Question: Please help - there are 3 questions in this post, thanks! Current Attempt in Progress Blossom Clark opened Blossom's Cleaning Service on July 1, 2022.

Please help - there are 3 questions in this post, thanks!

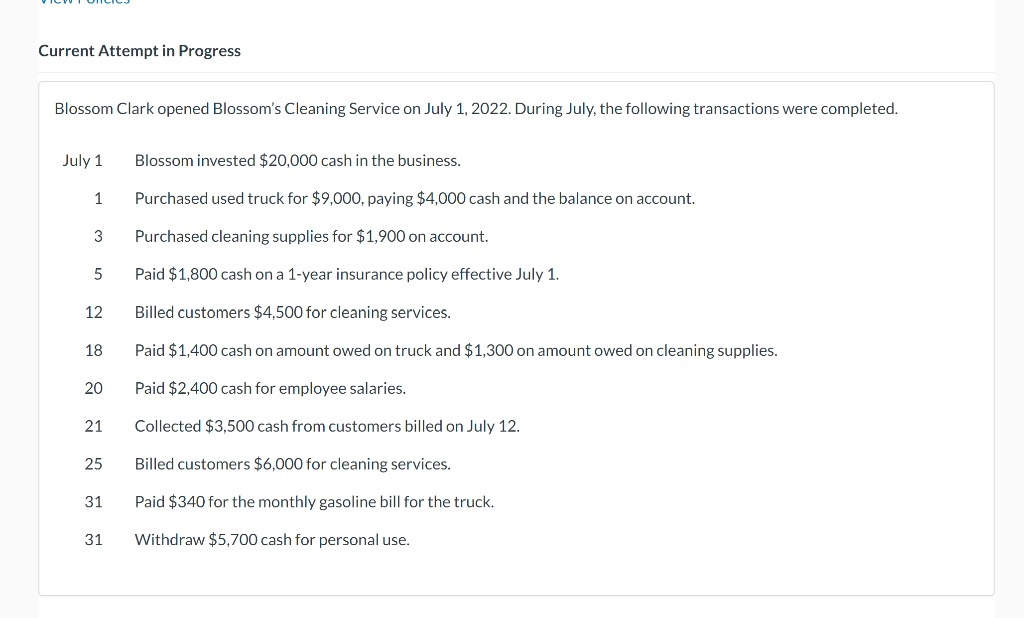

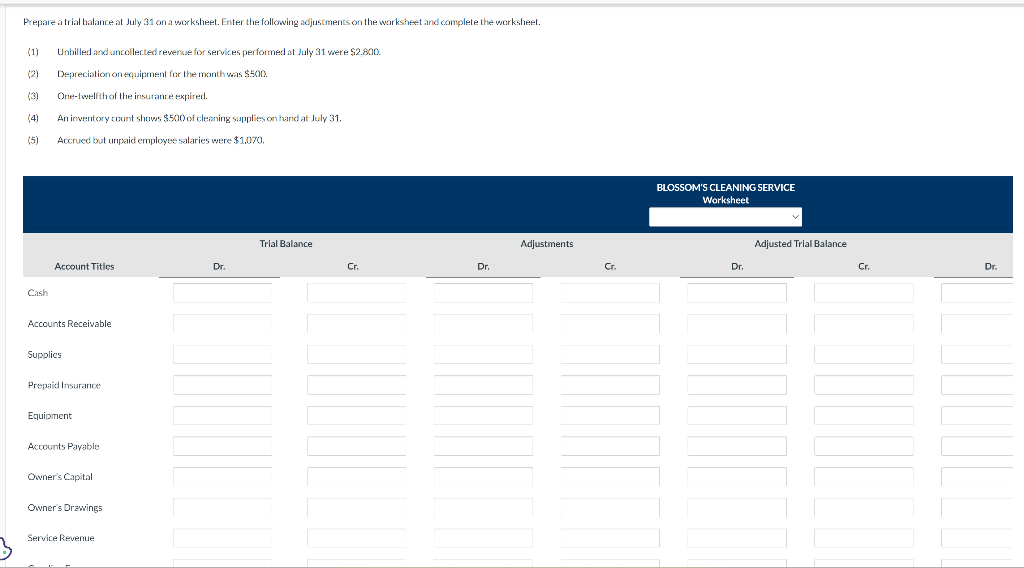

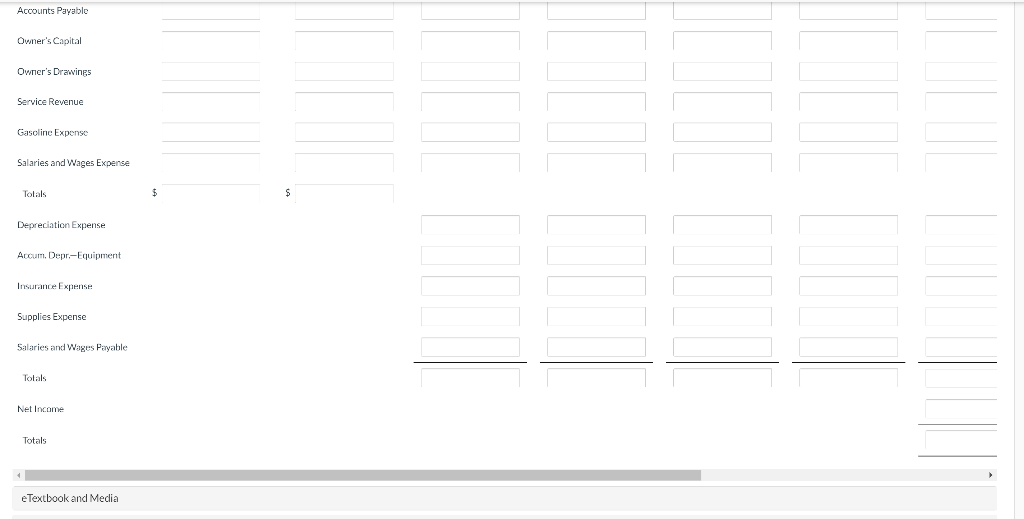

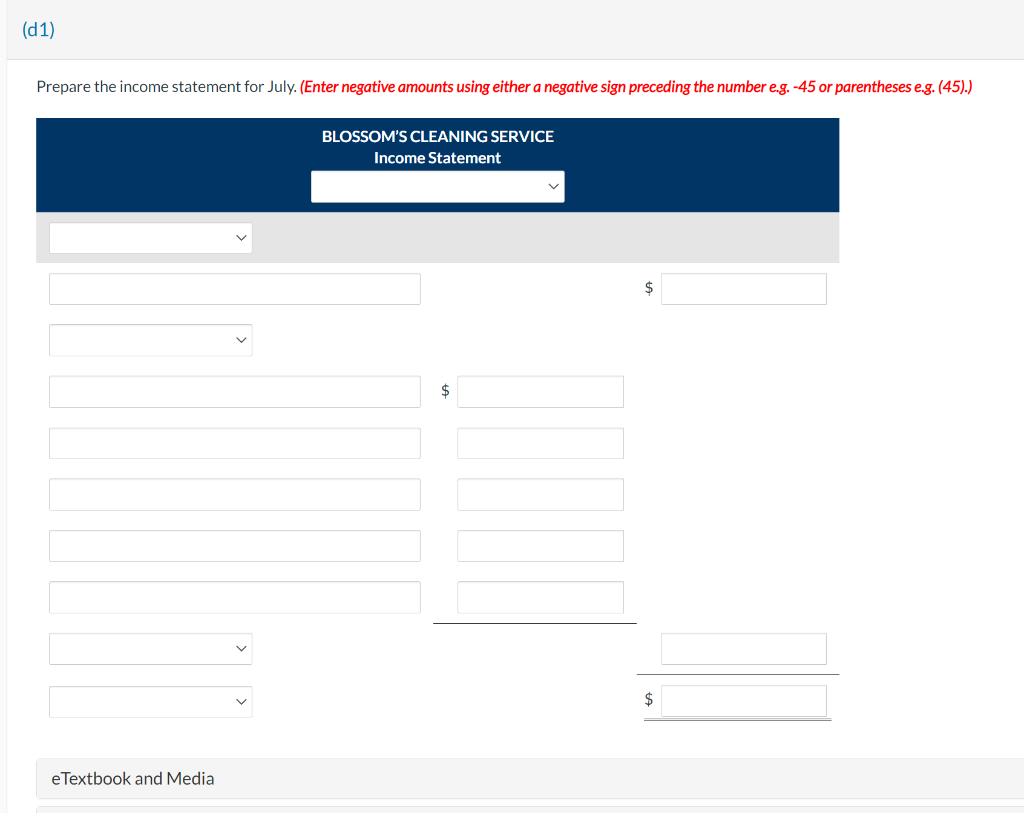

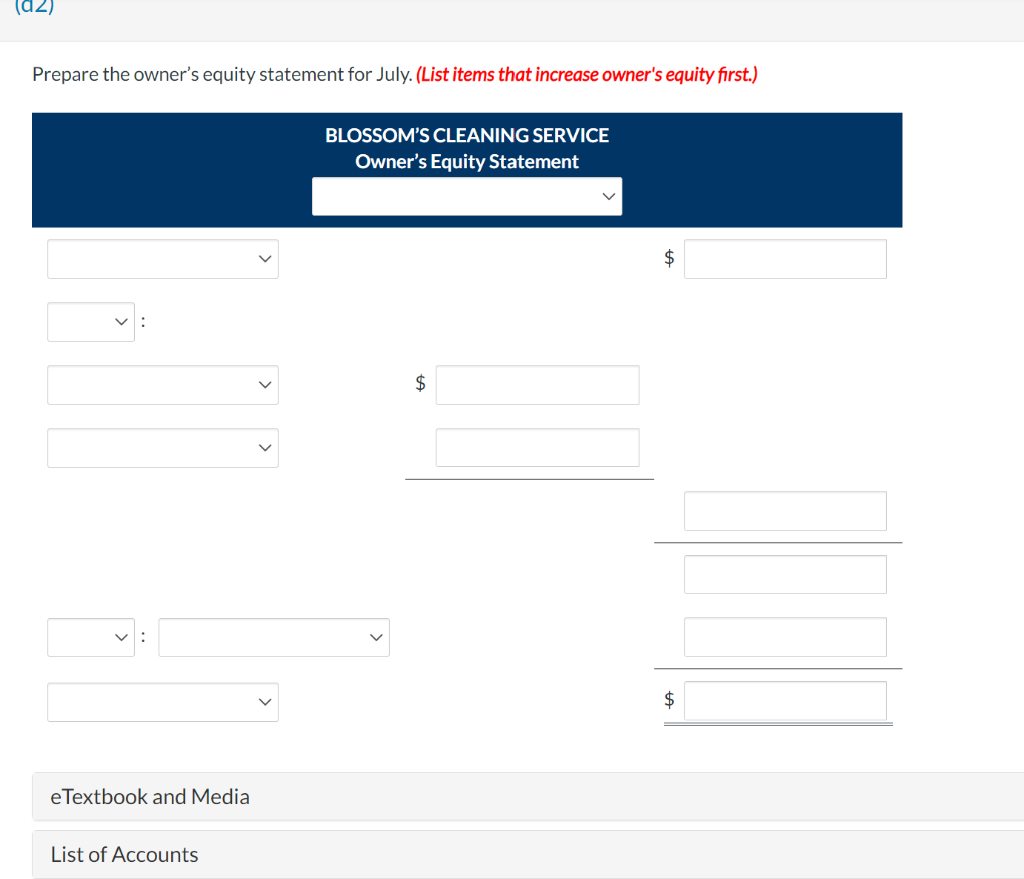

Current Attempt in Progress Blossom Clark opened Blossom's Cleaning Service on July 1, 2022. During July, the following transactions were completed. July 1 Blossom invested $20,000 cash in the business. 1 Purchased used truck for $9,000, paying $4,000 cash and the balance on account. 3 Purchased cleaning supplies for $1,900 on account. 5 Paid $1,800 cash on a 1-year insurance policy effective July 1. 12 Billed customers $4,500 for cleaning services. 18 Paid $1,400 cash on amount owed on truck and $1,300 on amount owed on cleaning supplies. 20 Paid $2,400 cash for employee salaries. 21 Collected $3,500 cash from customers billed on July 12. 25 Billed customers $6,000 for cleaning services. 31 Paid $340 for the monthly gasoline bill for the truck. 31 Withdraw $5,700 cash for personal use. Prepare a trial balance at July 31 on a worksheet. Enter the following adjustments on the worksheet and complete the worksheet. (1) Unbilled and uncollected reverue for services performed at July 31 were $2,800. (2) Depreciation on equipment for the month was $500. (3) One-twelfthof the insurante expired. (4) An irventory count shows $500 of cleaning supplies on hand at July 31 . (5) Accrued but unpaid employee salaries were $1,070. Accounts Payable Owner's Capital Owner's Drawings Service Revenue Gasoline Expense Salaries and Wages Expense Tolals $ $ Depreciation Expense Accum, Depr,-Equipment Insurance Expense Supplies Expense 5alaries and Wages Payable Totals Net Income Totals eTextbook and Media (d1) Prepare the income statement for July. (Enter negative amounts using either a negative sign preceding the number e.g. -45 or parentheses e.g. (45).) BLOSSOM'S CLEANING SERVICE Income Statement $ $ eTextbook and Media Prepare the owner's equity statement for July. (List items that increase owner's equity first.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts