Question: Please help this two question and explain in details QUESTION 5 Given the information below, compute the after-tax WACC for Tiny Corp.Tiny Corp, Tiny Corp

Please help this two question and explain in details

Please help this two question and explain in details

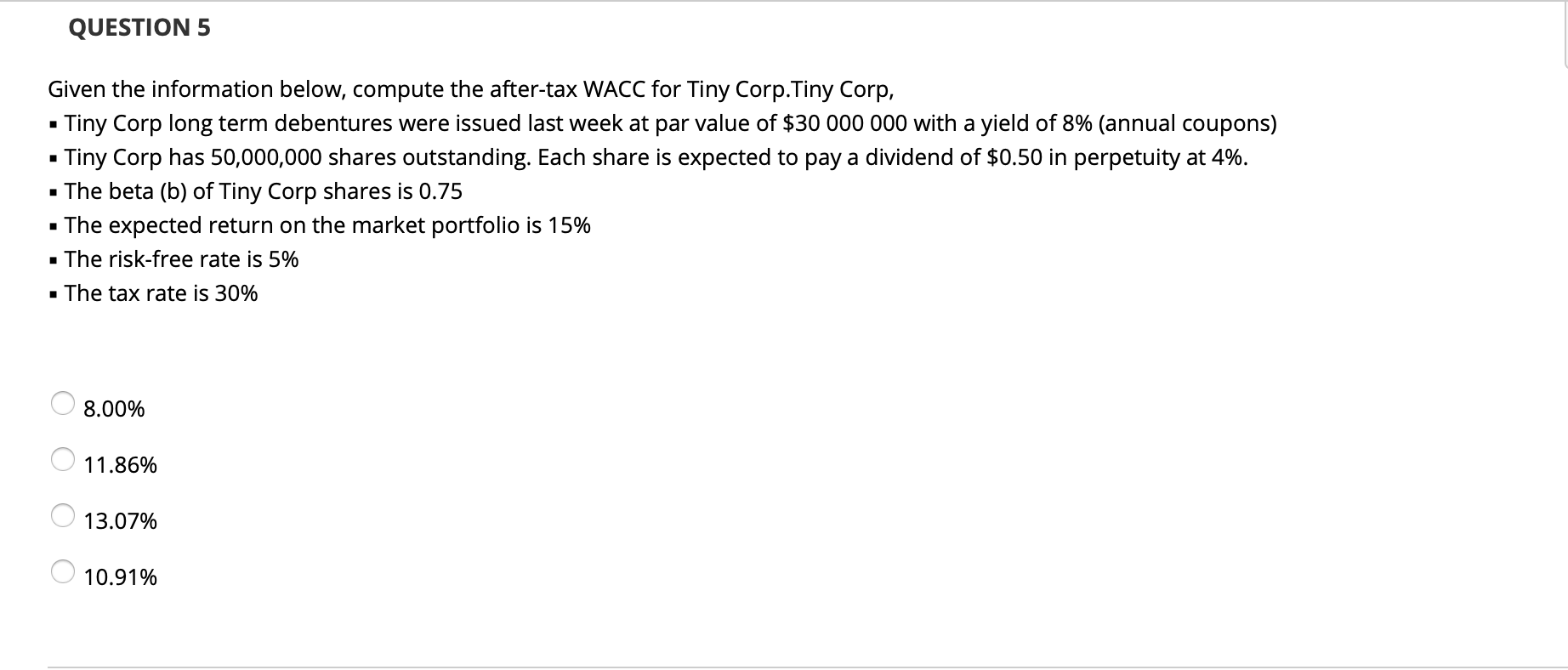

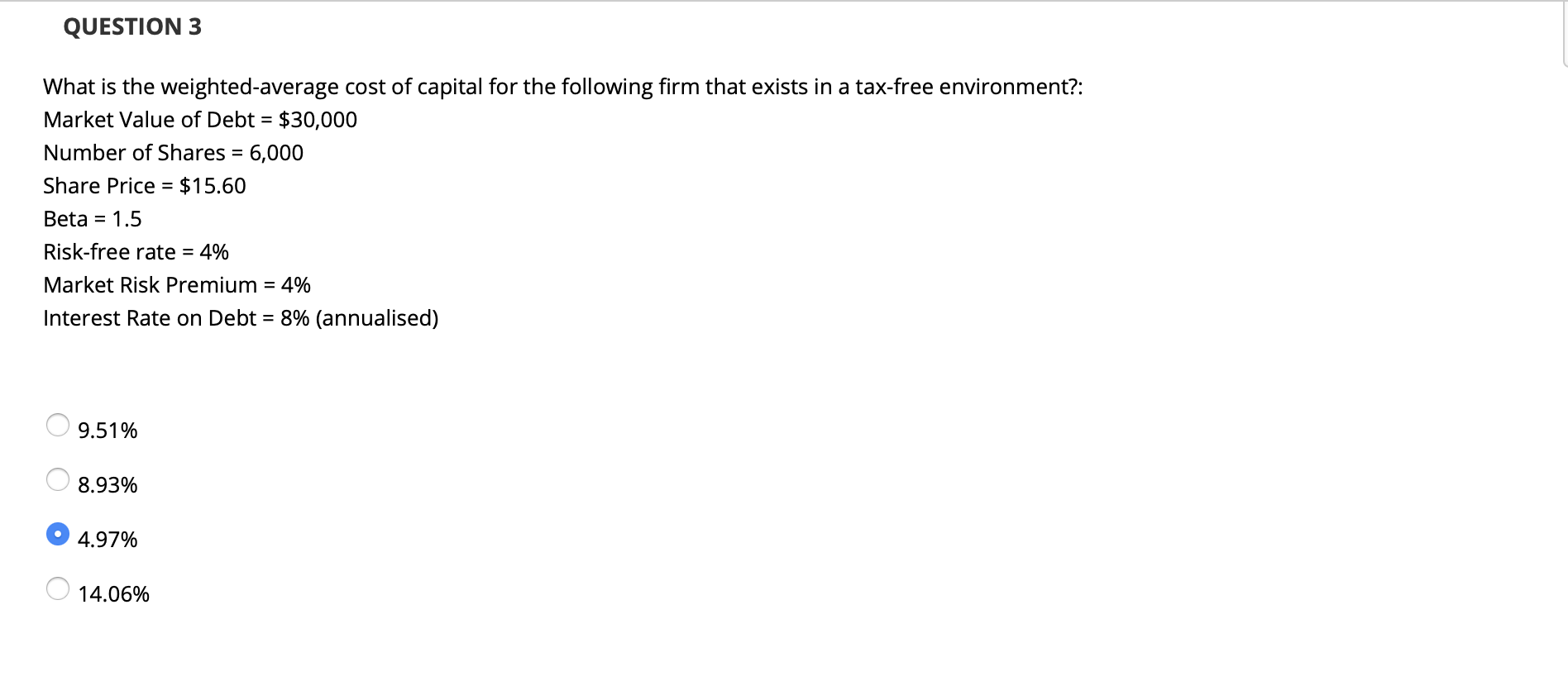

QUESTION 5 Given the information below, compute the after-tax WACC for Tiny Corp.Tiny Corp, Tiny Corp long term debentures were issued last week at par value of $30 000 000 with a yield of 8% (annual coupons) Tiny Corp has 50,000,000 shares outstanding. Each share is expected to pay a dividend of $0.50 in perpetuity at 4%. The beta (b) of Tiny Corp shares is 0.75 . The expected return on the market portfolio is 15% The risk-free rate is 5% . The tax rate is 30% 8.00% 11.86% 13.07% 10.91% QUESTION 3 What is the weighted-average cost of capital for the following firm that exists in a tax-free environment?: Market Value of Debt = $30,000 Number of Shares = 6,000 Share Price = $15.60 Beta = 1.5 Risk-free rate = 4% Market Risk Premium = 4% Interest Rate on Debt = 8% (annualised) 9.51% 8.93% 4.97% 14.06%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts