Question: please help! this is the data: this is an example on how to answer it: HW Score: 16.67%, 1 of P10-8 (similar to) Question Help

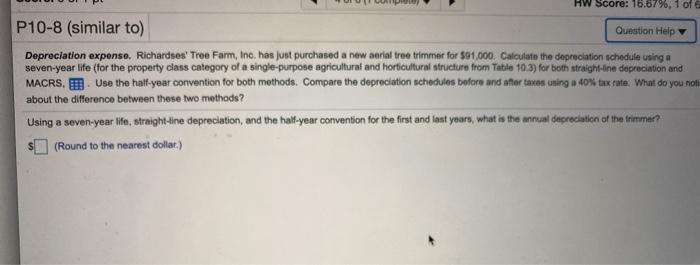

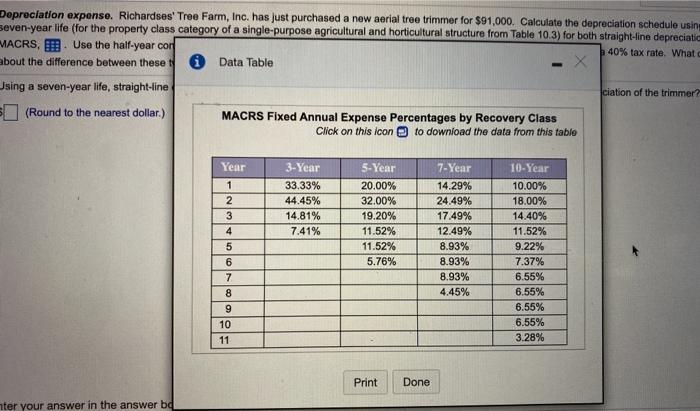

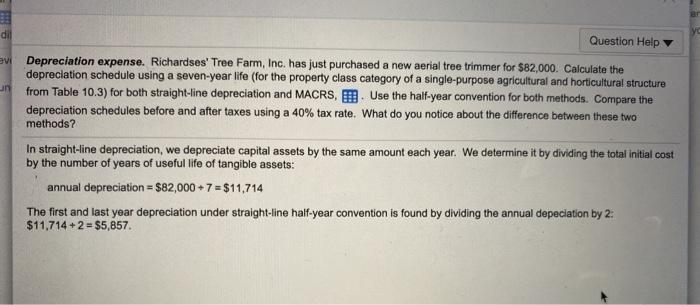

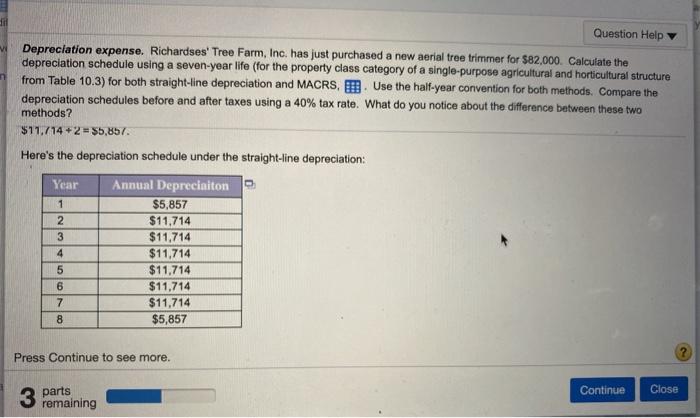

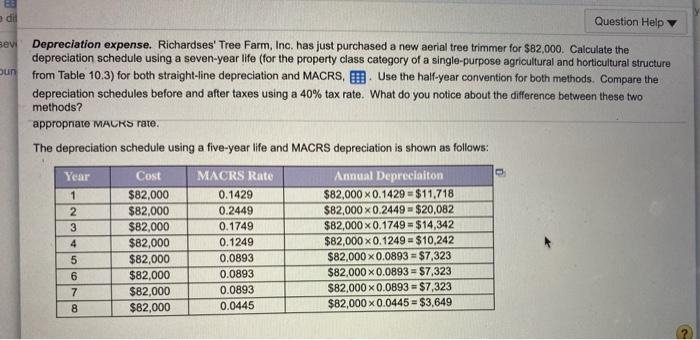

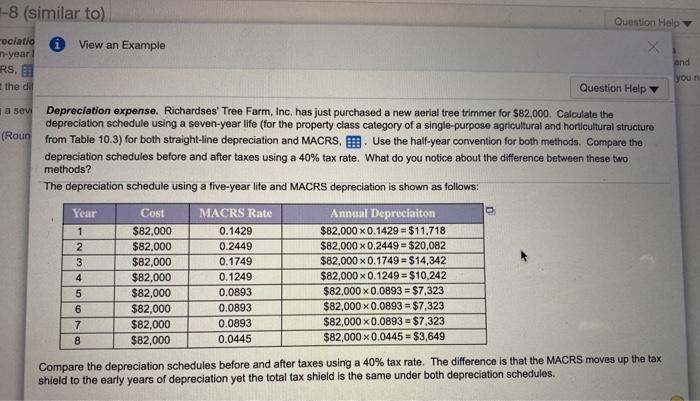

HW Score: 16.67%, 1 of P10-8 (similar to) Question Help Depreciation expense. Richardses' Tree Farm, Inc. has just purchased a new serial tree trimmer for $91,000. Calculate the depreciation schedule using a seven-year life (for the property class category of a single-purpose agricultural and horticultural structure from Table 10:3) for both straight-line depreciation and MACRS... Use the half-year convention for both methods. Compare the depreciation schedules before and after taxes using a 40% tax rate. What do you noti about the difference between these two methods? Using a seven-year life, straight-line depreciation, and the half-year convention for the first and last years, what is the annual depreciation of the trimmar? (Round to the nearest dollar) Depreciation expense. Richardses' Tree Farm, Inc. has just purchased a new aerial tree trimmer for $91,000. Calculate the depreciation schedule using seven-year life (for the property class category of a single-purpose agricultural and horticultural structure from Table 10.3) for both straight-line depreciatic MACRS, . Use the half-year cor 40% tax rate. What about the difference between these te * Data Table X ciation of the trimmer? Using a seven-year life, straight-line = (Round to the nearest dollar.) MACRS Fixed Annual Expense Percentages by Recovery Class Click on this icon to download the data from this table 3-Year 33.33% 44.45% 14.81% 7.41% Year 1 2 3 4 5 6 7 8 9 10 11 5-Year 20.00% 32.00% 19.20% 11.52% 11.52% 5.76% 7-Year 14.29% 24.49% 17.49% 12.49% 8.93% 8.93% 8.93% 4.45% 10-Year 10.00% 18.00% 14.40% 11.52% 9.22% 7.37% 6.55% 6.55% 6.55% 6.55% 3.28% Print Done nter your answer in the answer bo dil Question Help Ev Depreciation expense. Richardses' Tree Farm, Inc. has just purchased a new aerial tree trimmer for $82,000. Calculate the depreciation schedule using a seven-year life (for the property class category of a single-purpose agricultural and horticultural structure un from Table 10.3) for both straight-line depreciation and MACRS, . Use the half-year convention for both methods. Compare the depreciation schedules before and after taxes using a 40% tax rate. What do you notice about the difference between these two methods? In straight-line depreciation, we depreciate capital assets by the same amount each year. We determine it by dividing the total initial cost by the number of years of useful life of tangible assets: annual depreciation = $82,000 + 7 = $11,714 The first and last year depreciation under straight-line half-year convention is found by dividing the annual depeciation by 2: $11,714 + 2 = $5,857 Question Help Depreciation expense. Richardses' Tree Farm, Inc. has just purchased a new aerial tree trimmer for $82,000. Calculate the depreciation schedule using a seven-year life (for the property class category of a single-purpose agricultural and horticultural structure from Table 10.3) for both straight-line depreciation and MACRS, . Use the half-year convention for both methods. Compare the depreciation schedules before and after taxes using a 40% tax rate. What do you notice about the difference between these two methods? $11,714+2 = $5,857 Here's the depreciation schedule under the straight-line depreciation: Year Annual Depreciaiton 1 $5,857 2 $11,714 3 $11,714 $11,714 5 $11,714 6 $11,714 7 $11,714 $5,857 4 8 Press Continue to see more. Continue Close 3 parts remaining did Question Help sev Depreciation expense. Richardses' Tree Farm, Inc. has just purchased a new aerial tree trimmer for $82,000. Calculate the depreciation schedule using a seven-year life (for the property class category of a single-purpose agricultural and horticultural structure Sun from Table 10.3) for both straight-line depreciation and MACRS, . Use the half-year convention for both methods. Compare the depreciation schedules before and after taxes using a 40% tax rate. What do you notice about the difference between these two methods? appropriate MACRS rate. . The depreciation schedule using a five-year life and MACRS depreciation is shown as follows: Year Cost MACRS Rate Annual Depreciaiton 1 $82,000 0.1429 $82,000 0.1429 = $11,718 2 $82,000 0.2449 $82,000 x 0.2449 - $20,082 3 $82,000 0.1749 $82,000 x 0.1749$14,342 4 $82,000 0.1249 $82,000 x 0.1249 $10,242 5 $82,000 0.0893 $82,000 X 0.0893 = $7,323 6 $82,000 0.0893 $82,000 X 0.0893 = $7,323 7 $82,000 0.0893 $82,000 x 0.0893 = $7,323 8 $82,000 0.0445 $82,000 x 0.0445 = $3,649 7-8 (similar to) Question Help View an Example X ociatia n-year RS. the di and youn Question Help a son Depreciation expense. Richardses' Tree Farm, Inc. has just purchased a new aerial tree trimmer for $82,000. Calculate the depreciation schedule using a seven-year life (for the property class category of a single-purpose agricultural and horticultural structure (Roun from Table 10.3) for both straight-line depreciation and MACRS, . Use the half-year convention for both methods. Compare the depreciation schedules before and after taxes using a 40% tax rate. What do you notice about the difference between these two methods? The depreciation schedule using a five-year life and MACRS depreciation is shown as follows: Year Cost MACRS Rate Annual Deprecialton 1 $82,000 0.1429 $82,000 x 0.1429 = $11,718 2 $82,000 0.2449 $82,000 x 0.2449 = $20,082 3 $82,000 0.1749 $82,000 x 0.1749 = $14,342 4 $82,000 0.1249 $82,000 x 0.1249 = $10,242 5 $82,000 0.0893 $82,000 X 0.0893 = $7,323 6 $82,000 0.0893 $82,000 x 0.0893 = $7,323 7 $82,000 0.0893 $82,000 x 0.0893 = $7,323 8 $82,000 0.0445 $82,000 0.0445 - $3,649 Compare the depreciation schedules before and after taxes using a 40% tax rate. The difference is that the MACRS moves up the tax shield to the early years of depreciation yet the total tax shield is the same under both depreciation schedules

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts