Question: please help this finance subject in math, thank you Problem 4 (Required, 30 marks) In the lecture, we have shown that the European call option

please help this finance subject in math, thank you

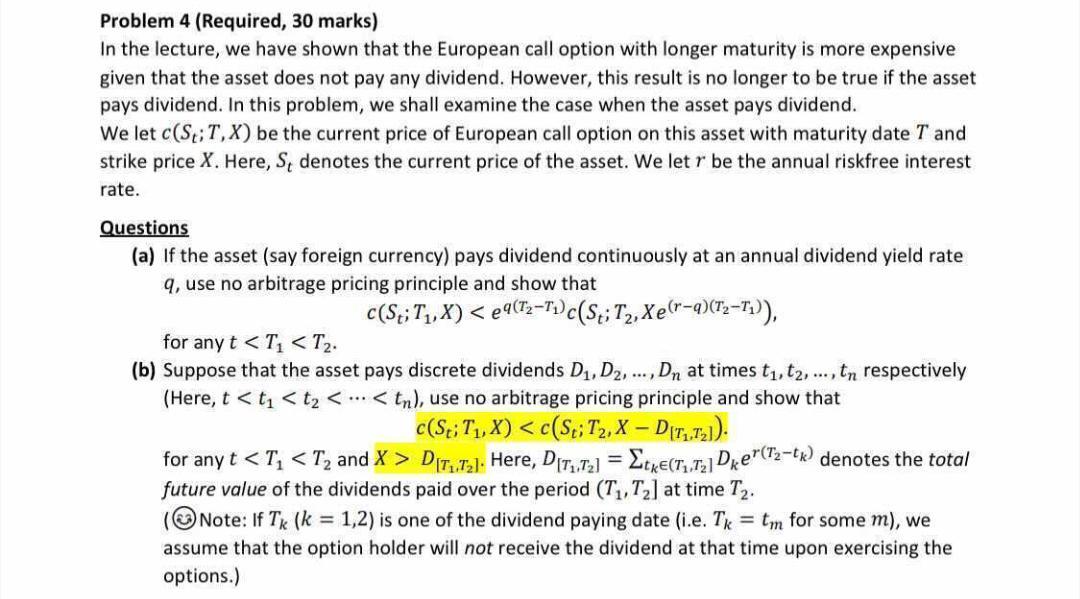

Problem 4 (Required, 30 marks) In the lecture, we have shown that the European call option with longer maturity is more expensive given that the asset does not pay any dividend. However, this result is no longer to be true if the asset pays dividend. In this problem, we shall examine the case when the asset pays dividend. We let (SE;T,X) be the current price of European call option on this asset with maturity date T and strike price X. Here, S, denotes the current price of the asset. We let r be the annual riskfree interest rate. Questions (a) If the asset (say foreign currency) pays dividend continuously at an annual dividend yield rate q, use no arbitrage pricing principle and show that C(St;T,X) DITTa]. Here, Dit,T] = Etke(, ta] Dker(T2-tw) denotes the total future value of the dividends paid over the period (T1, T2] at time T2. (Note: If Tk (k = 1,2) is one of the dividend paying date (i.e. Tk = tm for some m), we assume that the option holder will not receive the dividend at that time upon exercising the options.) Problem 4 (Required, 30 marks) In the lecture, we have shown that the European call option with longer maturity is more expensive given that the asset does not pay any dividend. However, this result is no longer to be true if the asset pays dividend. In this problem, we shall examine the case when the asset pays dividend. We let (SE;T,X) be the current price of European call option on this asset with maturity date T and strike price X. Here, S, denotes the current price of the asset. We let r be the annual riskfree interest rate. Questions (a) If the asset (say foreign currency) pays dividend continuously at an annual dividend yield rate q, use no arbitrage pricing principle and show that C(St;T,X) DITTa]. Here, Dit,T] = Etke(, ta] Dker(T2-tw) denotes the total future value of the dividends paid over the period (T1, T2] at time T2. (Note: If Tk (k = 1,2) is one of the dividend paying date (i.e. Tk = tm for some m), we assume that the option holder will not receive the dividend at that time upon exercising the options.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts