Question: Please help. thanks 26. The CAPM is a factor model, whereas the APT is a factor model. A) 1;2 B) 1;3 C) 1;4 D) 1

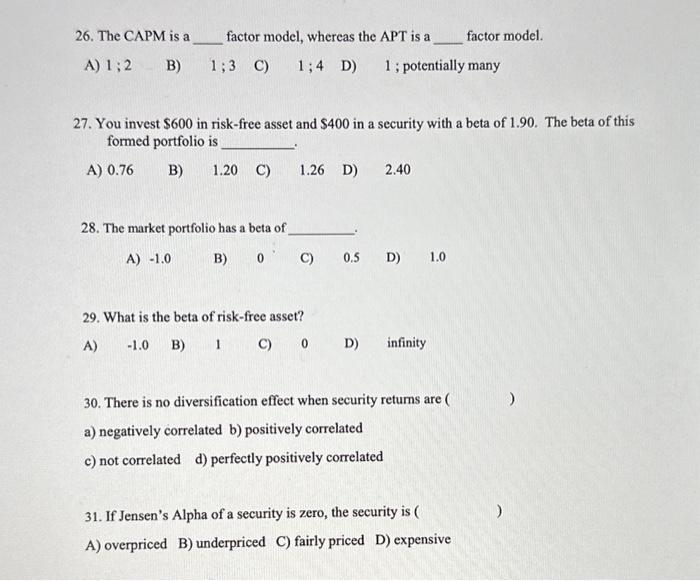

26. The CAPM is a factor model, whereas the APT is a factor model. A) 1;2 B) 1;3 C) 1;4 D) 1 ; potentially many 27. You invest $600 in risk-free asset and $400 in a security with a beta of 1.90 . The beta of this formed portfolio is A) 0.76 B) 1.20 C) 1.26 D) 2.40 28. The market portfolio has a beta of A) -1.0 B) 0 C) 0.5 D) 1.0 29. What is the beta of risk-free asset? A) 1.0 B) 1 C) 0 D) infinity 30. There is no diversification effect when security returns are ( a) negatively correlated b) positively correlated c) not correlated d) perfectly positively correlated 31. If Jensen's Alpha of a security is zero, the security is I A) overpriced B) underpriced C) fairly priced D) expensive

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts