Question: Please help, thank you! A trader uses delta hedging strategy to hedge a portfolio of short positions in call option on Apple Computer stocks. The

Please help, thank you!

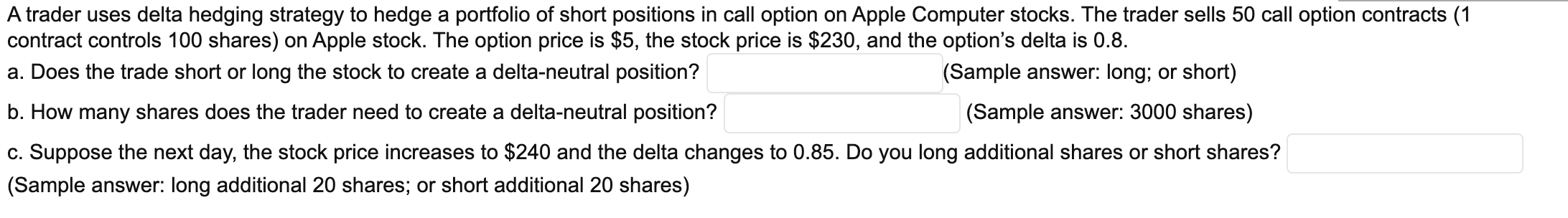

A trader uses delta hedging strategy to hedge a portfolio of short positions in call option on Apple Computer stocks. The trader sells 50 call option contracts (1 contract controls 100 shares) on Apple stock. The option price is $5, the stock price is $230, and the option's delta is 0.8. a. Does the trade short or long the stock to create a delta-neutral position? (Sample answer: long; or short) b. How many shares does the trader need to create a delta-neutral position? (Sample answer: 3000 shares) c. Suppose the next day, the stock price increases to $240 and the delta changes to 0.85. Do you long additional shares or short shares? (Sample answer: long additional 20 shares; or short additional 20 shares)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts