Question: please help. thank you : ) Select a term from the awer bank to complete the following statements. Some answers may be used more than

please help. thank you : )

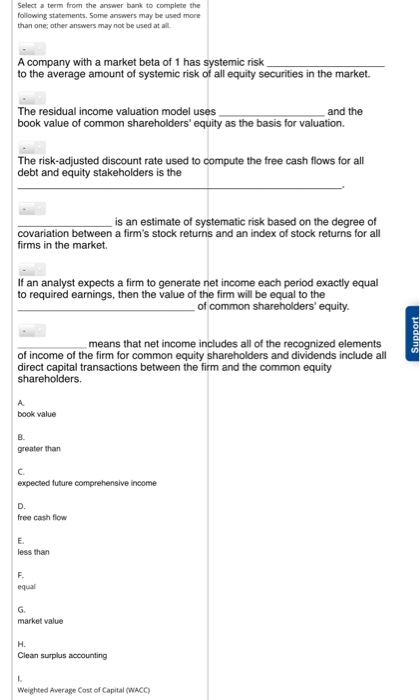

please help. thank you : )Select a term from the awer bank to complete the following statements. Some answers may be used more than one other answers may not be used at all A company with a market beta of 1 has systemic risk to the average amount of systemic risk of all equity securities in the market. The residual income valuation model uses and the book value of common shareholders' equity as the basis for valuation. The risk-adjusted discount rate used to compute the free cash flows for all debt and equity stakeholders is the is an estimate of systematic risk based on the degree of covariation between a firm's stock returns and an index of stock returns for all firms in the market. If an analyst expects a firm to generate net income each period exactly equal to required earnings, then the value of the firm will be equal to the of common shareholders' equity. Guns means that net income includes all of the recognized elements of income of the firm for common equity shareholders and dividends include all direct capital transactions between the firm and the common equity shareholders. book value greater than expected future comprehensive income free cash fow less than market value Clean surplus accounting Weighted Average Cost of Capital (WACC)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts