Question: please help. thumbs up (Payback period, net present value, profitability Index, and internal rate of return calculations) You are considering a project with an initial

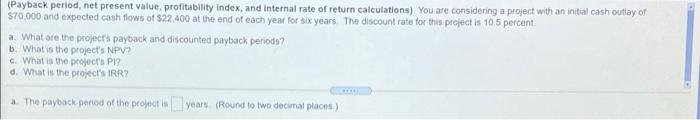

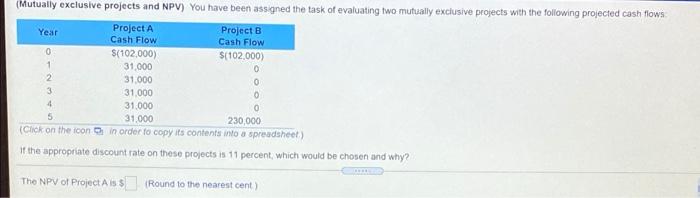

(Payback period, net present value, profitability Index, and internal rate of return calculations) You are considering a project with an initial cash outlay of $70.000 and expected cash flows of $22.400 at the end of each year for six years. The discount rate for this project is 10,5 percent 2. What are the project's payback and discounted payback perioda? b. What is the project's NPV? C. What is the project's Pl? d. What is the project's IRR? The payback period of the project is years (Round to two decimal places) 1 (Mutually exclusive projects and NPV) You have been assigned the task of evaluating two mutually exclusive projects with the following projected cash flows Project A Year Project B Cash Flow Cash Flow 0 ${102,000) S(102,000) 31.000 0 2 31.000 31.000 0 4 31.000 0 5 31.000 230,000 (Click on the icon in order to copy its contents into a spreadsheet If the appropriate discount rate on these projects is 11 percent, which would be chosen and why? 0 3 The NPV of Project Ais Round to the nearest cent)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts