Question: please help thanks Using the balance sheet provided for Universal Exports, determine the weighted average cost of capital. The firm's tax rate is 30%, the

please help thanks

please help thanks

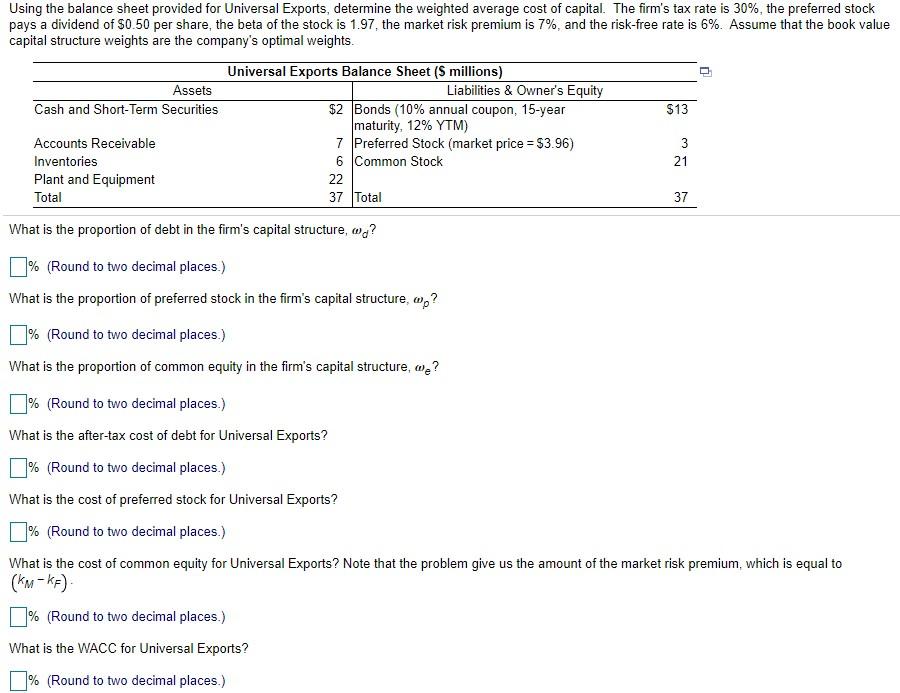

Using the balance sheet provided for Universal Exports, determine the weighted average cost of capital. The firm's tax rate is 30%, the preferred stock pays a dividend of $0.50 per share the beta of the stock is 1.97, the market risk premium is 7%, and the risk-free rate is 6%. Assume that the book value capital structure weights are the company's optimal weights. $13 Universal Exports Balance Sheet (5 millions) Assets Liabilities & Owner's Equity Cash and Short-Term Securities $2 Bonds (10% annual coupon, 15-year maturity, 12% YTM) Accounts Receivable 7 Preferred Stock (market price = $3.96) Inventories 6 Common Stock Plant and Equipment 22 Total 37 Total What is the proportion of debt in the firm's capital structure, 3 21 37 ]% (Round to two decimal places.) What is the proportion of preferred stock in the firm's capital structure, w,? ]% (Round to two decimal places.) What is the proportion of common equity in the firm's capital structure, we? 1% (Round to two decimal places.) What is the after-tax cost of debt for Universal Exports? % (Round to two decimal places.) What is the cost of preferred stock for Universal Exports? ]% (Round to two decimal places.) What is the cost of common equity for Universal Exports? Note that the problem give us the amount of the market risk premium, which is equal to (km-KE) 1% (Round to two decimal places.) What is the WACC for Universal Exports? % (Round to two decimal places.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts