Question: please help The data in the accompanying table represent the rate of return of a certain company stock for 11 months, compared with the rate

please help

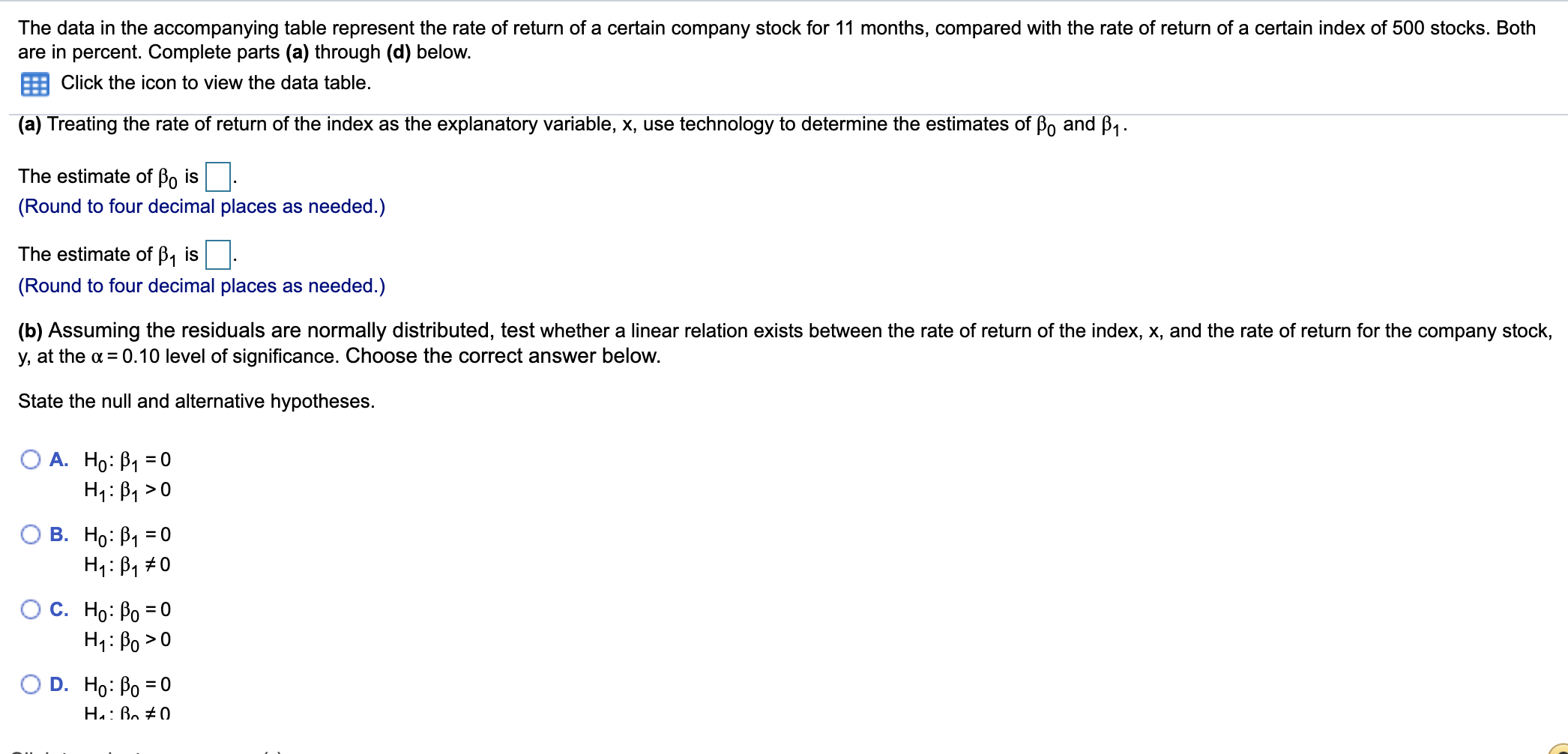

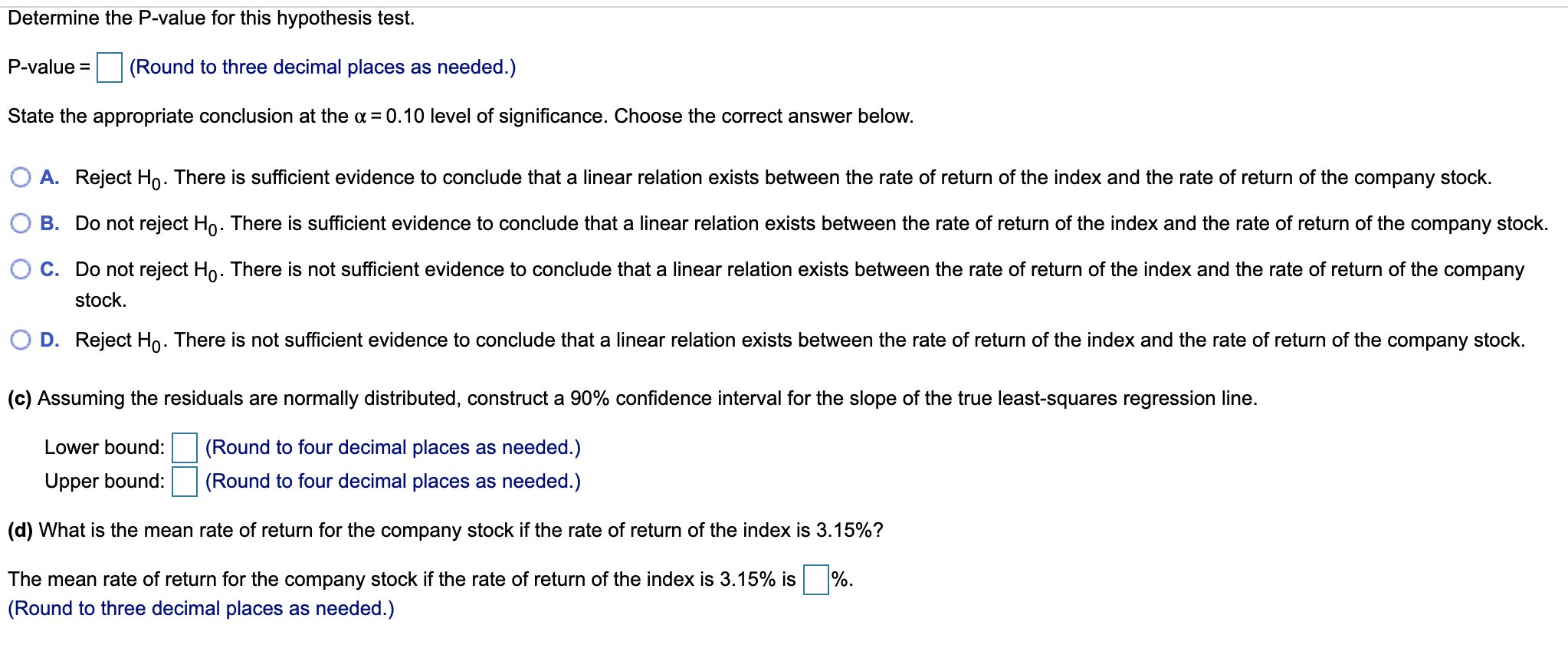

The data in the accompanying table represent the rate of return of a certain company stock for 11 months, compared with the rate of return of a certain index of 500 stocks. Both are in percent. Complete parts (a) through (cl) below. a Click the icon to view the data table. (a) Treating the rate of return of the index as the explanatory variable, x, use technology to determine the estimates of [to and B1 . The estimate of Do is (Round to four decimal places as needed.) The estimate of B1 is (Round to four decimal places as needed.) (b) Assuming the residuals are normally distributed, test whether a linear relation exists between the rate of return of the index, x, and the rate of return for the company stock, y, at the a = 0.10 level of signicance. Choose the correct answer below. State the null and alternative hypotheses. OA. OB. H031=0 H131>0 H0431=0 H1i10 . H0:0=0 H1io>0 . Ho:o=0 H.:n0 Determine the P-value for this hypothesis test. P-value = (Round to three decimal places as needed.) State the appropriate conclusion at the a = 0.10 level of significance. Choose the correct answer below. O A. Reject Ho. There is sufficient evidence to conclude that a linear relation exists between the rate of return of the index and the rate of return of the company stock. O B. Do not reject Ho. There is sufficient evidence to conclude that a linear relation exists between the rate of return of the index and the rate of return of the company stock. O C. Do not reject Ho. There is not sufficient evidence to conclude that a linear relation exists between the rate of return of the index and the rate of return of the company stock. O D. Reject Ho. There is not sufficient evidence to conclude that a linear relation exists between the rate of return of the index and the rate of return of the company stock. (c) Assuming the residuals are normally distributed, construct a 90% confidence interval for the slope of the true least-squares regression line. Lower bound: (Round to four decimal places as needed.) Upper bound: (Round to four decimal places as needed.) (d) What is the mean rate of return for the company stock if the rate of return of the index is 3.15%? The mean rate of return for the company stock if the rate of return of the index is 3.15% is |%. (Round to three decimal places as needed.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts