Question: Please help. Thank you. Attempts Keep the Highest / 20 1. The basic WACC equation The calculation of WACC involves calculating the weighted average of

Please help. Thank you.

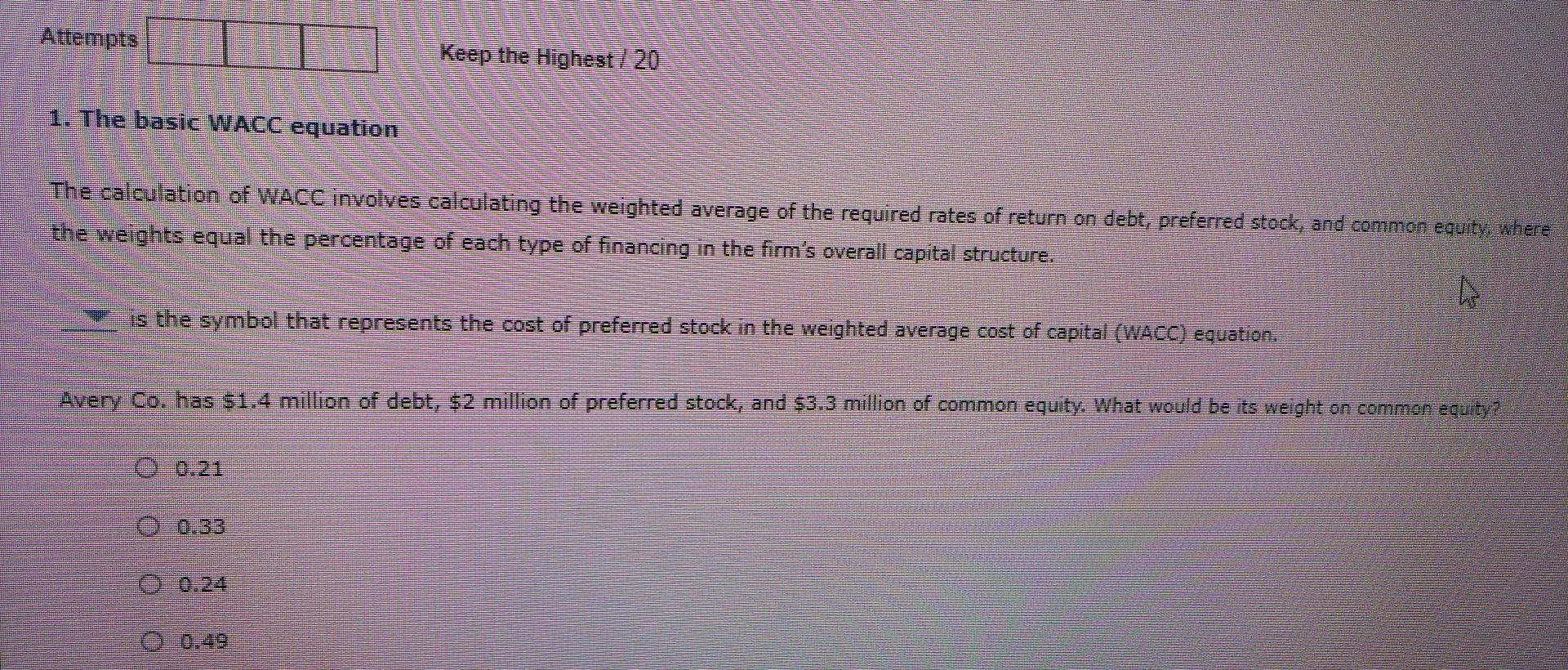

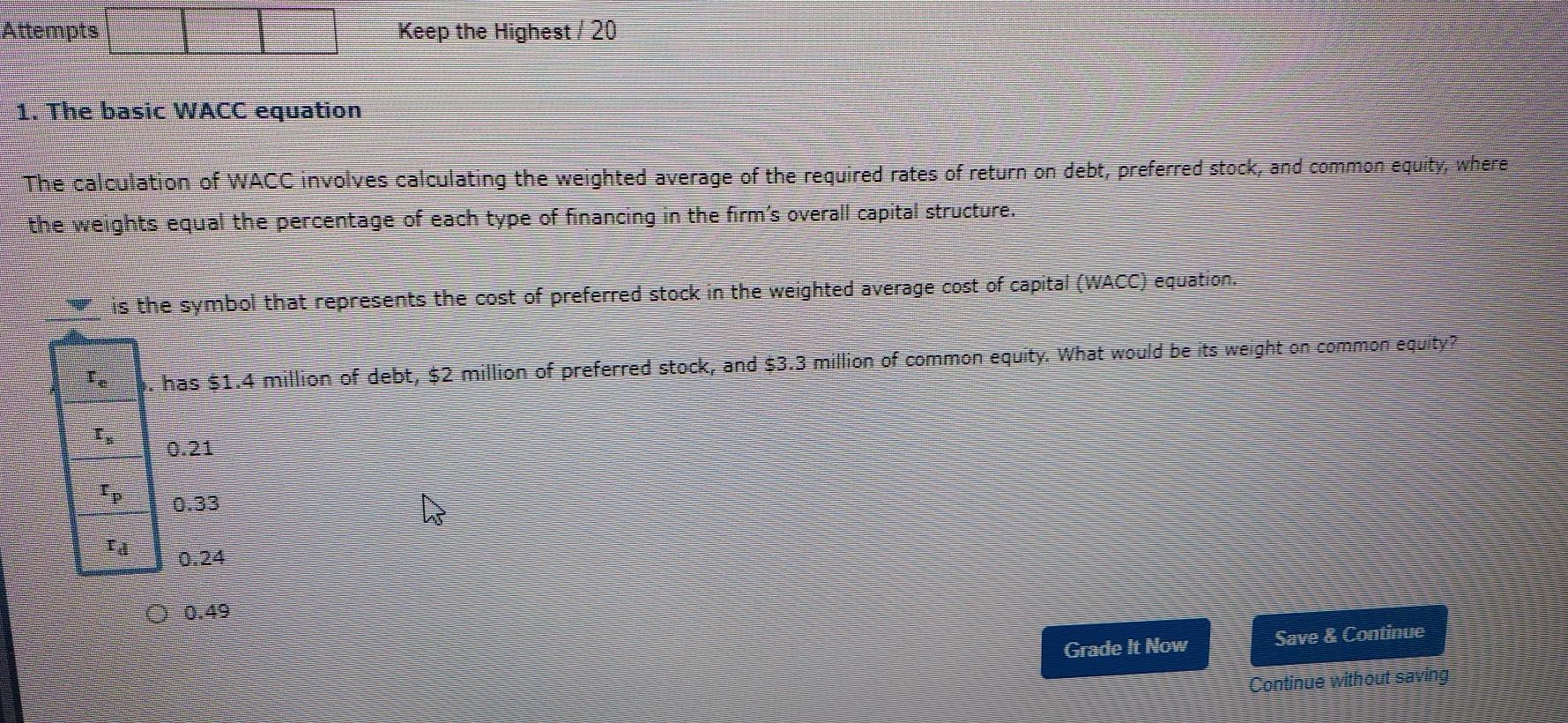

Attempts Keep the Highest / 20 1. The basic WACC equation The calculation of WACC involves calculating the weighted average of the required rates of return on debt, preferred stock, and common equity, where the weights equal the percentage of each type of financing in the firm's overall capital structure. is the symbol that represents the cost of preferred stock in the weighted average cost of capital (WACC) equation. Avery Co. has $1.4 million of debt, $2 million of preferred stock, and $3.3 million of common equity. What would be its weight on common equity 0 0.33 Attempts Keep the Highest / 20 1. The basic WACC equation The calculation of WACC involves calculating the weighted average of the required rates of return on debt, preferred stock, and common equity, where the weights equal the percentage of each type of financing in the firm's overall capital structure. is the symbol that represents the cost of preferred stock in the weighted average cost of capital (WACC) equation. has $1.4 million of debt, $2 million of preferred stock, and $3.3 million of common equity. What would be its weight on common equity? 0.21 0.33 7 & Save & Continue Grade It Now Continue without saving

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts