Question: please help!!!! The test is on investment project evaluation. You have to compare the project A from page 77 to the project B.from page 87,

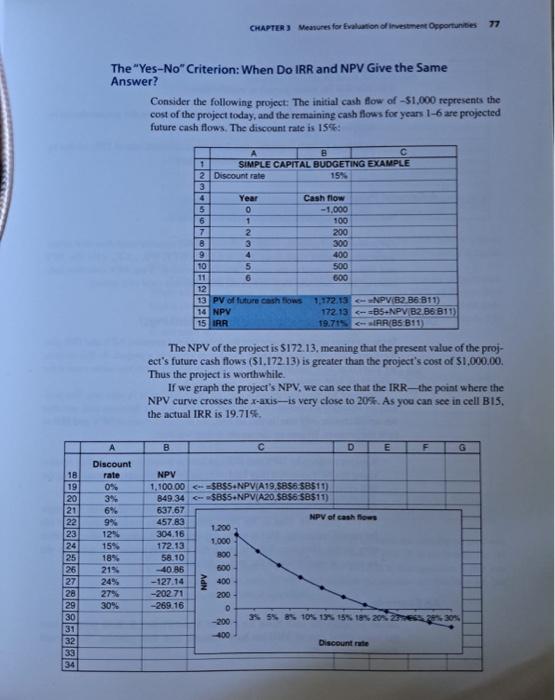

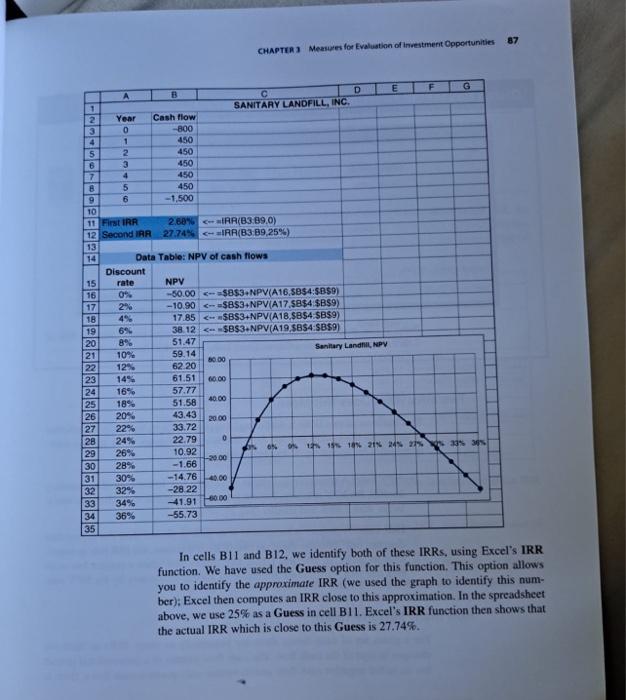

The test is on investment project evaluation. You have to compare the project A from page 77 to the project B.from page 87, as it is on pages 79, 80, 81. You have to make diagrams of the NPV vs Discount rates, Expected cash flows and PV as well as FV of these flows for the periods 0, and at the end of the project. When you consider the end of the project you make an evaluation when the cash flows occur at the end, as well as the beginning of the year.. 21 See pages 25 & 26 for that, Write a complete report, including your diagrams in your text and explain as detail as possible. ge se. CHAPTER) Measures for Evaluation of investment Opportunes 77 The "Yes-No" Criterion: When Do IRR and NPV Give the Same Answer? Consider the following project: The initial cash flow of -51.000 represents the cost of the project today, and the remaining cash flows for years 1-6 are projected future cash flows. The discount rate is 15% B 1 SIMPLE CAPITAL BUDGETING EXAMPLE 2. Discount rate 15% 3 Year Cash flow 5 o -1,000 6 1 100 7 2 200 B 300 9 4 400 10 5 500 11 6 600 12 13 PV of future cash flows 1.172.13 NPVB2 36 811) 14 NPV 172.13 =B5.NPV B2 B6 811) 15 IRR 19.715 AR/85 B11) Teem22 The NPV of the project is $172.13. meaning that the present value of the proj- ect's future cash flows (51.172.13) is greater than the project's cost of $1.000.00 Thus the project is worthwhile. If we graph the project's NPV, we can see that the IRR-the point where the NPV curve crosses the x-axis-is very close to 20%. As you can see in cell B15. the actual IRR is 19.71%. B D E F G 18 19 20 21 22 23 24 25 25 27 28 29 30 31 32 33 34 Discount rate 0% 3% 6% 9% 12 15% 18% 215 249 27% 30% NPV 1,100.00 $B$5.NPVA 19.5895 $8$11) B49.34 $8$5.NPV(A20.5856 58$11) 637.67 NPV of cash flow 457.83 1.200 304.16 172.13 1.000 58.10 800 -40.86 500 400 -20271 200 -269.16 -200 3 5 8 10% 15% 15% 18% 20% 400 Discount -127.14 30% CHAPTER) Measures for Evaluation of investment Opportunities 87 G 450 D F B E C 1 SANITARY LANDFILL, INC. 2 Year Cash flow 3 0 -800 4 1 5 2 450 6 3 450 7 4 450 5 450 9 6 -1,500 TO 11 First IRR 2,68% CHIRR(B3.09.0) 12 Second IRR 27.74% IRR(B389,25%) 13 14 Data Table: NPV of cash flows Discount 15 rate NPV 16 --50.00

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts