Question: Please Help. Thanks Question 5 (12 marks) You work for Hydro Tech, The firm specializes in from lakes, ponds, and streams in drought-stricken areas to

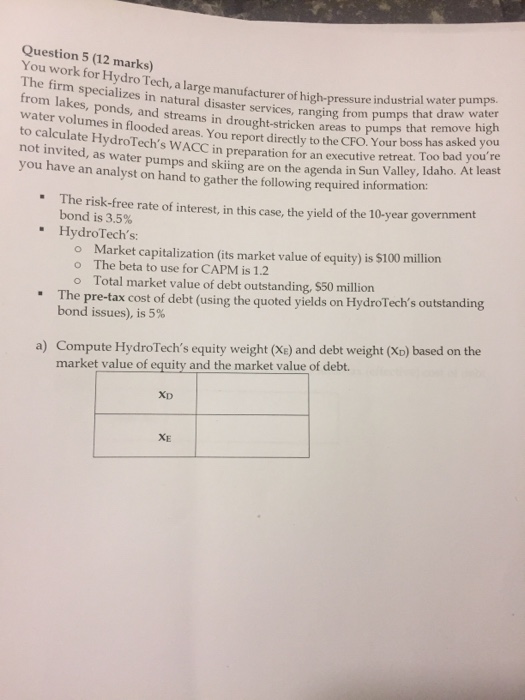

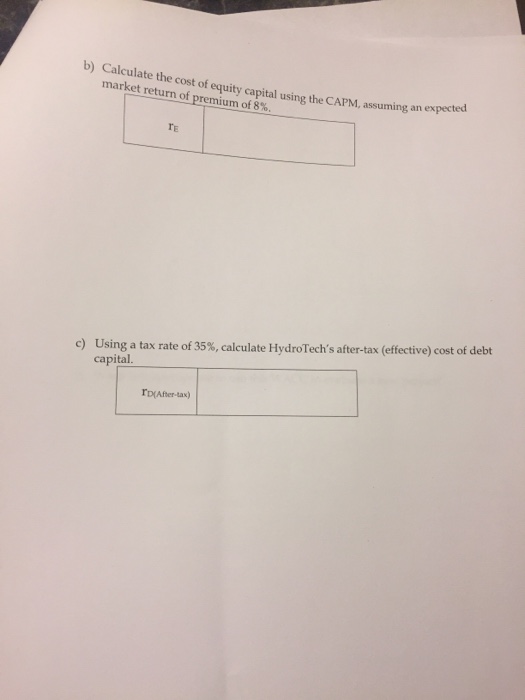

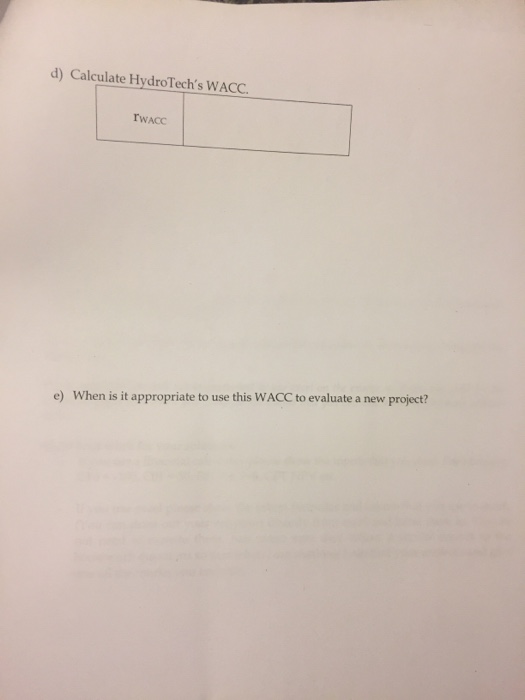

Question 5 (12 marks) You work for Hydro Tech, The firm specializes in from lakes, ponds, and streams in drought-stricken areas to pumps water volumes in flooded areas. You report directly to the o calculate HydroTech's WACC in preparation for an executive retreat. Too bad you re a large manufacturer of high-pressure industrial water pumps. that draw water that remove high boss has asked you natural disaster services, ranging from pumps CFO. Your not invited, as water pumps and skiing are on the agend innt you have an analyst on hand to gather the following required information Sun Valley, Idaho. At least The risk-free rate of interest, in this case, the yield of the 10-year government bond is 3.5% " .HydroTech's: Market capitalization (its market value of equity) is $100 million o The beta to use for CAPM is 1.2 Total market value of debt outstanding, $50 million The pre-tax cost of debt (using the quoted yields on HydroTech's outstanding bond issues), is 5% o " a) Compute HydroTech's equity weight (Xe) and debt weight (%) based on the market value of equity and the market value of debt. XD XE

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts