Question: please help, thank you! :) View Policies Current Attempt in Progress Michael Jones just received a cash gift from his grandfather. He plans to invest

please help, thank you! :)

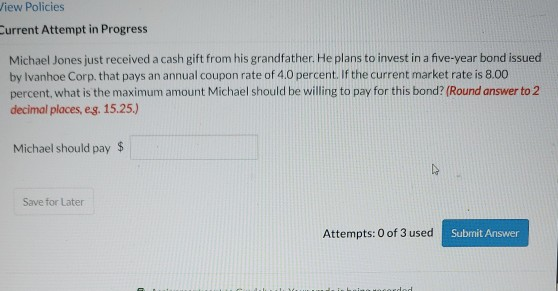

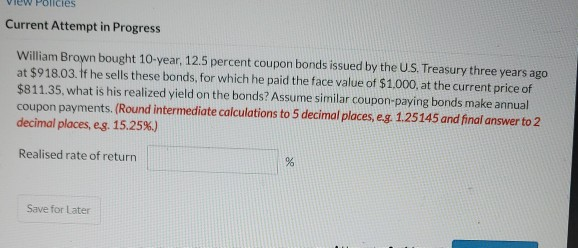

View Policies Current Attempt in Progress Michael Jones just received a cash gift from his grandfather. He plans to invest in a five-year bond issued by Ivanhoe Corp. that pays an annual coupon rate of 4.0 percent. If the current market rate is 8.00 percent, what is the maximum amount Michael should be willing to pay for this bond? (Round answer to 2 decimal places, eg. 15.25.) Michael should pay $ Save for Later Attempts: 0 of 3 used Submit Answer Current Attempt in Progress William Brown bought 10-year, 12.5 percent coupon bonds issued by the U.S. Treasury three years ago at $918.03. If he sells these bonds, for which he paid the face value of $1,000, at the current price of $811.35. what is his realized yield on the bonds? Assume similar coupon-paying bonds make annual coupon payments. (Round intermediate calculations to 5 decimal places, eg. 1.25145 and final answer to 2 decimal places, e.g. 15.25%) Realised rate of return % Save for Later

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts