Question: Please help. There are 3 separate problems. Thanks! Focus on the difference between feasible alternatives (Principle 2)! Insulated concrete forms (ICF) can be used as

Please help. There are 3 separate problems. Thanks!

Please help. There are 3 separate problems. Thanks!

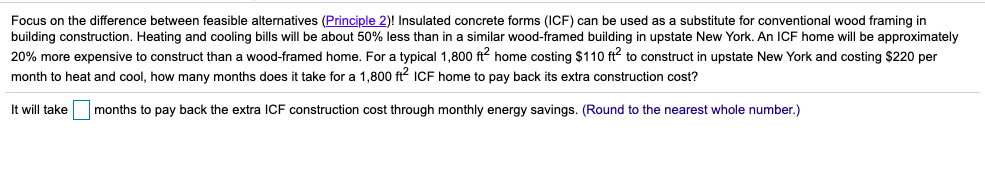

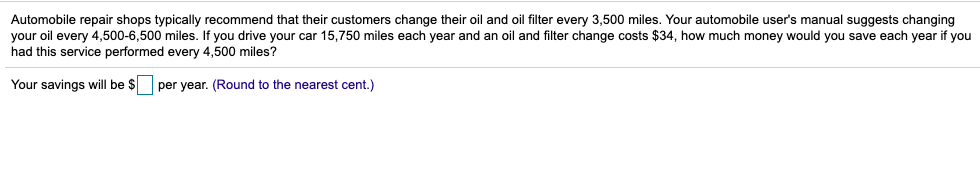

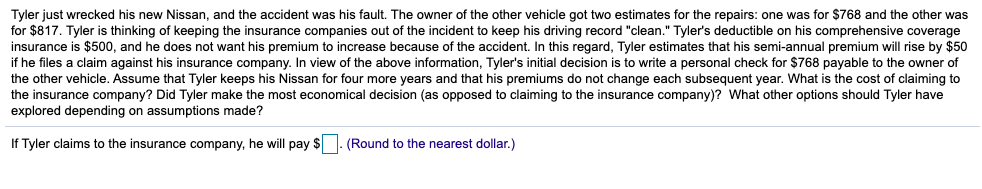

Focus on the difference between feasible alternatives (Principle 2)! Insulated concrete forms (ICF) can be used as a substitute for conventional wood framing in building construction. Heating and cooling bills will be about 50% less than in a similar wood-framed building in upstate New York. An ICF home will be approximately 20% more expensive to construct than a wood-framed home. For a typical 1,800 ft? home costing $110 ft? to construct in upstate New York and costing $220 per month to heat and cool, how many months does it take for a 1,800 ft ICF home to pay back its extra construction cost? It will take months to pay back the extra ICF construction cost through monthly energy savings. (Round to the nearest whole number.) Automobile repair shops typically recommend that their customers change their oil and oil filter every 3,500 miles. Your automobile user's manual suggests changing your oil every 4,500-6,500 miles. If you drive your car 15,750 miles each year and an oil and filter change costs $34, how much money would you save each year if you had this service performed every 4,500 miles? Your savings will be $ per year. (Round to the nearest cent.) Tyler just wrecked his new Nissan, and the accident was his fault. The owner of the other vehicle got two estimates for the repairs: one was for $768 and the other was for $817. Tyler is thinking of keeping the insurance companies out of the incident to keep his driving record "clean." Tyler's deductible on his comprehensive coverage insurance is $500, and he does not want his premium to increase because of the accident. In this regard, Tyler estimates that his semi-annual premium will rise by $50 if he files a claim against his insurance company. In view of the above information, Tyler's initial decision is to write a personal check for $768 payable to the owner of the other vehicle. Assume that Tyler keeps his Nissan for four more years and that his premiums do not change each subsequent year. What is the cost of claiming to the insurance company? Did Tyler make the most economical decision (as opposed to claiming to the insurance company)? What other options should Tyler have explored depending on assumptions made? If Tyler claims to the insurance company, he will pay $ (Round to the nearest dollar.) Focus on the difference between feasible alternatives (Principle 2)! Insulated concrete forms (ICF) can be used as a substitute for conventional wood framing in building construction. Heating and cooling bills will be about 50% less than in a similar wood-framed building in upstate New York. An ICF home will be approximately 20% more expensive to construct than a wood-framed home. For a typical 1,800 ft? home costing $110 ft? to construct in upstate New York and costing $220 per month to heat and cool, how many months does it take for a 1,800 ft ICF home to pay back its extra construction cost? It will take months to pay back the extra ICF construction cost through monthly energy savings. (Round to the nearest whole number.) Automobile repair shops typically recommend that their customers change their oil and oil filter every 3,500 miles. Your automobile user's manual suggests changing your oil every 4,500-6,500 miles. If you drive your car 15,750 miles each year and an oil and filter change costs $34, how much money would you save each year if you had this service performed every 4,500 miles? Your savings will be $ per year. (Round to the nearest cent.) Tyler just wrecked his new Nissan, and the accident was his fault. The owner of the other vehicle got two estimates for the repairs: one was for $768 and the other was for $817. Tyler is thinking of keeping the insurance companies out of the incident to keep his driving record "clean." Tyler's deductible on his comprehensive coverage insurance is $500, and he does not want his premium to increase because of the accident. In this regard, Tyler estimates that his semi-annual premium will rise by $50 if he files a claim against his insurance company. In view of the above information, Tyler's initial decision is to write a personal check for $768 payable to the owner of the other vehicle. Assume that Tyler keeps his Nissan for four more years and that his premiums do not change each subsequent year. What is the cost of claiming to the insurance company? Did Tyler make the most economical decision (as opposed to claiming to the insurance company)? What other options should Tyler have explored depending on assumptions made? If Tyler claims to the insurance company, he will pay $ (Round to the nearest dollar.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts