Previously, in 2020, the Garry family used itemized deductions and got full advantage from State Income Tax paid. Federal itemized deductions were $29,446 and after limitations indude:| - Home mortgage interest $13,200, average 2021 principal amount $350,000 used to purchase home in 2016. - Home equity loan interest $1,040, principal amount $75,000. Proceeds used to remodel their kitchen in 2017. - Real estate tax $5,400 - Personal property tax on value of autos $670 - Calfornia income tax $8,100 (withholding on 2021 W-2 Forms) - State disablily insurance (SDI) $956 - Cash donations (verifiable) $4,250 All members of the household enjoyed a full year of qualifying California Health Insurance Coverage during 2021. The family does not owe any Calfornia use tax. The Garry family elect to contribute $200 to the School Supplies for Homeless Children Fund (code 422). The Social Security numbers are: Charlie 111-22-2020 birth date 1/1/1976; Camilla 222-332020 birth date 2/1/1976; Bobby 333-44-5555 birth date 3/1/2014; and Bart 555-66-7777 birth date 4/1/2001

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts