Question: Please help! Thanks!!! to do with dividends. a. What will my financial position be after the stock split, compared to my current position? (Hint: Assume

Please help! Thanks!!!

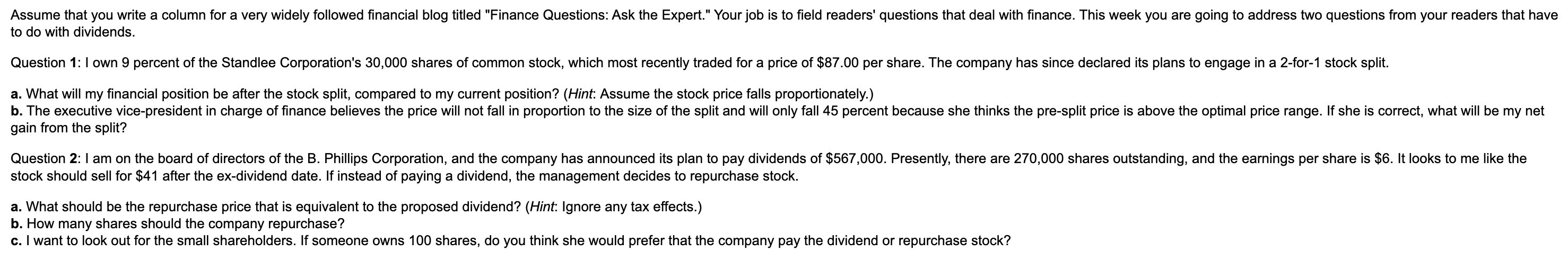

to do with dividends. a. What will my financial position be after the stock split, compared to my current position? (Hint: Assume the stock price falls proportionately.) gain from the split? stock should sell for $41 after the ex-dividend date. If instead of paying a dividend, the management decides to repurchase stock. a. What should be the repurchase price that is equivalent to the proposed dividend? (Hint: Ignore any tax effects.) b. How many shares should the company repurchase? c. I want to look out for the small shareholders. If someone owns 100 shares, do you think she would prefer that the company pay the dividend or repurchase stock

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts