Question: please help :) The following income statement and balance sheets for Virtual Gaming Systems are provided. VIRTUAL GAMING SYSTEMS Income Statement For the year ended

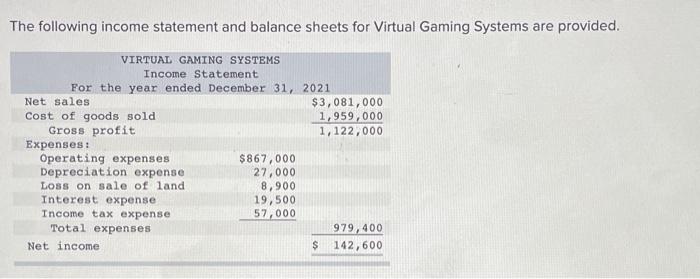

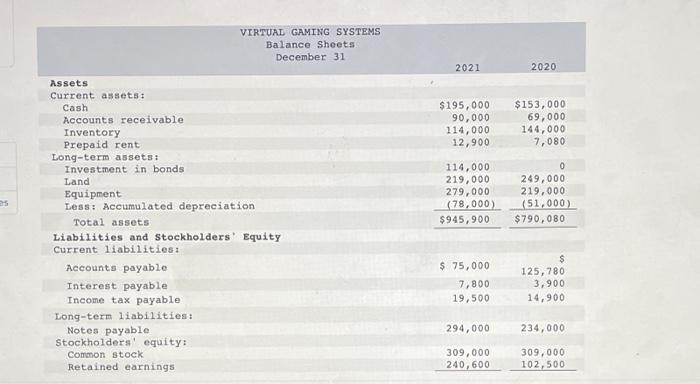

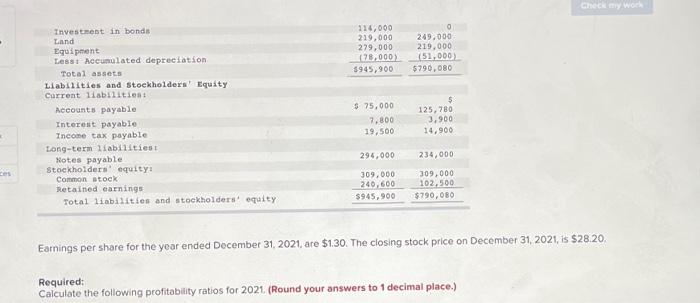

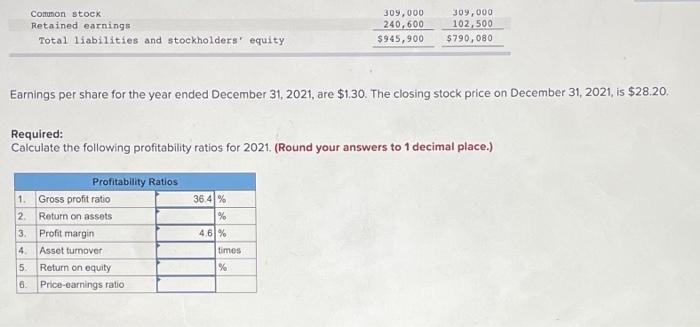

The following income statement and balance sheets for Virtual Gaming Systems are provided. VIRTUAL GAMING SYSTEMS Income Statement For the year ended December 31, 2021 Net sales $3,081,000 Cost of goods sold 1,959,000 Gross profit 1, 122,000 Expenses : Operating expenses $867,000 Depreciation expense 27,000 Loss on sale of land 8,900 Interest expense 19,500 Income tax expense 57,000 Total expenses 979,400 Net income $ 142,600 VIRTUAL GAMING SYSTEMS Balance Sheets December 31 2021 2020 $195,000 90,000 114,000 12,900 $153,000 69,000 144,000 7,080 Assets Current assets: Cash Accounts receivable Inventory Prepaid rent Long-term assets: Investment in bonds Land Equipment Less: Accumulated depreciation Total assets Liabilities and Stockholders. Equity Current liabilities: Accounts payable Interest payable Income tax payable Long-term liabilities: Notes payable Stockholders' equity: Common stock Retained earnings 114,000 219,000 279,000 (78,000) $945,900 0 249,000 219,000 (51.000) $790,080 $ 75,000 7,800 19,500 $ 125, 780 3,900 14,900 294,000 234,000 309,000 240,600 309,000 102,500 Check my work 114,000 219.000 279,000 120.000 $945,900 249.000 219.000 (51.000 $790,080 Investment in bonds Land Equipment Lesst Accumulated depreciation Total assets Liabilities and Stockholders' Equity Current liabilities: Accounts payable Interest payable Income tax payable Long-term liabilities Notes payable Stockholders' equity: Common stock Retained earnings Total liabilities and stockholders equity $ 75,000 7.800 19.500 5 125,780 3.900 14,900 294.000 234,000 309,000 240,600 $945,900 309,000 102,500 $790,000 Earnings per share for the year ended December 31, 2021, are $1.30. The closing stock price on December 31, 2021, is $28.20. Required: Calculate the following profitability ratios for 2021. (Round your answers to 1 decimal place.) Comon stock Retained earnings 309,000 240,600 $945,900 309,000 102,500 $790,080 Total liabilities and stockholders' equity Earnings per share for the year ended December 31, 2021, are $1.30. The closing stock price on December 31, 2021, is $28.20. Required: Calculate the following profitability ratios for 2021. (Round your answers to 1 decimal place.) 1. 2 N 3 Profitability Ratios Gross profit ratio Return on assets Profit margin Asset turnover Return on equity Price-earnings ratio 36.4% % 4.6% timos % 4 5. 6

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts