Question: Please help, thank you. (Forecasting financing needs) Beason Manufacturing forecasts its sales next year to be $5.9 million and expects to earn 5.1 percent of

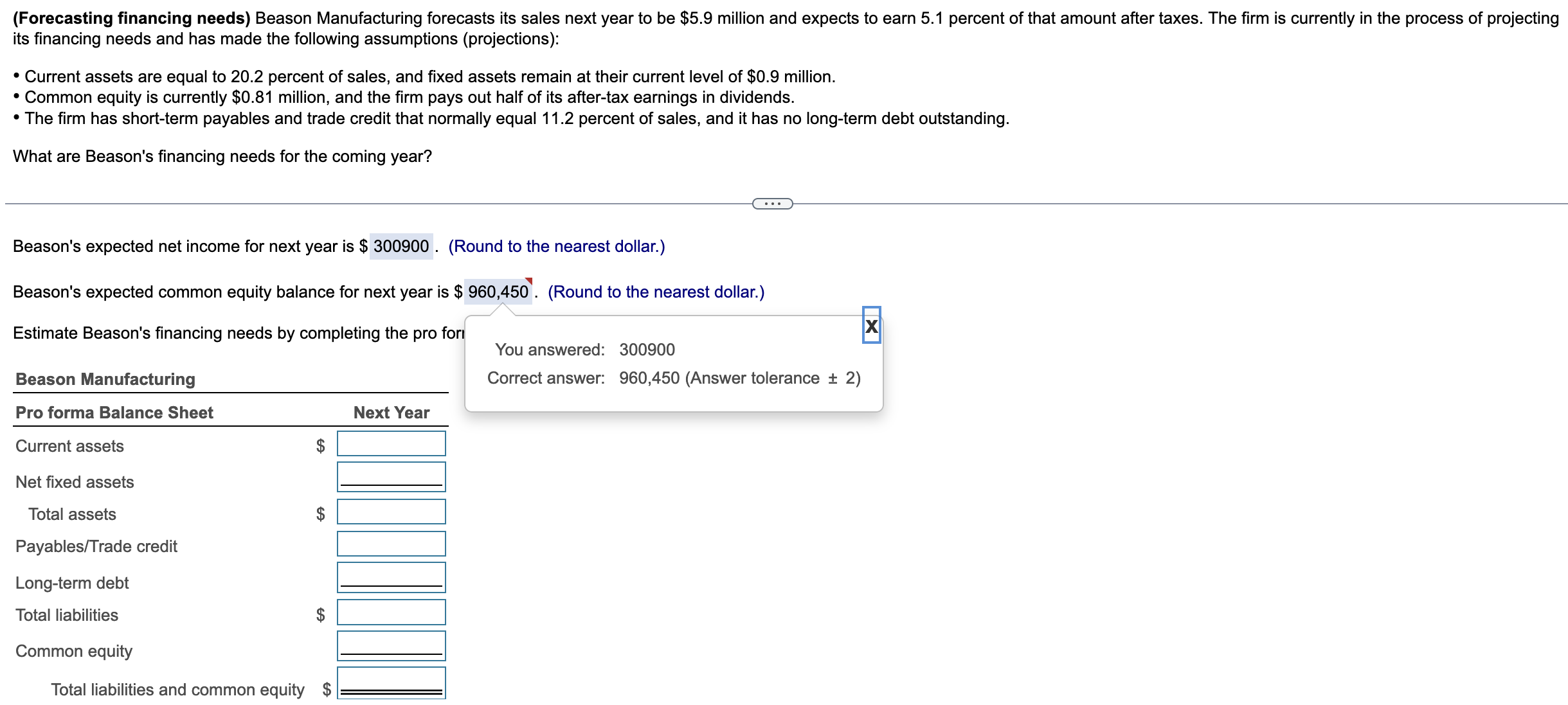

(Forecasting financing needs) Beason Manufacturing forecasts its sales next year to be $5.9 million and expects to earn 5.1 percent of that amount after taxes. The firm is currently in the process of projecting its financing needs and has made the following assumptions (projections): Current assets are equal to 20.2 percent of sales, and fixed assets remain at their current level of $0.9 million. Common equity is currently $0.81 million, and the firm pays out half of its after-tax earnings in dividends. The firm has short-term payables and trade credit that normally equal 1 1.2 percent of sales, and it has no long-term debt outstanding. What are Beason's financing needs for the coming year? Beason's expected net income for next year is $ 300900 . (Round to the nearest dollar.) Beason's expected common equity balance for next year is $ 960,450 . (Round to the nearest dollar.) Estimate Beason's financing needs by completing the pro for x 300900 960,450 (Answer tolerance 2) Beason Manufacturing Pro forma Balance Sheet Current assets Net fixed assets Total assets Payables/Trade credit Long-term debt Total liabilities Common equity Total liabilities and common equity $ You answered: Correct answer: Next Year

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts