Question: Please help The difference between a Roth IRA and a traditional IRA is that in a Roth IRA taxes are paid on the income that

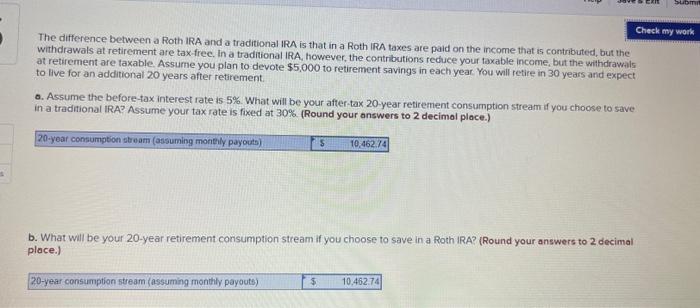

The difference between a Roth IRA and a traditional IRA is that in a Roth IRA taxes are paid on the income that is contributed, but the withdrawals at retirement are tax-free. In a traditional IRA, however, the contributions reduce your faxable income, but the withdrawals at retirement are laxable. Assume you plan to devote $5,000 to retirement savings in each year You will retire in 30 years and expect to live for an additional 20 years after retirement. a. Assume the before-tax interest rate is 5%. What will be your after-tax 20 -year retirement consumption stream if you choose to save in a traditional IRA? Assume your tax rate is fixed at 30%. (Round your answers to 2 decimol ploce.) What will be your 20 -year retirement consumption stream if you choose to save in a Roth IRA? (Round your answers to 2 decimal blace.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts