Question: Please Help. This is all the same question Carey Company manufactures soccer balls in two sequential processes: Cutting and Stitching. All direct materlals enter production

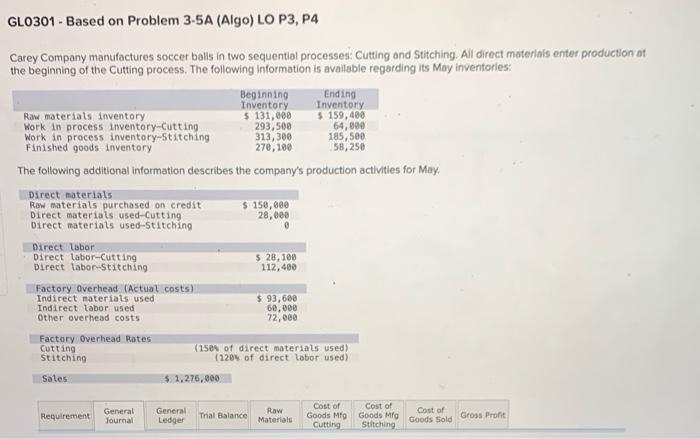

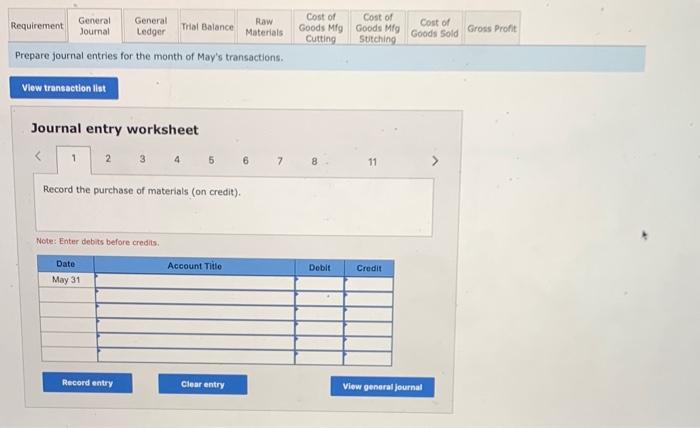

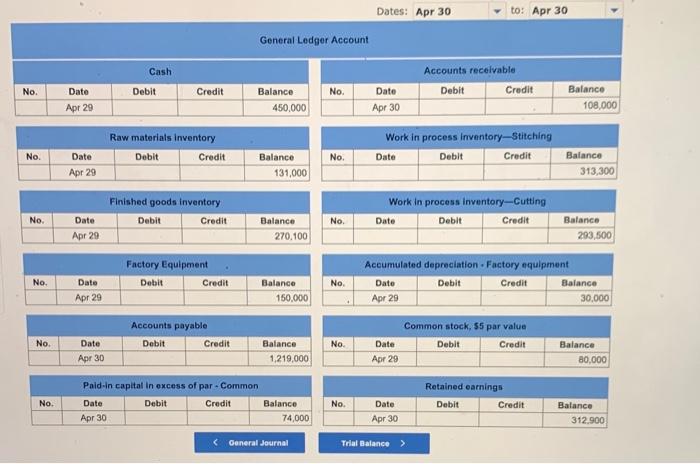

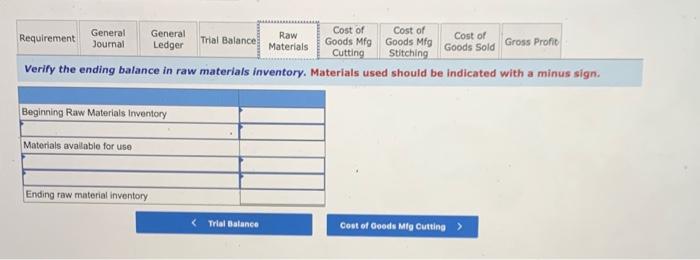

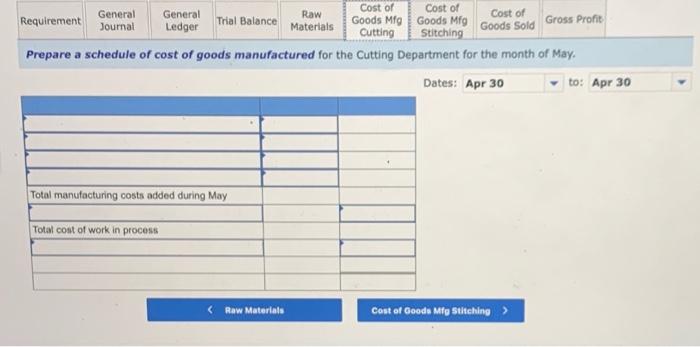

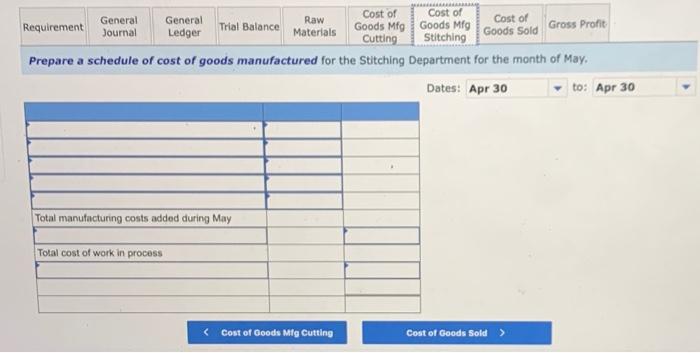

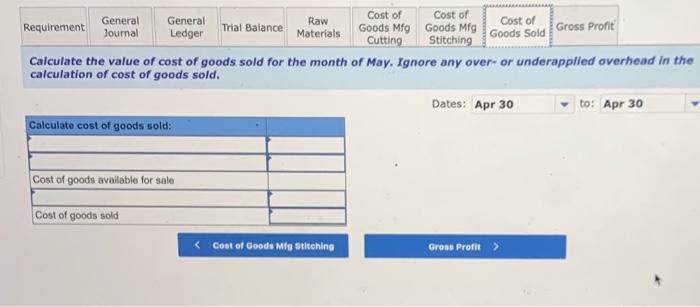

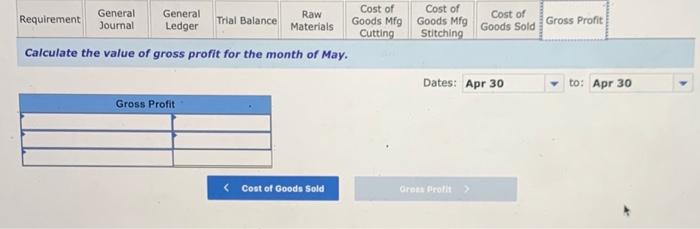

Carey Company manufactures soccer balls in two sequential processes: Cutting and Stitching. All direct materlals enter production at the beginning of the Cutting process. The following information is available regarding its May inventories: The following additional information describes the company's production activities for May. Prepare journal entries for the month of May's transactions. Journal entry worksheet douves conter bediss betore credits. General Ledger Account \begin{tabular}{|c|c|c|c|c|} \hline \multicolumn{5}{|c|}{ Cash } \\ \hline No. & Date & Debit & Credit & Balance \\ \hline & Apr 29 & & & 450,000 \\ \hline \end{tabular} \begin{tabular}{|c|c|c|c|c|} \hline \multicolumn{3}{|c|}{ Accounts recelvable } \\ \hline No. & Date & Debit & Credit & Balance \\ \hline & Apr 30 & & & 108,000 \\ \hline \end{tabular} \begin{tabular}{|c|c|c|c|c|} \hline \multicolumn{5}{|c|}{ Raw materials inventory } \\ \hline No. & Date & Debit & Credit & Balance \\ \hline & Apr 29 & & & 131,000 \\ \hline \end{tabular} \begin{tabular}{|c|c|c|c|c|} \hline \multicolumn{6}{|c|}{ Work in process inventory - Stitching } \\ \hline No. & Date & Debit & Credit & Balance \\ \hline & & & & 313,300 \\ \hline \end{tabular} \begin{tabular}{|c|c|c|c|c|} \hline \multicolumn{5}{|c|}{ Finished goods inventory } \\ \hline No. & Date & Dabit & Credit & Balance \\ \hline & Apr 29 & & & 270.100 \\ \hline \end{tabular} \begin{tabular}{|l|c|c|c|c|} \hline \multicolumn{5}{|c|}{ Work in process inventory-Cutting } \\ \hline No. & Date & Debit & Credit & Balance \\ \hline & & & & 293,500 \\ \hline \end{tabular} \begin{tabular}{|c|c|c|c|c|} \hline \multicolumn{3}{|c|}{ Factory Equipment } \\ \hline No. & Date & Debit & Credit & Balance \\ \hline & Apr 29 & & & 150,000 \\ \hline \end{tabular} \begin{tabular}{|r|c|c|c|c|} \hline \multicolumn{3}{|c|}{ Accumulated depreciation - Factory equipment } \\ \hline No. & Date & Debit & Credit & Balance \\ \hline. & Apr 29 & & & 30,000 \\ \hline \end{tabular} \begin{tabular}{|c|c|c|c|c|} \hline \multicolumn{5}{|c|}{ Accounts payable } \\ \hline No. & Date & Dobit & Credit & Balance \\ \hline & Apr 30 & & & 1,219,000 \\ \hline \end{tabular} \begin{tabular}{|c|c|c|c|c|} \hline \multicolumn{5}{|c|}{ Common stock, 55 par value } \\ \hline No. & Date & Debit & Credit & Balance \\ \hline & Apr 29 & & & 80,000 \\ \hline \end{tabular} \begin{tabular}{|l|c|c|c|c|} \hline \multicolumn{3}{|c|}{ Paid -in capltal in excess of par-Common } \\ \hline No. & Date & Debit & Credit & Balance \\ \hline & Apr 30 & & & 74,000 \\ \hline \end{tabular} \begin{tabular}{|r|c|c|c|c|} \hline \multicolumn{5}{|c|}{ Retained earnings } \\ \hline No. & Date & Debit & Credit & Balance \\ \hline & Apr 30 & & & 312.900 \\ \hline \end{tabular} Verify the ending balance in raw materials inventory. Materials used should be indicated with a minus sign. Prepare a schedule of cost of goods manufactured for the Cutting Department for the month of May. Prepare a schedule of cost of goods manufactured for the Stitching Department for the month of May, Calculate the value of cost of goods sold for the month of May. Ignore any over-or underapplied overhead in the calculation of cost of goods sold. Calculate the value of gross profit for the month of May

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts