Question: PLEASE HELP TO ANSWER ALL THE QUESTIONS. I NEED A CLEAR EXPLAINATIONS. THANK YOU Question 3 MicroSun Computer Berhad (MSCB) is one of the well-known

PLEASE HELP TO ANSWER ALL THE QUESTIONS. I NEED A CLEAR EXPLAINATIONS. THANK YOU

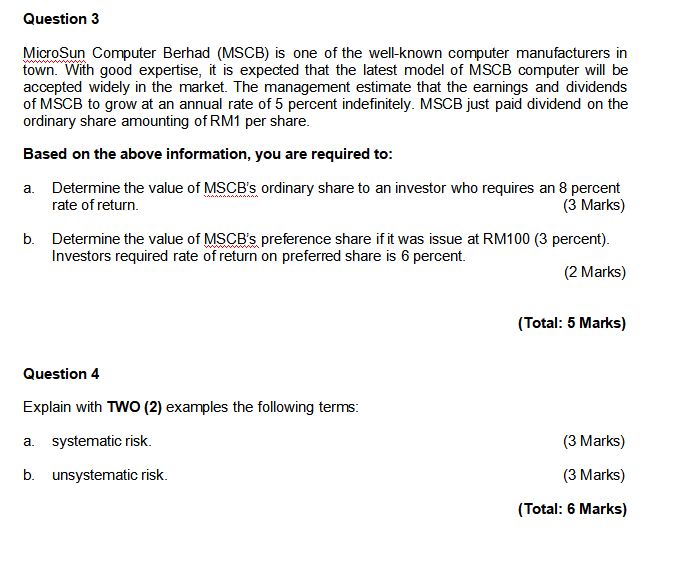

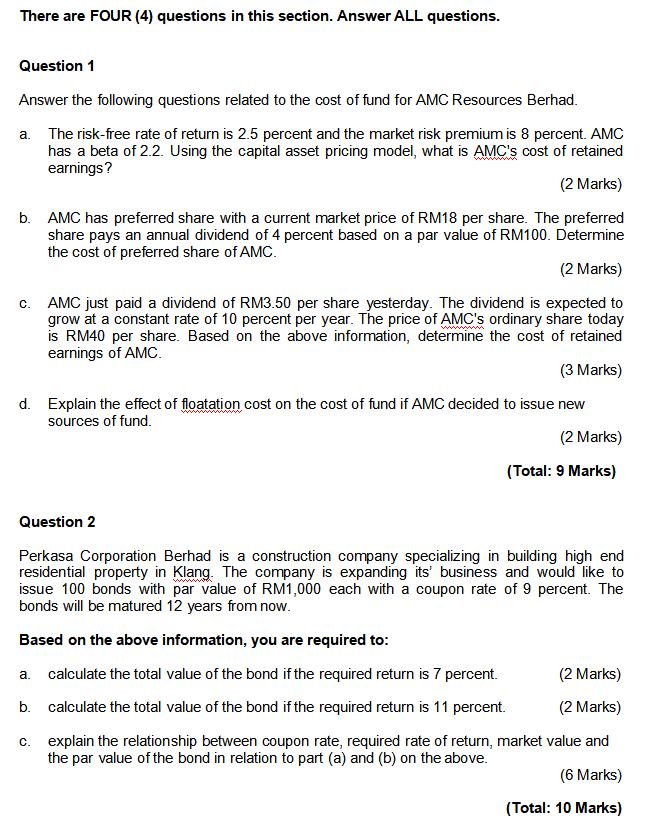

Question 3 MicroSun Computer Berhad (MSCB) is one of the well-known computer manufacturers in town. With good expertise, it is expected that the latest model of MSCB computer will be accepted widely in the market. The management estimate that the earnings and dividends of MSCB to grow at an annual rate of 5 percent indefinitely. MSCB just paid dividend on the ordinary share amounting of RM1 per share. Based on the above information, you are required to: a. Determine the value of MSCB's ordinary share to an investor who requires an 8 percent rate of return. (3 Marks) b. Determine the value of MSCB's preference share if it was issue at RM100 (3 percent). Investors required rate of return on preferred share is 6 percent. (2 Marks) (Total: 5 Marks) Question 4 Explain with TWO (2) examples the following terms: a. systematic risk. (3 Marks) b. unsystematic risk. (3 Marks) (Total: 6 Marks)There are FOUR {4} questions in this section. Answer ALL questions. Question '1 Answer the following questions related to the cost of liJnd for AMC Resources Eierhad. a. The riskfree rate of return is 2.5 percent and the market risk premium is 8 percent. AMC has a beta of 2.2. Using the capital asset pricing model, what is M cost of retained earnings? [2 Marks} AlvlC has preferred share with a current market price of Rlvl18 per share. The preferred share pays an annual dividend of 4 percent based on a par value of Rlvl1titi. Determine the cost of preferred share of AME. [2 Marius} AlvlC just paid a dividend of EMBED per share yesterday. The dividend is expected to grow at a constant rate of 10 percent per year. The price of AlvlC's ordinary share today is Rut-ill} per share. Based on the above information, determine the cost of retained earnings of AME. {3 Marks} Explain the effect of oatation cost on the cost of fund if AlvlC decided to issue new sources of fund. [2 Marius} {Total: 9 Marks} Question 2 Perkasa Corporation Elerhad is a construction conpany specializing in building high end residential property in glam, The conpany is expanding itsr business and would like to issue 133 bonds with par value of Rlvl1,l}l}l} each with a coupon rate of 9 percent. The bonds will be matured 12 years from now. Based on the above information, you are required to: a. b. C. calculate the total value of the bond if the required return is T percent. [2 Marks} calculate the total value of the bond if the required return is 11 percent. [2 Marks} explain the relationship between coupon rate, required rate of return: market value and the par value of the bond in relation to part {a} and [b} on the above. [B Marks} {Total: 10 Marks}

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts