Question: please help, thank you Question #9(5+5=10 marks ) (a) Grace Bros. Ltd pays 20% corporate tax. It is comparing two different capital structures: an all-equity

please help, thank you

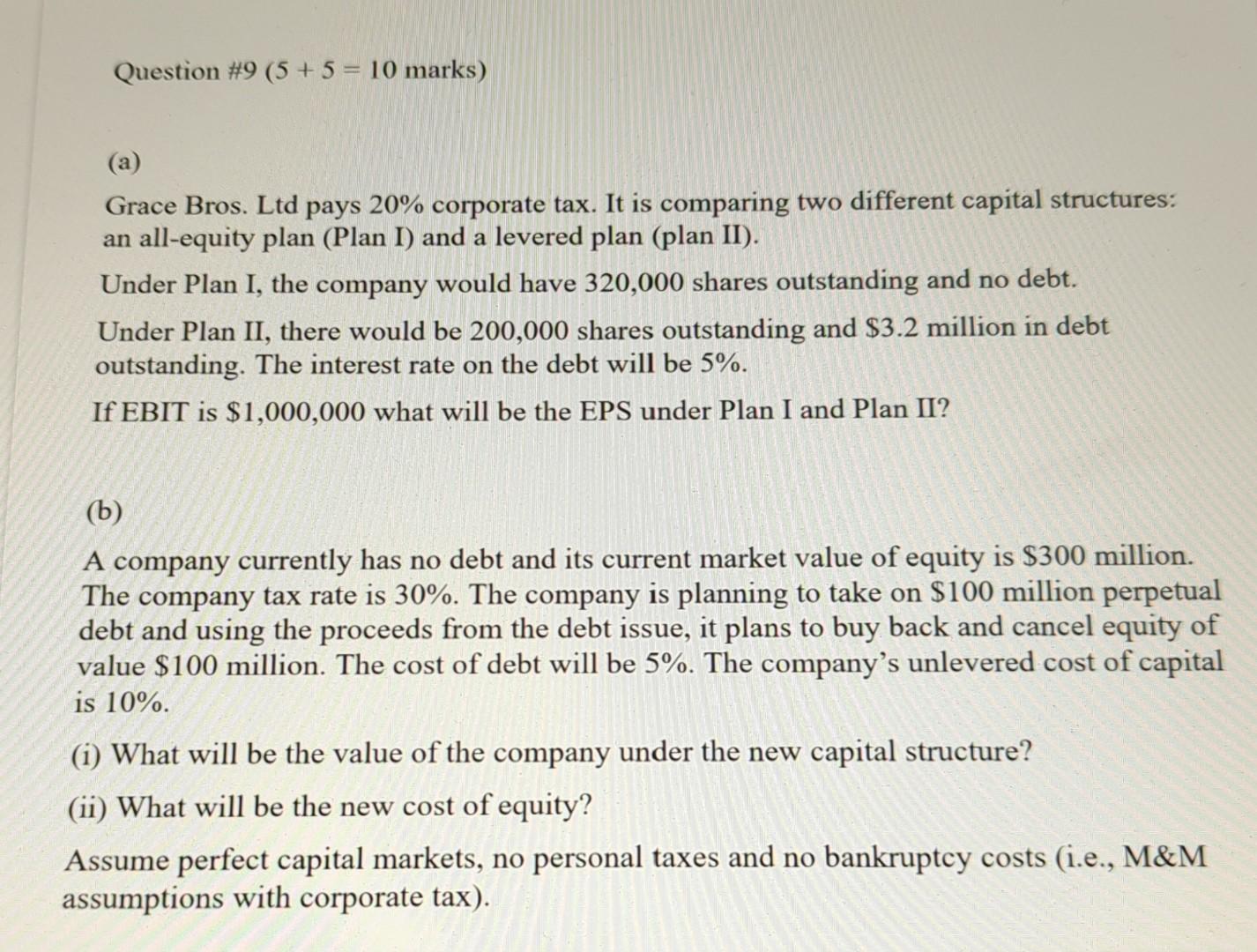

Question #9(5+5=10 marks ) (a) Grace Bros. Ltd pays 20% corporate tax. It is comparing two different capital structures: an all-equity plan (Plan I) and a levered plan (plan II). Under Plan I, the company would have 320,000 shares outstanding and no debt. Under Plan II, there would be 200,000 shares outstanding and \$3.2 million in debt outstanding. The interest rate on the debt will be 5%. If EBIT is $1,000,000 what will be the EPS under Plan I and Plan II? (b) A company currently has no debt and its current market value of equity is $300 million. The company tax rate is 30%. The company is planning to take on $100 million perpetual debt and using the proceeds from the debt issue, it plans to buy back and cancel equity of value $100 million. The cost of debt will be 5%. The company's unlevered cost of capital is 10% (i) What will be the value of the company under the new capital structure? (ii) What will be the new cost of equity? Assume perfect capital markets, no personal taxes and no bankruptcy costs (i.e., M\&M assumptions with corporate tax)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts