Question: please help. thank you :) 1. (10 points) Suppose the value of the investments in your 401k portfolio increases in value from $12,750 to $14,500

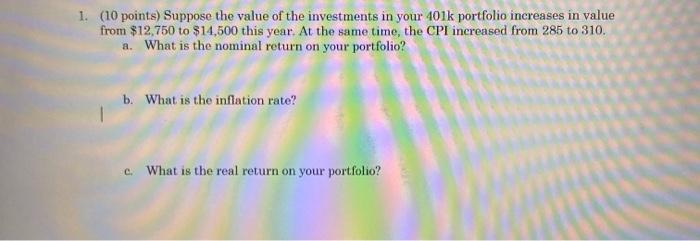

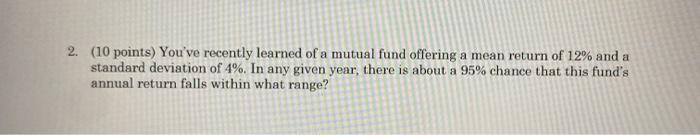

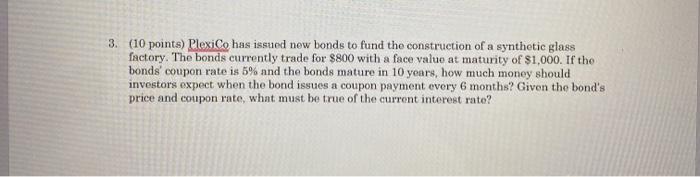

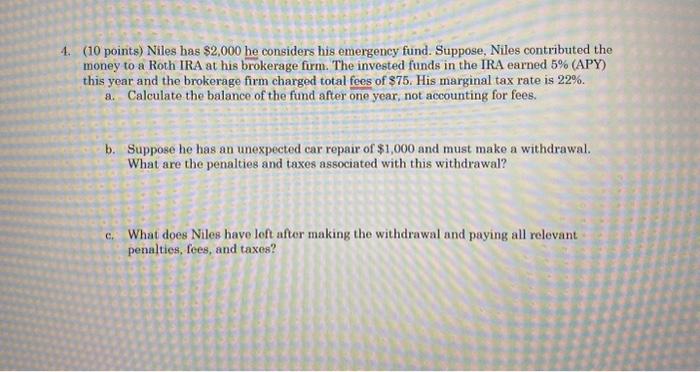

1. (10 points) Suppose the value of the investments in your 401k portfolio increases in value from $12,750 to $14,500 this year. At the same time, the CPI increased from 285 to 310 . a. What is the nominal return on your portfolio? b. What is the inflation rate? c. What is the real return on your portfolio? (10 points) You've recently learned of a mutual fund offering a mean return of 12% and a standard deviation of 4%. In any given year, there is about a 95% chance that this fund's annual return falls within what range? 3. (10 points) PlexiCo has issued new bonds to fund the construction of a synthetic glass factory. The bonds currently trade for $800 with a face value at maturity of $1,000. If the bonds' coupon rate is 5% and the bonds mature in 10 years, how much money should investors expect when the bond issues a coupon payment every 6 months? Given the bond's price and coupon rate, what must be true of the current interest rate? 4. (10 points) Niles has $2,000 he considers his emergency fund. Suppose, Niles contributed the money to a Roth IRA at his brokerage firm. The invested funds in the IRA earned 5% (APY) this year and the brokerage firm charged total fees of $75. His marginal tax rate is 22%. a. Calculate the balance of the fund after one year, not accounting for fees. b. Suppose he has an unexpected car repair of $1,000 and must make a withdrawal. What are the penalties and taxes associated with this withdrawal? c. What does Niles have loft after making the withdrawal and paying all relevant penalties, fees, and taxes

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts