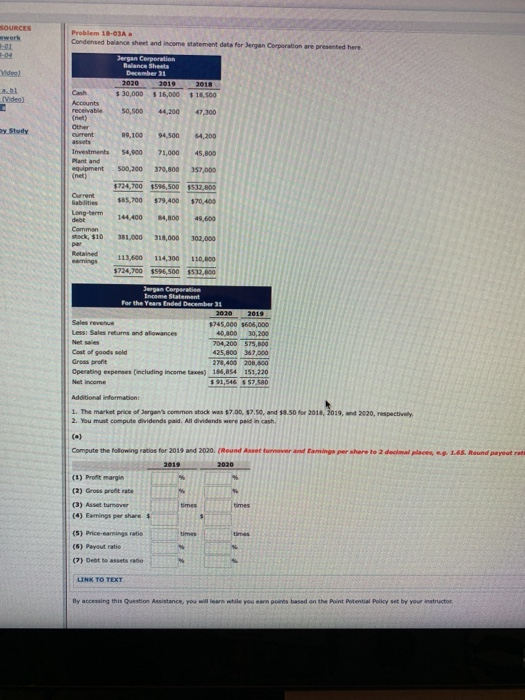

Question: please help thanks! SOURCES Problem 18-03A Condensed balance sheet and income statement data for Vergan Corporation are presented here -01 -04 Video) Sergan Corporation Balance

please help thanks!

please help thanks!SOURCES Problem 18-03A Condensed balance sheet and income statement data for Vergan Corporation are presented here -01 -04 Video) Sergan Corporation Balance Sheets December 31 2020 2019 $ 30,000 $ 16,000 2018 $10.500 (Video) Cash Accounts receivable (net) Other Current 50,500 44,200 47.300 by Study 09.100 94,500 64,200 54,900 71,000 45,800 Investments Plant and equipment (net) 500,200 370,800 357,000 $724,700 595,500 $532,800 $85,700 $79,400 $70,400 144,400 84,800 49,600 Ourrent Sabtes Long-term debt Common stack, $10 par Retained earnings 381,000 318,000 102,000 113.600 114,300 $724,700 $596,500 110,000 $532.600 Jergan Corporation Income Statement For the Year Ended December 31 2020 2019 Sales revenue $745,000 $605,000 Less Sales returns and lowances 40,300 30,200 Neties 704,200 575,000 Cost of goods sold 425,800 367,000 Gross profit 278,400 208.800 Operating expenses (including income taxes) 186,854 151,220 Net Income $ 91,546 557.580 Additional information: 1. The market price of Sergan's common stock was $7.00, 87.50 and $8.50 for 2018, 2019 and 2020, respectively 2. You must compute dividends pald. All dividends were paid in cash, Compute the following ratios for 2019 and 2020. (Round Assettorever and aming per share to 2 decimal places. 1.65. Round payout rat 2019 2020 (1) Profit margin % (2) Gross profitate (3) Adset turnover times times (4) Earnings per share $ 5 (5) Price-earnings ratio mes (6) Payout ratio (7) Debt to strato UNK TO TEXT By accessing this question Assistance, you will learn while you earn points based on the Point Potential Policy set by your instructor

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts