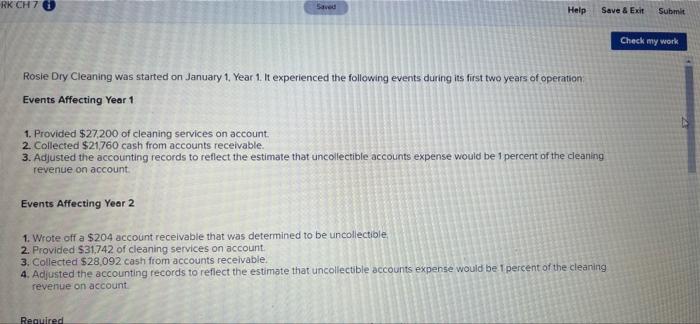

Question: please help! thank you!! RK CH7 0 Saved Help Save & Exit Submit Check my work Rosie Dry Cleaning was started on January 1, Year

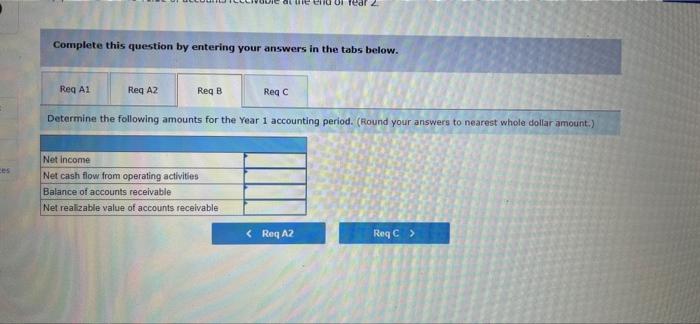

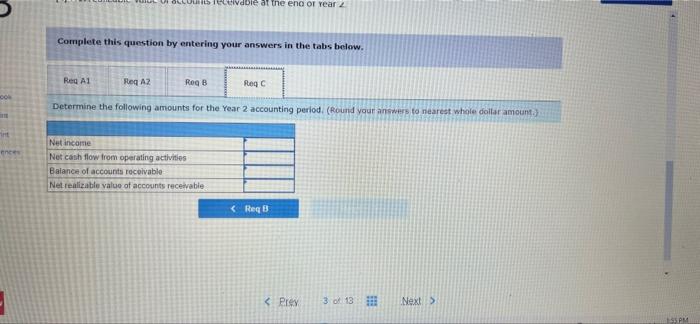

RK CH7 0 Saved Help Save & Exit Submit Check my work Rosie Dry Cleaning was started on January 1, Year 1. It experienced the following events during its first two years of operation Events Affecting Year 1 1. Provided $27.200 of cleaning services on account. 2. Collected $21760 cash from accounts receivable. 3. Adjusted the accounting records to reflect the estimate that uncollectible accounts expense would be 1 percent of the cleaning revenue on account Events Affecting Year 2 1. Wrote off a $204 account receivable that was determined to be uncollectible 2. Provided $31,742 of cleaning services on account 3. Collected $28,092 cash from accounts receivable 4. Adjusted the accounting records to reflect the estimate that uncollectible accounts expense would be 1 percent of the cleaning revenue on account Required alueella rear 2 Complete this question by entering your answers in the tabs below. Reg A1 Req AZ Reg B Reqc Determine the following amounts for the Year 1 accounting period. (Round your answers to nearest whole dollar amount.) ces Net Income Net cash flow from operating activities Balance of accounts receivable Net realizable value of accounts receivable OLLOdble at the end of Year 2 Complete this question by entering your answers in the tabs below. Reg A1 Reg AZ Rog B Reqc DO Determine the following amounts for the Year 2 accounting period (Round your answers to nearest whole dollar amount Net income Net cash flow from operating activities Balance of accounts receivable Net realizable value of accounts receivable SPM RK CH7 0 Saved Help Save & Exit Submit Check my work Rosie Dry Cleaning was started on January 1, Year 1. It experienced the following events during its first two years of operation Events Affecting Year 1 1. Provided $27.200 of cleaning services on account. 2. Collected $21760 cash from accounts receivable. 3. Adjusted the accounting records to reflect the estimate that uncollectible accounts expense would be 1 percent of the cleaning revenue on account Events Affecting Year 2 1. Wrote off a $204 account receivable that was determined to be uncollectible 2. Provided $31,742 of cleaning services on account 3. Collected $28,092 cash from accounts receivable 4. Adjusted the accounting records to reflect the estimate that uncollectible accounts expense would be 1 percent of the cleaning revenue on account Required alueella rear 2 Complete this question by entering your answers in the tabs below. Reg A1 Req AZ Reg B Reqc Determine the following amounts for the Year 1 accounting period. (Round your answers to nearest whole dollar amount.) ces Net Income Net cash flow from operating activities Balance of accounts receivable Net realizable value of accounts receivable OLLOdble at the end of Year 2 Complete this question by entering your answers in the tabs below. Reg A1 Reg AZ Rog B Reqc DO Determine the following amounts for the Year 2 accounting period (Round your answers to nearest whole dollar amount Net income Net cash flow from operating activities Balance of accounts receivable Net realizable value of accounts receivable SPM

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts