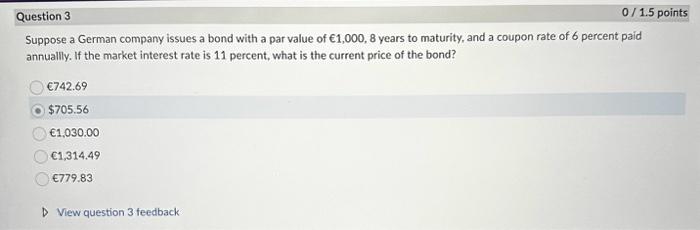

Question: please help! thank you! the current answer is wrong. Suppose a German company issues a bond with a par value of 1,000,8 years to maturity,

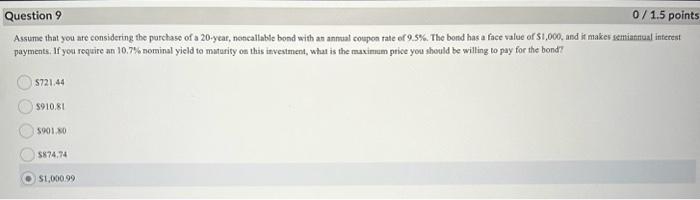

Suppose a German company issues a bond with a par value of 1,000,8 years to maturity, and a coupon rate of 6 percent paid annually. If the market interest rate is 11 percent, what is the current price of the bond? 6742.69 $705.56 61,030.00 61,314.49 779.83 D) View question 3 feedback Assume that you ate considering the porchase of a 20 ycar, noticallable bond with an annual coupen rate of 9.5%. The bond has a face value of 51,000 , and it makes ictniatnual infereat payments. If yea require an 10.7% nominal yield to materity on thas investment, what is the maximum price yoa should be willing to pay for the bond? 5721,44 5910.81 5901.00 5874,74 51,000.99

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts