Question: Please help! This one has given me so much trouble. Thank you. 7. Calculating a beta coefficient for a portfolio A Aa Butoh Tech is

Please help! This one has given me so much trouble. Thank you.

Please help! This one has given me so much trouble. Thank you.

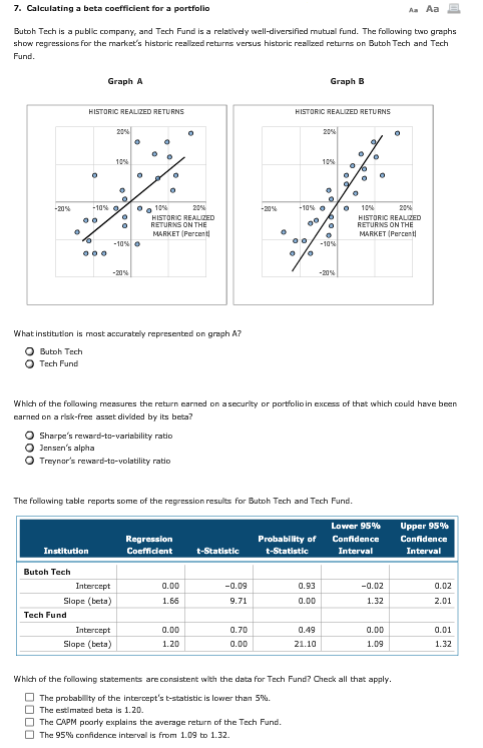

7. Calculating a beta coefficient for a portfolio A Aa Butoh Tech is a public company, and Tech Fund is a relatively well-diversified mutual fund. The follawing two graphs show regressions for the market's historic realized returns versus historic real ized returns on Butoh Tech and Tech Fund. Graph A Graph B HISTORIC REALIZED RETURNS HISTORIC REALIZED RETURNS -10% 0/ 0 10% HISTORIC REALIZED RETURNS ON THE MARKET (Perce 20% RETURNS ON THE MARKET Percent What institution is most accurately represented on graph A Butoh Tech O Tech Fund which of the folawing measures the return earned on aseerty or portfolio in excess of th, which could hnve been carned on a risk-free asset divided by its beta O Sharpes reward-to-variability ratio O Jensen's alpha O Treynor's reward-to-volatility rato The following table reports some of the regression results for Butoh Tech and Tech Fund. Lower 95% Upper 95% Butoh Tech 0.00 -0.09 0.93 -0.02 1.32 0.02 Slape (beta) 1.66 9.71 0.00 2.01 Tech Fund 0.00 0.70 0.00 0.49 21.10 0.00 1.09 0.01 1.32 Slape (beta) 1.20 Which of the following statements are consistent with the data for Tech Fund? Oheck all that apply The p babilty of the intercept's t-statistic is lower than 5%. The estimated beta is 1.20 The CAPM poorly explains the average return of the Tech Fund O The 95% confidence interval is from 1.09 to 1.32

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts